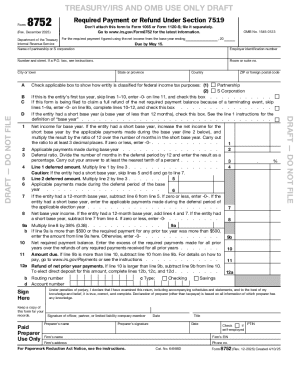

IRS 8752 2019 free printable template

Instructions and Help about IRS 8752

How to edit IRS 8752

How to fill out IRS 8752

About IRS 8 previous version

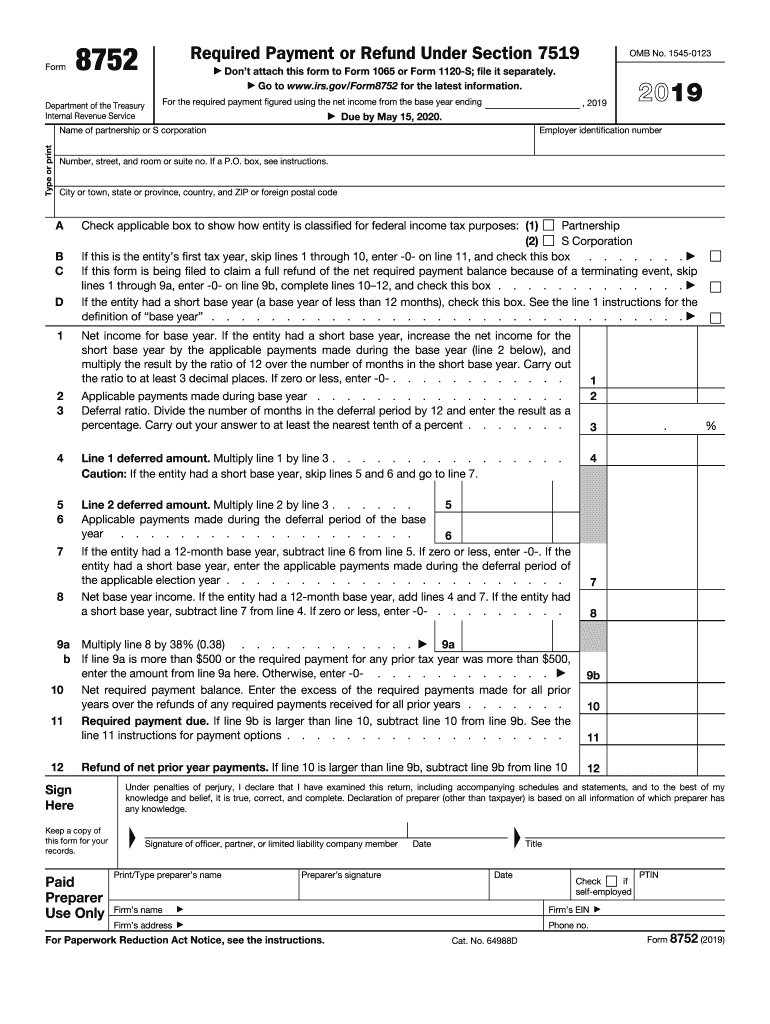

What is IRS 8752?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8752

What should I do if I realize I made a mistake after submitting my no refund policy for?

If you discover an error in your no refund policy for submission, you can file an amended version. Make sure to clearly indicate that it is a correction and follow any specific procedures outlined by the relevant authority. Correcting mistakes promptly helps mitigate any potential issues.

How can I track the status of my no refund policy for submission?

To verify the receipt and processing of your no refund policy for, you can check the tracking feature provided by the filing authority. This will typically provide updates on whether your submission has been received and is being processed, allowing you to address any issues that may arise.

Are there any common errors I should be aware of when filing the no refund policy for?

Common errors in filing the no refund policy for include incorrect recipient information and forgetting to sign the form. Carefully reviewing your submission before finalizing can help prevent these mistakes, ensuring that your filing is accepted without delays.

What are the data privacy considerations for the no refund policy for submissions?

When filing the no refund policy for, it is crucial to ensure that personal information is handled securely. Organizations must comply with relevant data protection regulations, keeping sensitive information confidential and stored securely to prevent unauthorized access.

See what our users say