OH TBOR 1 2019 free printable template

Show details

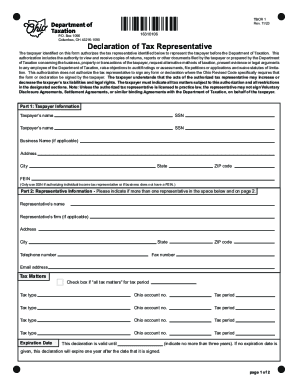

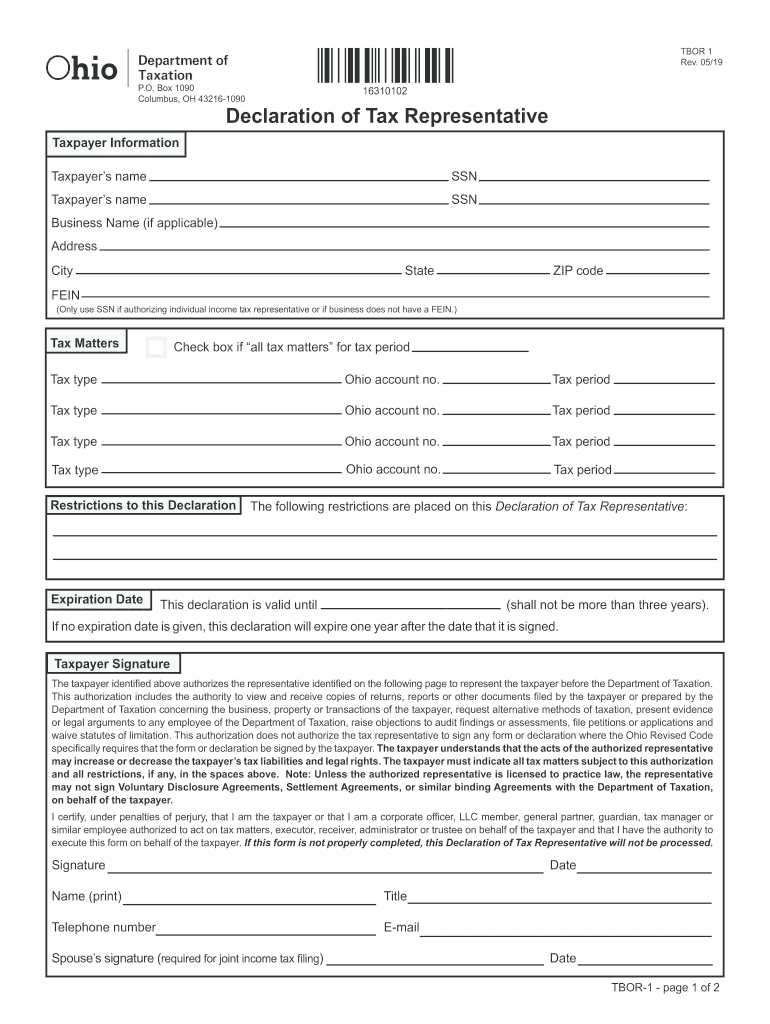

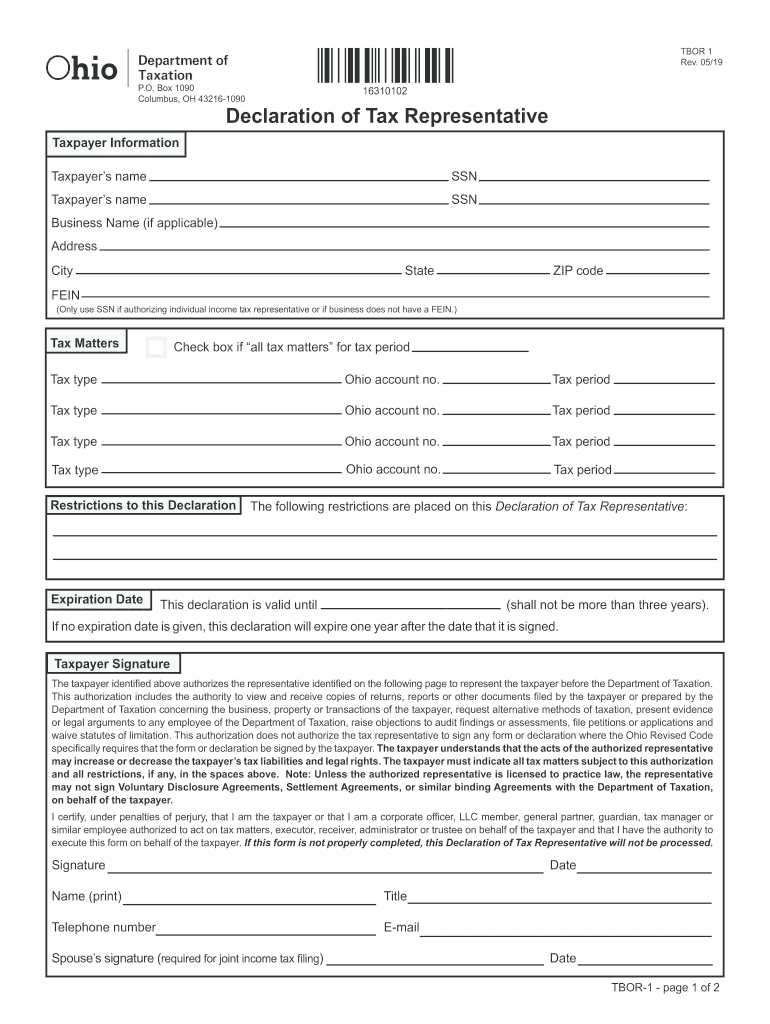

THOR 1

Rev. 05/19

P.O. Box 1090

Columbus, OH 432161090

16310102Declaration of Tax RepresentativeTaxpayer Information

Taxpayers nameSSNTaxpayers nameSSNBusiness Name (if applicable)AddressCityStateZIP

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH TBOR 1

Edit your OH TBOR 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH TBOR 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH TBOR 1 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit OH TBOR 1. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH TBOR 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH TBOR 1

How to fill out OH TBOR 1

01

Obtain the OH TBOR 1 form from the relevant authority or website.

02

Fill in your personal information in the designated fields, such as your name, address, and contact details.

03

Provide accurate information about the financial activities or transactions relevant to the form.

04

Include any necessary supporting documentation as required by the form's instructions.

05

Review all the information to ensure accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate office or department by the specified method.

Who needs OH TBOR 1?

01

Individuals or businesses engaged in specific financial activities that require reporting.

02

Taxpayers who need to disclose financial information as part of compliance obligations.

03

Anyone involved in real estate transactions or financial investments as outlined by state regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a Tbor 1 in Ohio?

An Ohio tax power of attorney form, or 'Form TBOR 1', is a document you can fill out to appoint an agent to represent you before the Department of Taxation. The principal taxpayer will be responsible for naming the representational powers the agent can wield in this paperwork.

Who must file Ohio form it 1140?

A PTE or trust that has a tax year starting during calendar year 2021 must file the 2021 IT 1140. The PTE or trust must maintain its bank account to ensure it can receive refunds after its closing date.

Why would I get a letter from Ohio Department of Taxation?

The agency or agencies shown on the letter have reported to the Department of Taxation that you owe one or more debts. The Department is required to apply your Ohio income tax refund as partial or complete payment of the debt(s). There are two types of Ohio Income Tax Refund Offset letters.

What does the Ohio Department of Taxation do?

The Ohio Department of Taxation administers most state and several local taxes. It makes assessments, prepares tax forms, provides taxpayer assistance, processes returns, distributes taxes to local government, and more.

What is Ohio tax status letter?

What is an Ohio Tax Status Compliance Certificate? In Ohio a Tax Status Compliance Certificate is called a Form D5 and is issued by the Ohio Department of Revenue for a Company (Corporation or LLC) or Sole Proprietor which has met all of its Ohio tax obligations.

What form do I use for Ohio state taxes?

Ohio IT 1040 and SD100 Forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the OH TBOR 1 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your OH TBOR 1 in minutes.

How can I fill out OH TBOR 1 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your OH TBOR 1. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out OH TBOR 1 on an Android device?

Use the pdfFiller mobile app to complete your OH TBOR 1 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is OH TBOR 1?

OH TBOR 1 is a form used in Ohio to report various tax-related information, specifically for businesses.

Who is required to file OH TBOR 1?

Businesses operating in Ohio that meet certain criteria related to tax obligations are required to file OH TBOR 1.

How to fill out OH TBOR 1?

To fill out OH TBOR 1, businesses should provide accurate financial information as required on the form, ensuring all sections are completed and reviewed for accuracy.

What is the purpose of OH TBOR 1?

The purpose of OH TBOR 1 is to ensure compliance with Ohio tax regulations by collecting necessary financial data from businesses.

What information must be reported on OH TBOR 1?

The information that must be reported on OH TBOR 1 includes revenues, expenses, and other specific financial details as outlined in the form's instructions.

Fill out your OH TBOR 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH TBOR 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.