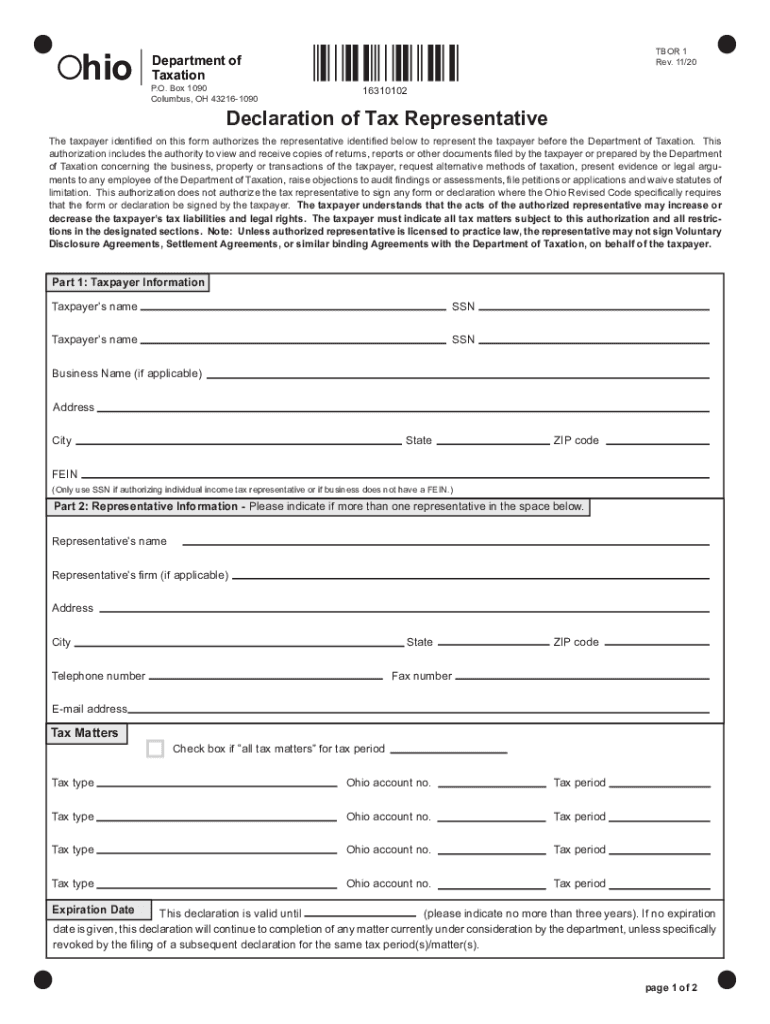

OH TBOR 1 2020 free printable template

Get, Create, Make and Sign OH TBOR 1

Editing OH TBOR 1 online

Uncompromising security for your PDF editing and eSignature needs

OH TBOR 1 Form Versions

How to fill out OH TBOR 1

How to fill out OH TBOR 1

Who needs OH TBOR 1?

Instructions and Help about OH TBOR 1

Hello and welcome to the Ohio Department of Taxation information guide series today will be walking you through the w-2 and 1099 forms your forms may look different from throne displayed but will contain the same information the w-2 is a wage and earning statement sent to you by your employer this document it's used to file your income taxes you generally receive multiple W 2s that are each used to file a specific return such as federal state or local taxes we suggest you keep a copy of your W 2s for at least four years the w-2 will contain your name address and social security number and boxes A and E it will also contain your employers name and address in box C in box B and 15 you will find your employers federal identification number and state employers withholding number the Ohio Department of Taxation uses these two numbers to identify your employer the wages you receive from your employer will be in box 1 the taxes withheld for the federal government will be in box to typically the boxes that you will need to look at for Ohio information will be in boxes 14 through twenty box 15 shows the state and state employer withholding number box 16 shows the amount of wages that were taxed for the state box 17 shows the amount of taxes you had withheld from your paycheck for the state if box 15 shows a state other than Ohio then do not include the amount from box17 on your Ohio return as it will be for another state boxes18 through 20 deals with both local in school district taxes box 18 shows the amount of wages that were taxed by the school district or by a local government typically city or municipal income tax box 19 list the amount of taxes withheld for the specific local government or school district box 20 list the specific local government or school district the Ohio Department of Taxation uses boxes 18 through 20 to determine your school district income tax liability city and municipal taxes are handled through either the specificity or Rita the regional income-tax authority for school district withholding box 20 will list a certain school district name and then SD or have the four digit school district code the school district name may also be followed by LSD or see CSD for city taxes box 20 will have a city name with no cold following occasionally employers will put the school district withholding information and box 14 as well a 1099 is an earning statement for miscellaneous income earned you may receive a 1099 for retirement income contract work gambling interest income are other miscellaneous income earned a 1099 will also contain your name address social security number as Wells your employers or payers name an address and federal identification number the gross distribution you receive Willie in box 1 the taxable amount in box 2 the statein-state employers withholding number will be inboxed 11 again if this does not say Ohio do not include on your Ohio return apart from taxes withheld the amount of taxes you had withheld forth estate...

People Also Ask about

How do I get a tax ID number in Ohio?

What is a power of attorney for tax return in Ohio?

What is my Ohio tax ID or EIN number?

What is a Tbor 1 in Ohio?

What services are exempt from sales tax in Ohio?

Why would I get a letter from Ohio Department of Taxation?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OH TBOR 1 from Google Drive?

How do I complete OH TBOR 1 online?

How do I edit OH TBOR 1 on an iOS device?

What is OH TBOR 1?

Who is required to file OH TBOR 1?

How to fill out OH TBOR 1?

What is the purpose of OH TBOR 1?

What information must be reported on OH TBOR 1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.