MA Form 96-5 2019 free printable template

Show details

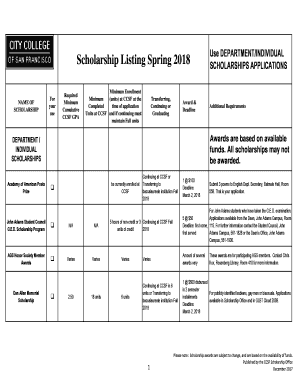

22 The Commonwealth of MassachusettsState Tax Form 96537Assessors Use only Date ReceivedRevised 7/2019Application No. Parcel I'd. Name of City or Townsend VETERAN FISCAL YEAR APPLICATION FOR STATUTORY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA Form 96-5

Edit your MA Form 96-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA Form 96-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA Form 96-5 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit MA Form 96-5. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA Form 96-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA Form 96-5

How to fill out MA Form 96-5

01

Download MA Form 96-5 from the official website.

02

Start by entering your personal information in the designated fields, including your name, address, and contact information.

03

Provide the details of the event or situation requiring the form, including dates and locations.

04

Fill in any required financial information accurately.

05

Review any additional sections that may require specific data or signatures.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form at the bottom where specified.

08

Submit the form according to the guidelines provided on the webpage or instruction manual.

Who needs MA Form 96-5?

01

Individuals who are applying for local government assistance programs.

02

Residents needing documentation for specific municipal services or claims.

03

Anyone who has been directed by a local government agency to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

What town has the highest tax rate in Massachusetts?

Holmdel. Rumson.

How much is personal property tax in Massachusetts?

Massachusetts General Laws Chapter 59, Section 18 It is assessed tax separately from real estate, but is taxed at the same rate. The tax rate for Fiscal Year 2022 was set at $12.86 per thousand dollars of value. Personal Property is taxable in the municipality where it is situated on January 1st of that year.

Should I claim an exemption on my taxes?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

What is tax exempt in Massachusetts?

While the Massachusetts sales tax of 6.25% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Massachusetts. CategoryExemption StatusClothingMedical Goods and ServicesMedical DevicesEXEMPT *Medical ServicesEXEMPT24 more rows

What does exemptions mean in taxes?

What are exemptions? An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Does Ma have high property taxes?

“ing to the Tax Foundation, Massachusetts property owners pay among the highest property taxes in the entire country.

Why are property taxes so high in Massachusetts?

It's the high market values of real estate in Massachusetts that push the state toward the top of the list in property taxes. Massachusetts home values hit a high-water mark in 2021, topping out at $750,000 for an average single-family, up 10.5% from 2020.

Does Massachusetts have business personal property tax?

All personal property situated in Massachusetts is subject to tax, unless specifically exempt by law. G.L.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is the property tax rate in Massachusetts?

The tax rate has been approved at $14.86 per thousand dollars of assessed value for all property. The tax rate for Fiscal Year 2023 will not be approved until December 2022.

Is business personal property the same as inventory?

Business personal property is all property owned or leased by a business except real property. Business inventory is personal property but is 100 percent exempt from taxation.

How do I file for tax exempt status in Massachusetts?

To obtain an exemption from Massachusetts sales taxes, you must apply for a Certificate of Exemption (Form ST-2) from the Department of Revenue. You must apply on online through MassTaxConnect.

How do I get a tax exempt number in Massachusetts?

After being deemed federally tax exempt by the IRS, you must fill out Form TA1 and submit it, with a copy of the IRS exemption letter, to the Massachusetts Bureau of Sales Excise of the Department of Revenue.

What qualifies a person as tax exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

How does Massachusetts calculate property tax?

The tax rate is calculated by dividing the total amount to be raised by the total assessed value of all property multiplied by 1,000.

What is tangible personal property in Massachusetts?

Tangible personal property is the only type of personalty subject to local property taxation in Massachusetts. Tangible personalty is property that has a physical form, is touchable and has intrinsic value. Land, buildings and “things thereon or affixed thereto” are assessed as real estate.

What are examples of exemptions for taxes?

Certain types of income, such as portions of retirement income and some academic scholarships, are tax exempt, meaning that they are not included as part of a filer's taxable income.

How do I apply for Massachusetts tax exempt status?

To obtain an exemption from Massachusetts sales taxes, you must apply for a Certificate of Exemption (Form ST-2) from the Department of Revenue. You must apply on online through MassTaxConnect.

How many tax exemptions should I claim?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Does Massachusetts have personal property tax on vehicles?

The excise rate is $25 per $1,000 of your vehicle's value. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. If your vehicle is registered in Massachusetts but garaged outside of Massachusetts, the Commissioner of Revenue will bill the excise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute MA Form 96-5 online?

pdfFiller has made it easy to fill out and sign MA Form 96-5. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in MA Form 96-5?

With pdfFiller, it's easy to make changes. Open your MA Form 96-5 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I complete MA Form 96-5 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your MA Form 96-5 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is MA Form 96-5?

MA Form 96-5 is a specific form used by the Massachusetts Department of Revenue for reporting certain financial information related to taxation.

Who is required to file MA Form 96-5?

Individuals, businesses, and entities that meet specific criteria outlined by the Massachusetts Department of Revenue are required to file MA Form 96-5.

How to fill out MA Form 96-5?

To fill out MA Form 96-5, taxpayers need to gather the required financial information, accurately complete each section of the form, ensuring that all figures are correct, and submit it by the due date specified by the Massachusetts Department of Revenue.

What is the purpose of MA Form 96-5?

The purpose of MA Form 96-5 is to provide the Massachusetts Department of Revenue with necessary information to assess tax liabilities and ensure compliance with state tax laws.

What information must be reported on MA Form 96-5?

MA Form 96-5 requires the reporting of financial information such as income, deductions, tax credits, and other relevant data that affects the taxpayer's tax liability.

Fill out your MA Form 96-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA Form 96-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.