NY Substitute W-9 2017-2025 free printable template

Show details

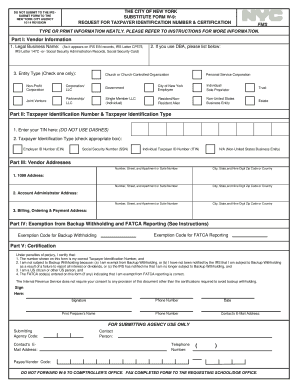

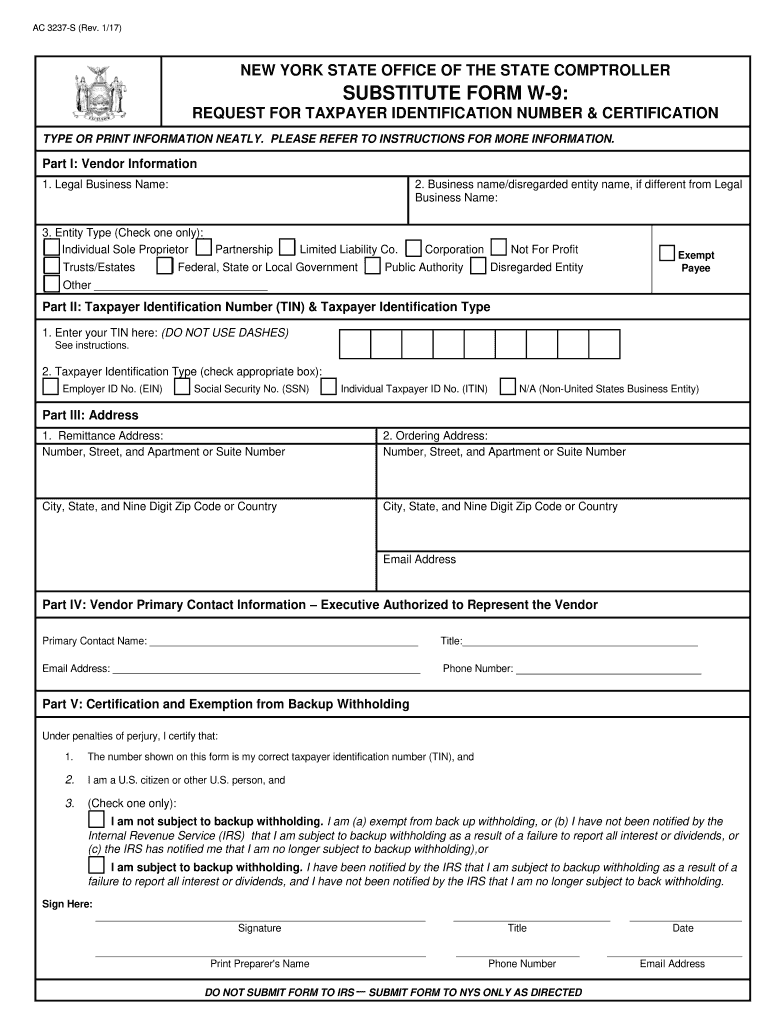

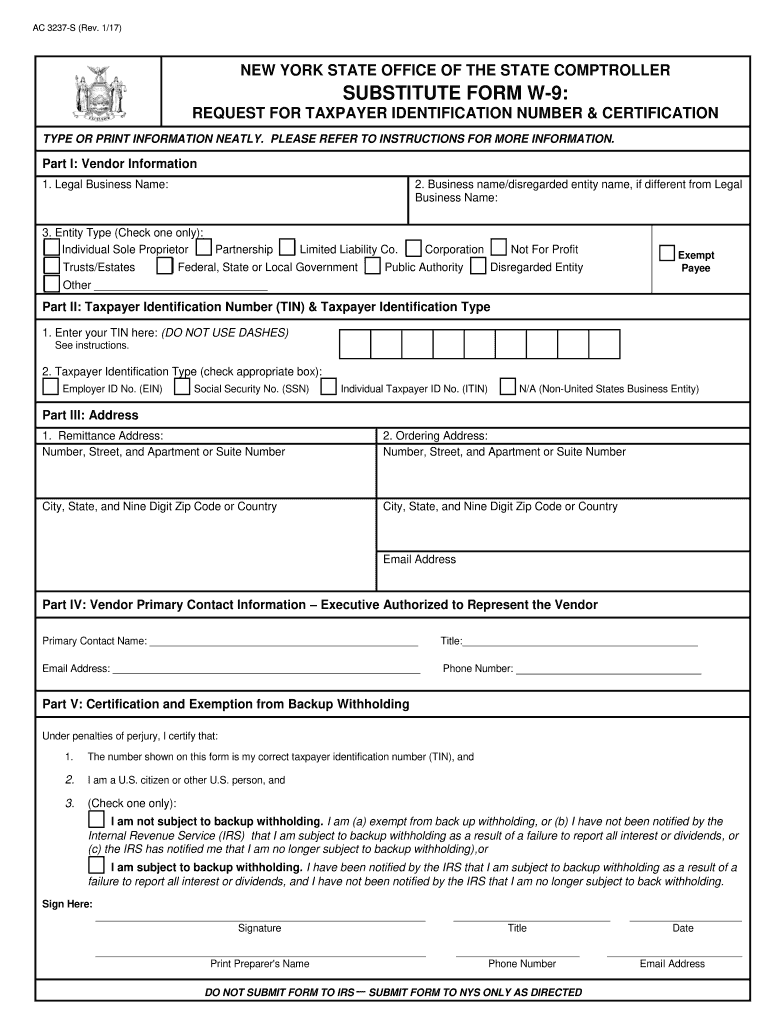

AC 3237S (Rev. 1/17)NEW YORK STATE OFFICE OF THE STATE COMPTROLLERSUBSTITUTE FORM W9: REQUEST FOR TAXPAYER IDENTIFICATION NUMBER & CERTIFICATION TYPE OR PRINT INFORMATION NEATLY. PLEASE REFER TO INSTRUCTIONS

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign w9 form nyc

Edit your substitute w9 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the substitute w form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing substitute w 9 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit city request taxpayer form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Substitute W-9 Form Versions

Version

Form Popularity

Fillable & printabley

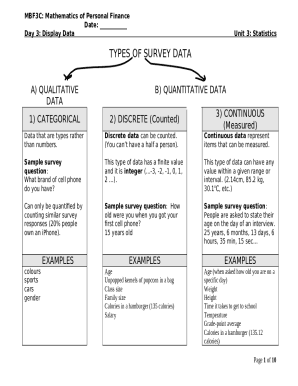

How to fill out city fatca apartment form

How to fill out NY Substitute W-9

01

Obtain the NY Substitute W-9 form from the appropriate source, typically from the New York State Department of Taxation and Finance website.

02

Enter your name in the first line as it appears on your tax return.

03

If applicable, provide your business name on the second line.

04

Fill in the address where you receive your mail, including city, state, and ZIP code.

05

Specify your tax identification number (TIN), which may be your Social Security Number (SSN) or Employer Identification Number (EIN).

06

Indicate your tax classification by marking the appropriate box (individual, corporation, partnership, etc.).

07

Provide your signature, followed by the date you signed the form.

Who needs NY Substitute W-9?

01

Any individual or entity that is receiving payments or income from a New York state agency or organization that requires tax reporting.

02

Independent contractors or freelancers who provide services to New York entities.

03

Businesses that need to report their tax information to New York State.

Fill

new substitute type

: Try Risk Free

People Also Ask about

Does NY have a state tax form?

If you live in the state of New York or earn income within the state, it's likely you will have to pay New York income tax. And with that, comes completing and filing New York (NYS) tax forms. Read on to learn more about common NYS tax forms here!

How do I get a NY state tax form?

You can order forms using our automated forms order telephone line: 518-457-5431. It's compatible with TTY equipment through NY Relay (Dial 711) and with Internet and mobile relay services (see Assistance for the hearing and speech impaired for more information).

How many allowances should I claim 2104?

When you use the form IT-2104 Employee's Withholding Allowance Certificate for your state and city taxes, you may claim as many allowances as are justified by your circumstances. However, if you claim more than 14 allowances, you must complete the Withholding Certificate Affirmation.

Which NYS tax form do I use?

You must file Form IT-201, Resident Income Tax Return, if you were a New York State resident for the entire year.

What is a NY 2104 form?

Overview. Form IT-2104 is completed by you, as an employee, and given to your employer to instruct them how much New York State (and New York City and Yonkers) tax to withhold from your pay and send to the New York State Tax Department on your behalf.

What is IT-2104.1 form used for?

NYS, NYC, and Yonkers Non-Residence Certificate (IT-2104.1) Use to determine your tax withholding allocations if you work in NYS, NYC, or Yonkers but are not a resident of NYS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send taxpayer identification number certification to be eSigned by others?

When your taxpayer identification number certification is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the taxpayer identification number certification in Gmail?

Create your eSignature using pdfFiller and then eSign your taxpayer identification number certification immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit taxpayer identification number certification on an Android device?

You can make any changes to PDF files, like taxpayer identification number certification, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NY Substitute W-9?

The NY Substitute W-9 is a form used in New York for taxpayers to provide their taxpayer identification information to a requester. It serves as an alternative to the standard IRS W-9 form.

Who is required to file NY Substitute W-9?

Individuals or entities that receive income reportable to the state of New York, such as independent contractors, freelancers, and businesses receiving payments, are required to file the NY Substitute W-9.

How to fill out NY Substitute W-9?

To fill out the NY Substitute W-9, provide your name, business name (if applicable), address, taxpayer identification number (TIN), and any additional required information as specified on the form.

What is the purpose of NY Substitute W-9?

The purpose of the NY Substitute W-9 is to collect accurate taxpayer information to ensure appropriate reporting of income and to comply with state tax regulations.

What information must be reported on NY Substitute W-9?

Information that must be reported on the NY Substitute W-9 includes the individual's or entity's name, business name (if applicable), address, taxpayer identification number (TIN), and any certifications required by the form.

Fill out your taxpayer identification number certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayer Identification Number Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.