OH TBOR 1 2013 free printable template

Show details

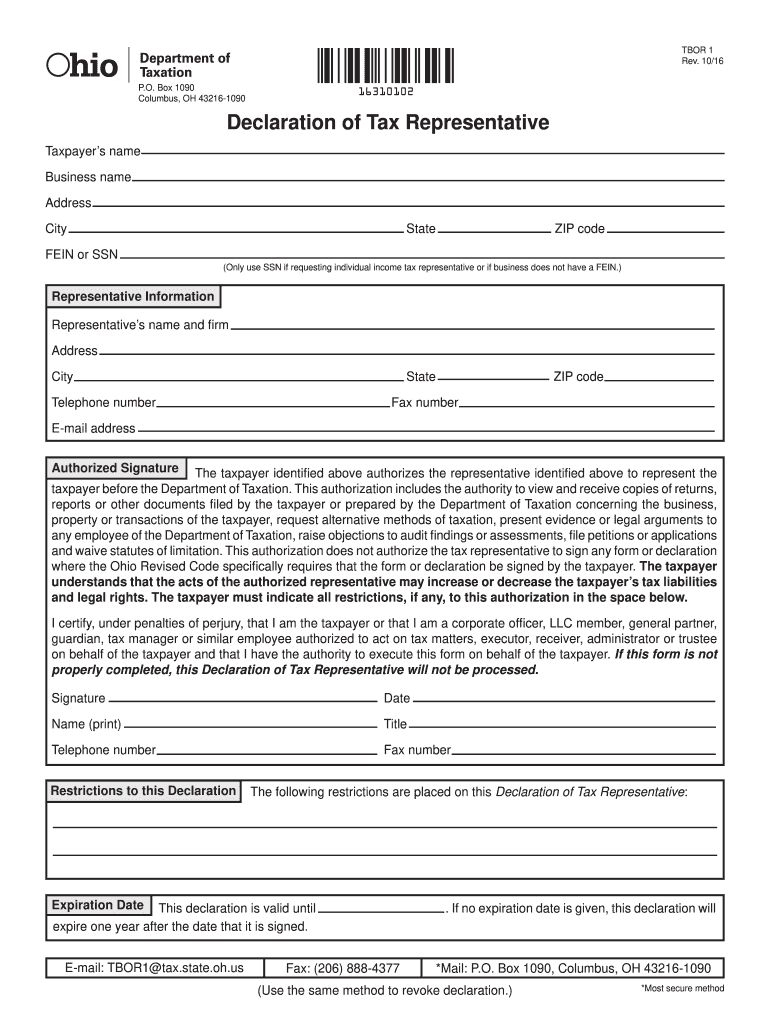

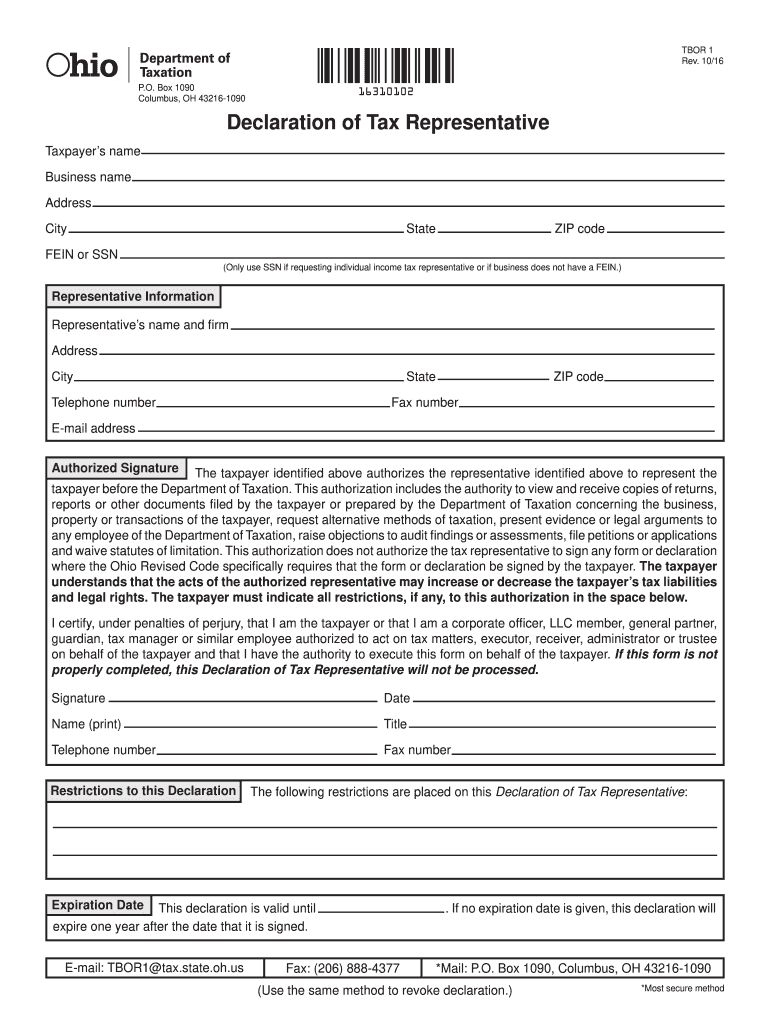

TBOR 1 Rev. 12/13 P. O. Box 1090 Columbus OH 43216-1090 Declaration of Tax Representative Taxpayer s name Business name Address City State ZIP code FEIN or Social Security number Only use Social Security number if requesting individual income tax representative or if business does not have a FEIN. Representative Information Telephone number Fax number E-mail address Authorized Signature The taxpayer identi ed above authorizes the representative identi ed above to represent the taxpayer before...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH TBOR 1

Edit your OH TBOR 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH TBOR 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH TBOR 1 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit OH TBOR 1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH TBOR 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH TBOR 1

How to fill out OH TBOR 1

01

Obtain the OH TBOR 1 form from the appropriate source, such as online or your local office.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the designated fields, including name, address, and contact details.

04

Provide any necessary identification numbers as requested.

05

Complete the relevant sections concerning the nature of the request or reporting.

06

Review all entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form as instructed, ensuring you keep a copy for your records.

Who needs OH TBOR 1?

01

Individuals or businesses required to report certain information to comply with regulations.

02

Professionals who are mandated to provide specific data for auditing or reporting purposes.

03

Anyone involved in a scenario that necessitates the use of OH TBOR 1 for official documentation.

Fill

form

: Try Risk Free

People Also Ask about

Why would I get a letter from Ohio Department of Taxation?

The agency or agencies shown on the letter have reported to the Department of Taxation that you owe one or more debts. The Department is required to apply your Ohio income tax refund as partial or complete payment of the debt(s). There are two types of Ohio Income Tax Refund Offset letters.

What does the Ohio Department of Taxation do?

The Ohio Department of Taxation administers most state and several local taxes. It makes assessments, prepares tax forms, provides taxpayer assistance, processes returns, distributes taxes to local government, and more.

Why would the Department of Taxation send me a letter?

The IRS sends notices and letters for the following reasons: You have a balance due. You are due a larger or smaller refund. We have a question about your tax return.

What is a Tbor 1 in Ohio?

TAX. Taxpayer Representation Form (TBOR 1) Declaration of Tax Representative.

How do I order tax forms in Ohio?

Visit Online Services for electronic filing and payment options. For bulk requests (10 or more forms), fill out the Bulk Order form. Information needed for requesting a tax form: Name.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my OH TBOR 1 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your OH TBOR 1 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get OH TBOR 1?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the OH TBOR 1 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out OH TBOR 1 on an Android device?

Complete OH TBOR 1 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is OH TBOR 1?

OH TBOR 1 is a form used in Ohio for reporting business income tax, specifically related to the calculation of the Business Income Deduction.

Who is required to file OH TBOR 1?

Individuals and businesses that have income from pass-through entities and want to claim the Business Income Deduction must file OH TBOR 1.

How to fill out OH TBOR 1?

To fill out OH TBOR 1, you need to provide your name, Social Security number or tax ID, details of the business income, and any other required financial information as outlined in the form instructions.

What is the purpose of OH TBOR 1?

The purpose of OH TBOR 1 is to allow taxpayers to report their business income and calculate their eligibility for the Business Income Deduction in Ohio.

What information must be reported on OH TBOR 1?

Reported information on OH TBOR 1 includes details like the taxpayer's identification information, income received from business operations, and any deductions or expenses related to that income.

Fill out your OH TBOR 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH TBOR 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.