MA Form 96-5 2017 free printable template

Show details

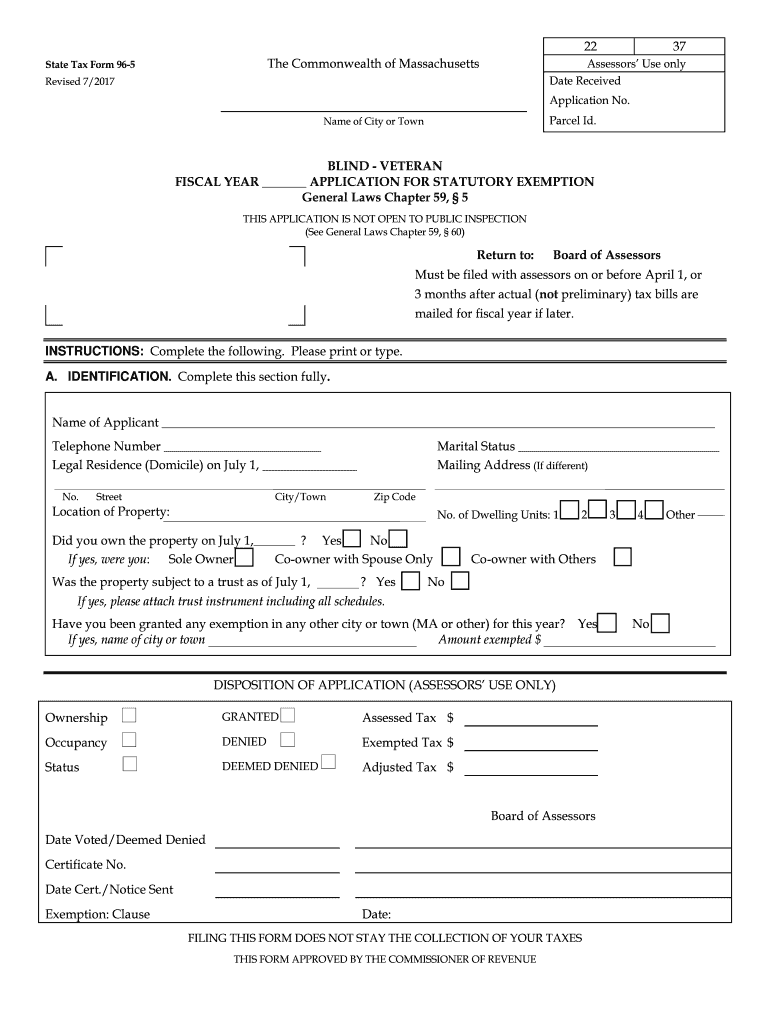

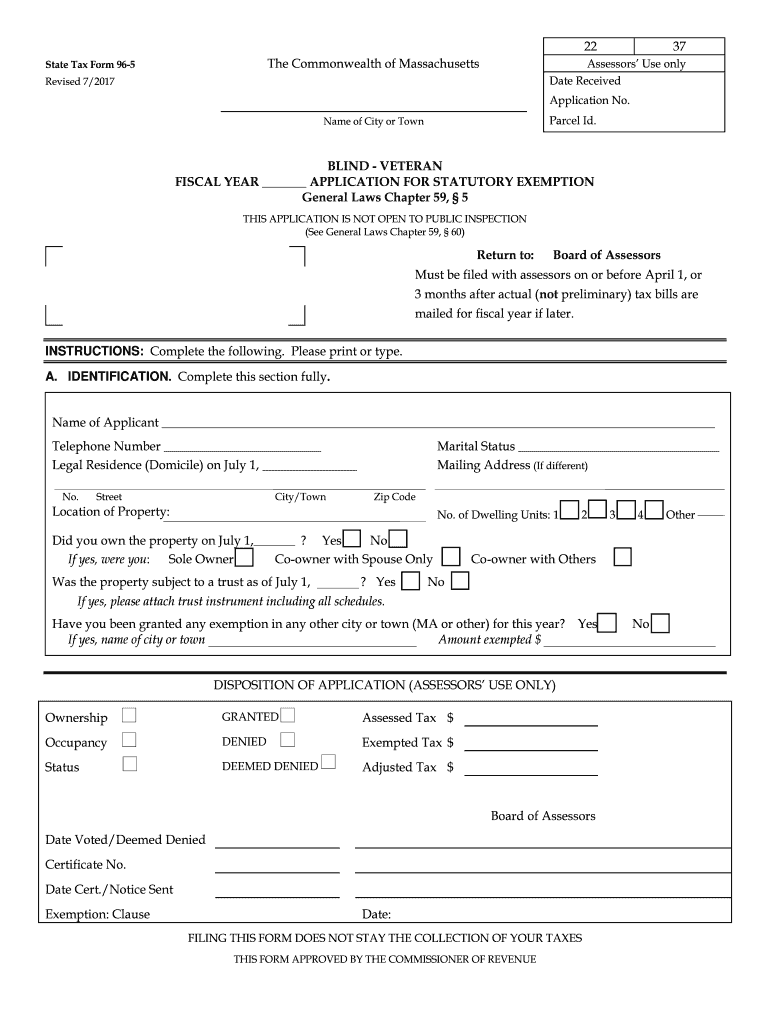

22 The Commonwealth of MassachusettsState Tax Form 96537Assessors Use only Date ReceivedRevised 7/2017Application No. Parcel I'd. Name of City or Townsend VETERAN FISCAL YEAR APPLICATION FOR STATUTORY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA Form 96-5

Edit your MA Form 96-5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA Form 96-5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

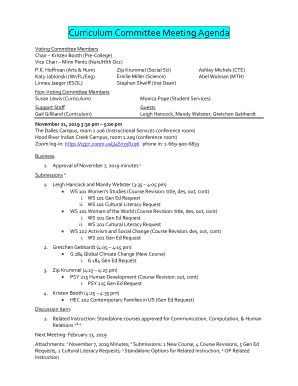

Editing MA Form 96-5 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MA Form 96-5. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA Form 96-5 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA Form 96-5

How to fill out MA Form 96-5

01

Begin by downloading the MA Form 96-5 from the official website or obtaining a physical copy.

02

Fill in the header section with your name, address, and contact information.

03

Specify the purpose of the form by checking the appropriate box or writing a brief description.

04

Provide the necessary details in the designated fields, ensuring all information is accurate and complete.

05

If applicable, attach any required supplementary documents as specified in the form instructions.

06

Review the filled form for any errors or missing information before submission.

07

Sign and date the form at the bottom to authenticate your submission.

08

Submit the completed form to the appropriate agency or office listed in the instructions.

Who needs MA Form 96-5?

01

Individuals applying for a specific type of administrative process in Massachusetts.

02

Businesses needing to submit compliance or registration information.

03

Anyone required to provide documentation related to the specified purpose of the form.

Fill

form

: Try Risk Free

People Also Ask about

What town has the highest tax rate in Massachusetts?

Holmdel. Rumson.

How much is personal property tax in Massachusetts?

Massachusetts General Laws Chapter 59, Section 18 It is assessed tax separately from real estate, but is taxed at the same rate. The tax rate for Fiscal Year 2022 was set at $12.86 per thousand dollars of value. Personal Property is taxable in the municipality where it is situated on January 1st of that year.

Should I claim an exemption on my taxes?

Who Should Be Filing Exempt on Taxes? As noted above, you can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability and had no tax liability in the previous tax year.

What is tax exempt in Massachusetts?

While the Massachusetts sales tax of 6.25% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Massachusetts. CategoryExemption StatusClothingMedical Goods and ServicesMedical DevicesEXEMPT *Medical ServicesEXEMPT24 more rows

What does exemptions mean in taxes?

What are exemptions? An exemption is a dollar amount that can be deducted from an individual's total income, thereby reducing. the taxable income. Taxpayers may be able to claim two kinds of exemptions: • Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse)

Does Ma have high property taxes?

“ing to the Tax Foundation, Massachusetts property owners pay among the highest property taxes in the entire country.

Why are property taxes so high in Massachusetts?

It's the high market values of real estate in Massachusetts that push the state toward the top of the list in property taxes. Massachusetts home values hit a high-water mark in 2021, topping out at $750,000 for an average single-family, up 10.5% from 2020.

Does Massachusetts have business personal property tax?

All personal property situated in Massachusetts is subject to tax, unless specifically exempt by law. G.L.

Is it better to claim 1 or 0?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

What is the property tax rate in Massachusetts?

The tax rate has been approved at $14.86 per thousand dollars of assessed value for all property. The tax rate for Fiscal Year 2023 will not be approved until December 2022.

Is business personal property the same as inventory?

Business personal property is all property owned or leased by a business except real property. Business inventory is personal property but is 100 percent exempt from taxation.

How do I file for tax exempt status in Massachusetts?

To obtain an exemption from Massachusetts sales taxes, you must apply for a Certificate of Exemption (Form ST-2) from the Department of Revenue. You must apply on online through MassTaxConnect.

How do I get a tax exempt number in Massachusetts?

After being deemed federally tax exempt by the IRS, you must fill out Form TA1 and submit it, with a copy of the IRS exemption letter, to the Massachusetts Bureau of Sales Excise of the Department of Revenue.

What qualifies a person as tax exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

How does Massachusetts calculate property tax?

The tax rate is calculated by dividing the total amount to be raised by the total assessed value of all property multiplied by 1,000.

What is tangible personal property in Massachusetts?

Tangible personal property is the only type of personalty subject to local property taxation in Massachusetts. Tangible personalty is property that has a physical form, is touchable and has intrinsic value. Land, buildings and “things thereon or affixed thereto” are assessed as real estate.

What are examples of exemptions for taxes?

Certain types of income, such as portions of retirement income and some academic scholarships, are tax exempt, meaning that they are not included as part of a filer's taxable income.

How do I apply for Massachusetts tax exempt status?

To obtain an exemption from Massachusetts sales taxes, you must apply for a Certificate of Exemption (Form ST-2) from the Department of Revenue. You must apply on online through MassTaxConnect.

How many tax exemptions should I claim?

Claiming 1 allowance is typically a good idea if you are single and you only have one job. You should claim 1 allowance if you are married and filing jointly. If you are filing as the head of the household, then you would also claim 1 allowance. You will likely be getting a refund back come tax time.

Does Massachusetts have personal property tax on vehicles?

The excise rate is $25 per $1,000 of your vehicle's value. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. If your vehicle is registered in Massachusetts but garaged outside of Massachusetts, the Commissioner of Revenue will bill the excise.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

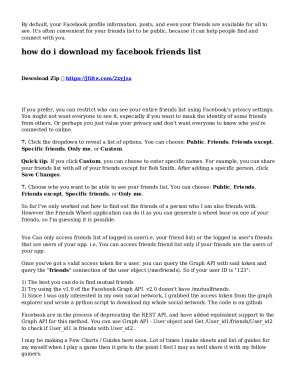

Can I create an electronic signature for signing my MA Form 96-5 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your MA Form 96-5 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit MA Form 96-5 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing MA Form 96-5.

Can I edit MA Form 96-5 on an iOS device?

Create, modify, and share MA Form 96-5 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is MA Form 96-5?

MA Form 96-5 is a tax form used in Massachusetts to report certain income and expenses for individuals who are claiming a specific tax credit or deduction.

Who is required to file MA Form 96-5?

Individuals who are residents of Massachusetts and wish to claim certain tax credits or deductions related to income or expenses must file MA Form 96-5.

How to fill out MA Form 96-5?

To fill out MA Form 96-5, taxpayers need to provide their personal information, details about their income, and any qualifying expenses. They should follow the instructions provided with the form carefully.

What is the purpose of MA Form 96-5?

The purpose of MA Form 96-5 is to allow taxpayers to claim specific tax credits or deductions that may reduce their overall state tax liability.

What information must be reported on MA Form 96-5?

MA Form 96-5 requires taxpayers to report personal identification details, income amounts, qualifying expenses, and any relevant tax credits or deductions they are claiming.

Fill out your MA Form 96-5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA Form 96-5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.