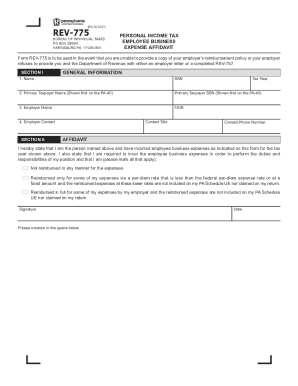

PA REV-775 EX 2019 free printable template

Show details

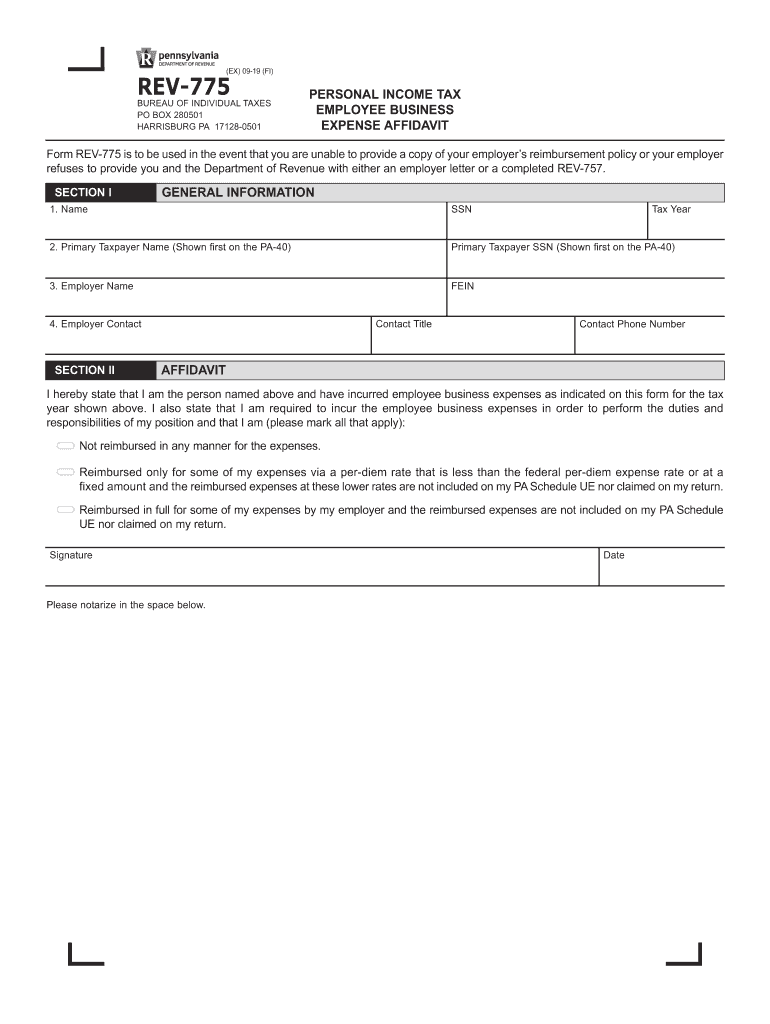

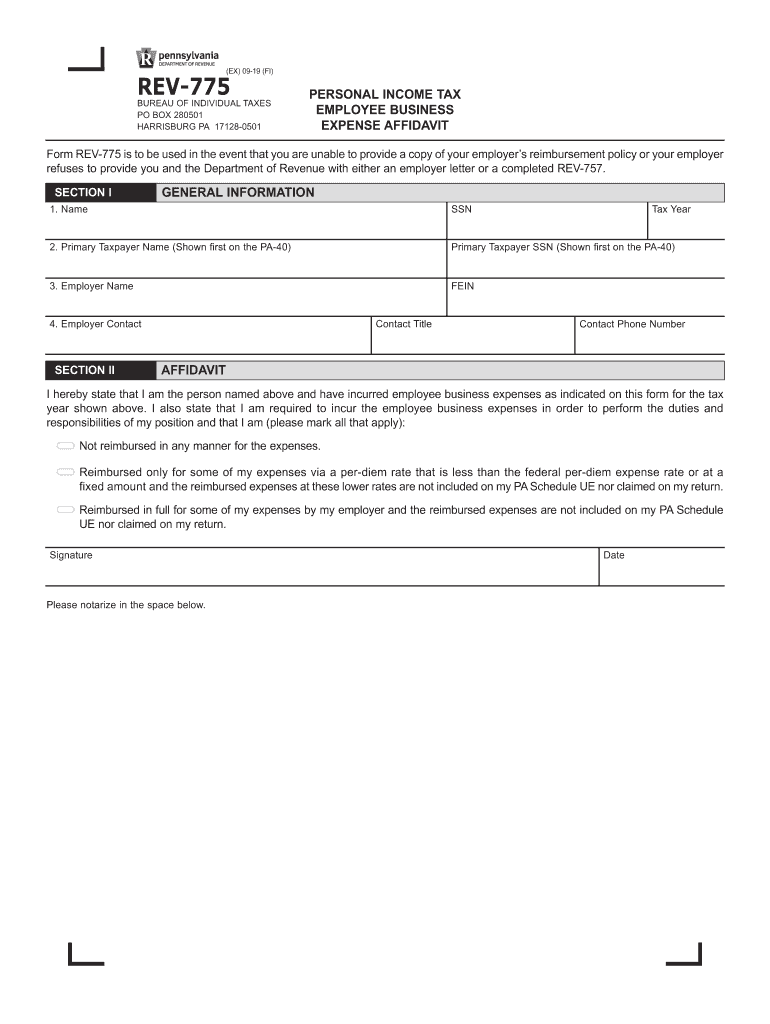

(EX) 0919 (FI)REV775BUREAU OF INDIVIDUAL TAXES

PO BOX 280501

HARRISBURG PA 171280501PERSONAL INCOME TAX

EMPLOYEE BUSINESS

EXPENSE AFFIDAVITForm REV775 is to be used in the event that you are unable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-775 EX

Edit your PA REV-775 EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-775 EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA REV-775 EX online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PA REV-775 EX. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-775 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-775 EX

How to fill out PA REV-775 EX

01

Obtain the PA REV-775 EX form from the Pennsylvania Department of Revenue website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out the taxpayer information section, including your name, address, and taxpayer identification number.

04

Complete the reason for the request section, providing a clear explanation for the change or request.

05

Provide any necessary financial information or documentation as required by the form.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to the Pennsylvania Department of Revenue either by mail or electronically, as per the instructions.

Who needs PA REV-775 EX?

01

Individuals or businesses that need to amend or adjust their previously filed tax returns in Pennsylvania.

02

Anyone seeking clarification or correction of tax information with the Department of Revenue.

03

Taxpayers who have experienced significant changes affecting their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

What is the address for PA Department of Revenue estimated taxes?

The mailing address is: PA Department of Revenue Harrisburg Call Center 6th Floor Strawberry Square-Quad 620 4th and Walnut Street Harrisburg, PA 17128-1210 You should include a copy of the notice

What is the phone number for the PA Department of Revenue tax Practitioner?

1-888-pataxes (728-2937) touch-tone service is required for this automated, 24-hour, toll-free line.

Where do I send PA Department of Revenue?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

What is the phone number for PA Department of Revenue Transfer tax Division?

By Phone. If you do not have access to the internet but would like to pay via ACH withdrawal using your routing number and account number, please contact us at 717-425-2495 Ext PAYPA (72972).

Why would the PA Dept of Revenue send me a letter?

Taxpayers will receive a letter asking them to complete a six-question ID Validation Quiz to verify their identity. The questions may be based on a taxpayer's individual credit background. Letters are mailed to the address on the taxpayer's PA-40 (Personal Income Tax Return).

What is the phone number for PA Dept of Revenue Realty transfer tax?

By Phone. If you do not have access to the internet but would like to pay via ACH withdrawal using your routing number and account number, please contact us at 717-425-2495 Ext PAYPA (72972).

How do I talk to a person at the PA Dept of Revenue?

If you are still unable to find an answer to your question, you may submit a question electronically through the Department of Revenue's Online Customer Service Center or by calling our Customer Experience Center at 717-787-1064 between 8 a.m. and 4:30 p.m. on weekdays (Monday through Friday).

What is the phone number for PA sales and use tax?

Call, toll-free, 1-800-748-8299.

Who do I make my PA state tax check out to?

If you intend to make your payment by check, please make the check payable to the PA Department of Revenue. Note on the check your PA Employer Account Number, your Entity Identification Number (EIN)

How do I write a check to PA for taxes?

Make the check or money order payable to the PA DEPARTMENT OF REVENUE. Please write on the check or money order: The last four digits of the primary taxpayer's SSN; ● "2022 PA-40 V"; and ● Daytime telephone number of the taxpayer(s).

What is the address for PA Department of Revenue for tax payment?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

How do I pay my PA Department of Revenue?

Online, by Phone or Mail Online. New electronic payments options are now available through myPATH. By Phone – Credit or Debt. You can also make state tax payments by calling ACI Payments Inc at 1-800-2PAYTAX (1-800-272-9829). By Phone – ACH. Mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA REV-775 EX without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your PA REV-775 EX into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send PA REV-775 EX to be eSigned by others?

Once your PA REV-775 EX is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find PA REV-775 EX?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the PA REV-775 EX in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is PA REV-775 EX?

PA REV-775 EX is a form used in Pennsylvania for the exemption of certain taxes under specific conditions, often related to property or tax filings.

Who is required to file PA REV-775 EX?

Individuals or entities that qualify for tax exemptions under Pennsylvania law are required to file PA REV-775 EX.

How to fill out PA REV-775 EX?

To fill out PA REV-775 EX, taxpayers must provide their personal information, the reason for exemption, and any required supporting documentation as specified in the form's instructions.

What is the purpose of PA REV-775 EX?

The purpose of PA REV-775 EX is to formally request an exemption from certain taxes, allowing eligible taxpayers to avoid or reduce their tax liability.

What information must be reported on PA REV-775 EX?

Information that must be reported on PA REV-775 EX includes the taxpayer's identification details, the type of exemption being claimed, and any relevant financial data that supports the exemption request.

Fill out your PA REV-775 EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-775 EX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.