PA REV-775 EX 2018 free printable template

Show details

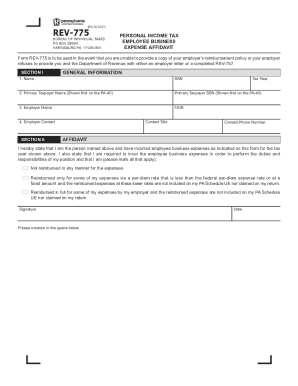

REV-775 (EX) 05-18 (FI) BUREAU OF INDIVIDUAL TAXES PO BOX 280501 HARRISBURG PA 17128-0501 PERSONAL INCOME TAX EMPLOYEE BUSINESS EXPENSE AFFIDAVIT Form REV-775 is to be used in the event that you are

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-775 EX

Edit your PA REV-775 EX form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-775 EX form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA REV-775 EX online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA REV-775 EX. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-775 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-775 EX

How to fill out PA REV-775 EX

01

Begin by downloading the PA REV-775 EX form from the Pennsylvania Department of Revenue's website.

02

Carefully read the instructions provided on the form before proceeding.

03

Fill in the taxpayer's name, address, and identification number in the designated sections.

04

Specify the type of tax being reported by selecting the appropriate boxes.

05

Enter the financial figures in the specified fields, ensuring accuracy to avoid issues.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate Pennsylvania Department of Revenue address as instructed.

Who needs PA REV-775 EX?

01

Individuals or businesses in Pennsylvania who wish to claim a refund for overpaid taxes need to complete the PA REV-775 EX form.

Fill

form

: Try Risk Free

People Also Ask about

What is the address for PA Department of Revenue estimated taxes?

The mailing address is: PA Department of Revenue Harrisburg Call Center 6th Floor Strawberry Square-Quad 620 4th and Walnut Street Harrisburg, PA 17128-1210 You should include a copy of the notice

What is the phone number for the PA Department of Revenue tax Practitioner?

1-888-pataxes (728-2937) touch-tone service is required for this automated, 24-hour, toll-free line.

Where do I send PA Department of Revenue?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

What is the phone number for PA Department of Revenue Transfer tax Division?

By Phone. If you do not have access to the internet but would like to pay via ACH withdrawal using your routing number and account number, please contact us at 717-425-2495 Ext PAYPA (72972).

Why would the PA Dept of Revenue send me a letter?

Taxpayers will receive a letter asking them to complete a six-question ID Validation Quiz to verify their identity. The questions may be based on a taxpayer's individual credit background. Letters are mailed to the address on the taxpayer's PA-40 (Personal Income Tax Return).

What is the phone number for PA Dept of Revenue Realty transfer tax?

By Phone. If you do not have access to the internet but would like to pay via ACH withdrawal using your routing number and account number, please contact us at 717-425-2495 Ext PAYPA (72972).

How do I talk to a person at the PA Dept of Revenue?

If you are still unable to find an answer to your question, you may submit a question electronically through the Department of Revenue's Online Customer Service Center or by calling our Customer Experience Center at 717-787-1064 between 8 a.m. and 4:30 p.m. on weekdays (Monday through Friday).

What is the phone number for PA sales and use tax?

Call, toll-free, 1-800-748-8299.

Who do I make my PA state tax check out to?

If you intend to make your payment by check, please make the check payable to the PA Department of Revenue. Note on the check your PA Employer Account Number, your Entity Identification Number (EIN)

How do I write a check to PA for taxes?

Make the check or money order payable to the PA DEPARTMENT OF REVENUE. Please write on the check or money order: The last four digits of the primary taxpayer's SSN; ● "2022 PA-40 V"; and ● Daytime telephone number of the taxpayer(s).

What is the address for PA Department of Revenue for tax payment?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

How do I pay my PA Department of Revenue?

Online, by Phone or Mail Online. New electronic payments options are now available through myPATH. By Phone – Credit or Debt. You can also make state tax payments by calling ACI Payments Inc at 1-800-2PAYTAX (1-800-272-9829). By Phone – ACH. Mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA REV-775 EX without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like PA REV-775 EX, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit PA REV-775 EX online?

With pdfFiller, it's easy to make changes. Open your PA REV-775 EX in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the PA REV-775 EX electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your PA REV-775 EX in minutes.

What is PA REV-775 EX?

PA REV-775 EX is a form used in Pennsylvania for the purpose of requesting an exemption from certain Pennsylvania taxes for eligible organizations.

Who is required to file PA REV-775 EX?

Organizations that seek tax-exempt status under Pennsylvania law, such as charitable organizations, must file PA REV-775 EX.

How to fill out PA REV-775 EX?

To fill out PA REV-775 EX, organizations need to provide basic information including their name, address, and the specific tax exemption they are applying for, followed by any required supporting documentation.

What is the purpose of PA REV-775 EX?

The purpose of PA REV-775 EX is to allow eligible nonprofit organizations to apply for exemptions from certain taxes imposed by the state of Pennsylvania.

What information must be reported on PA REV-775 EX?

The information that must be reported on PA REV-775 EX includes the organization's legal name, address, purpose, and the specific tax exemption being requested, along with any supporting documentation.

Fill out your PA REV-775 EX online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-775 EX is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.