PA REV-775 EX 2022-2025 free printable template

Show details

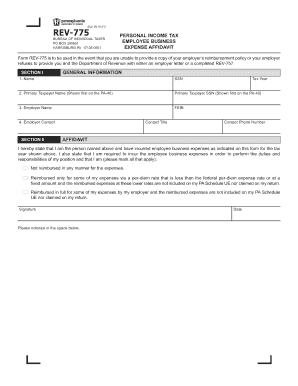

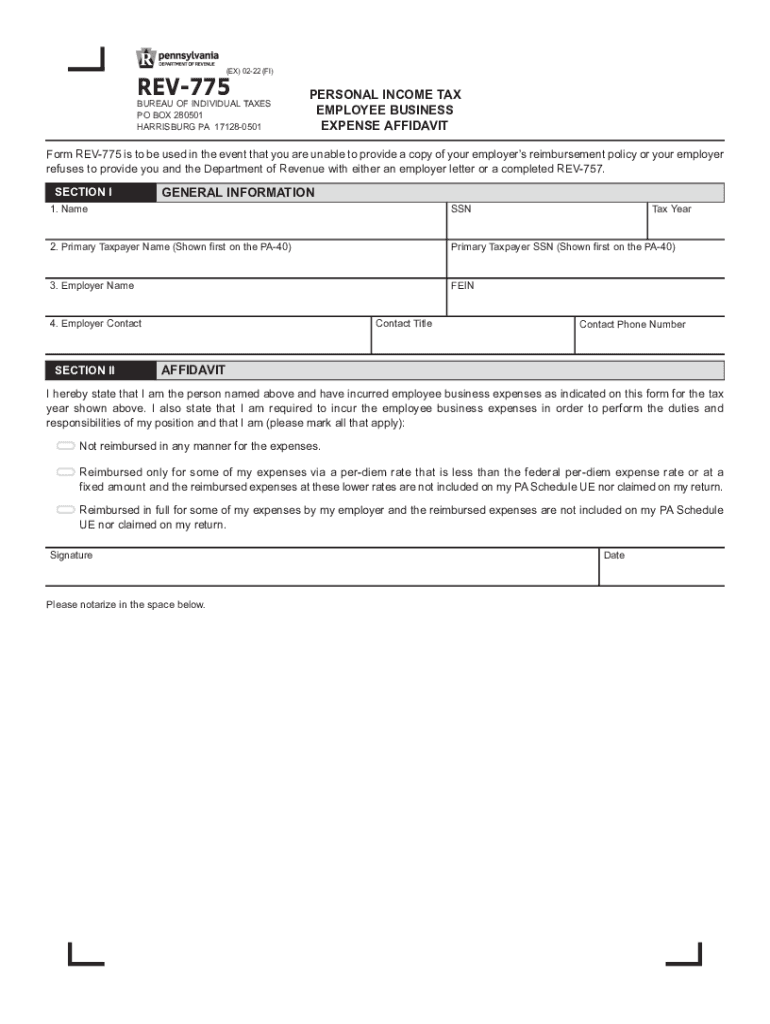

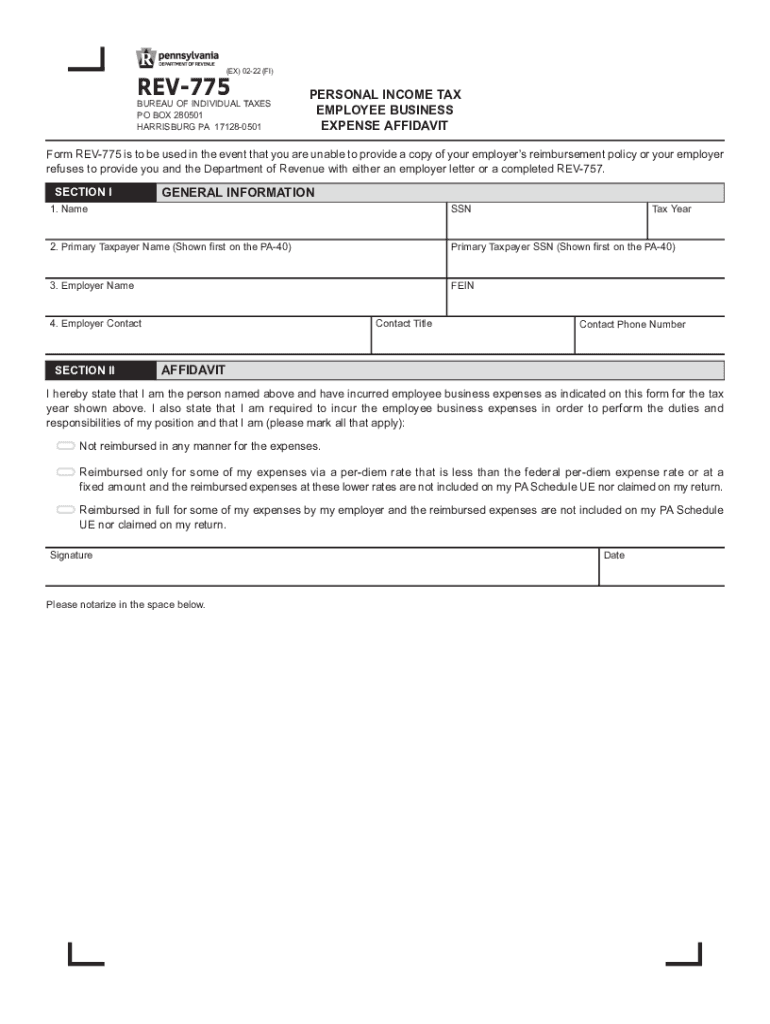

(EX) 0222 (FI)REV775BUREAU OF INDIVIDUAL TAXES PO BOX 280501 HARRISBURG PA 171280501PERSONAL INCOME TAX EMPLOYEE BUSINESS EXPENSE AFFIDAVITForm REV775 is to be used in the event that you are unable

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa rev tax employee

Edit your pa rev tax employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa rev tax employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pa rev tax employee online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pa rev tax employee. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-775 EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out pa rev tax employee

How to fill out PA REV-775 EX

01

Obtain the PA REV-775 EX form from the Pennsylvania Department of Revenue website.

02

Read the instructions carefully to understand the requirements and the information needed.

03

Fill out your personal information in the designated fields, including name, address, and social security number.

04

Indicate the type of credit or exemption you are claiming on the form.

05

Provide any required support documentation or information as specified in the instructions.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate department by the specified deadline.

Who needs PA REV-775 EX?

01

Individuals or businesses in Pennsylvania seeking a tax credit or exemption.

02

Taxpayers who are eligible and need to document their claim for tax benefits.

03

Professionals assisting clients with tax filings who need to provide the necessary documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is the address for PA Department of Revenue estimated taxes?

The mailing address is: PA Department of Revenue Harrisburg Call Center 6th Floor Strawberry Square-Quad 620 4th and Walnut Street Harrisburg, PA 17128-1210 You should include a copy of the notice

What is the phone number for the PA Department of Revenue tax Practitioner?

1-888-pataxes (728-2937) touch-tone service is required for this automated, 24-hour, toll-free line.

Where do I send PA Department of Revenue?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

What is the phone number for PA Department of Revenue Transfer tax Division?

By Phone. If you do not have access to the internet but would like to pay via ACH withdrawal using your routing number and account number, please contact us at 717-425-2495 Ext PAYPA (72972).

Why would the PA Dept of Revenue send me a letter?

Taxpayers will receive a letter asking them to complete a six-question ID Validation Quiz to verify their identity. The questions may be based on a taxpayer's individual credit background. Letters are mailed to the address on the taxpayer's PA-40 (Personal Income Tax Return).

What is the phone number for PA Dept of Revenue Realty transfer tax?

By Phone. If you do not have access to the internet but would like to pay via ACH withdrawal using your routing number and account number, please contact us at 717-425-2495 Ext PAYPA (72972).

How do I talk to a person at the PA Dept of Revenue?

If you are still unable to find an answer to your question, you may submit a question electronically through the Department of Revenue's Online Customer Service Center or by calling our Customer Experience Center at 717-787-1064 between 8 a.m. and 4:30 p.m. on weekdays (Monday through Friday).

What is the phone number for PA sales and use tax?

Call, toll-free, 1-800-748-8299.

Who do I make my PA state tax check out to?

If you intend to make your payment by check, please make the check payable to the PA Department of Revenue. Note on the check your PA Employer Account Number, your Entity Identification Number (EIN)

How do I write a check to PA for taxes?

Make the check or money order payable to the PA DEPARTMENT OF REVENUE. Please write on the check or money order: The last four digits of the primary taxpayer's SSN; ● "2022 PA-40 V"; and ● Daytime telephone number of the taxpayer(s).

What is the address for PA Department of Revenue for tax payment?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

How do I pay my PA Department of Revenue?

Online, by Phone or Mail Online. New electronic payments options are now available through myPATH. By Phone – Credit or Debt. You can also make state tax payments by calling ACI Payments Inc at 1-800-2PAYTAX (1-800-272-9829). By Phone – ACH. Mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pa rev tax employee without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including pa rev tax employee. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get pa rev tax employee?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the pa rev tax employee. Open it immediately and start altering it with sophisticated capabilities.

How do I fill out pa rev tax employee on an Android device?

Use the pdfFiller mobile app to complete your pa rev tax employee on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is PA REV-775 EX?

PA REV-775 EX is a form used in Pennsylvania for reporting and claiming an exemption from the state's inheritance tax.

Who is required to file PA REV-775 EX?

Individuals or entities who are inheriting property or assets that qualify for an exemption from Pennsylvania's inheritance tax are required to file PA REV-775 EX.

How to fill out PA REV-775 EX?

To fill out PA REV-775 EX, you need to provide required personal and asset information, ensure accurate reporting of asset values, and specify the exemption being claimed.

What is the purpose of PA REV-775 EX?

The purpose of PA REV-775 EX is to allow heirs to formally claim an exemption from inheritance tax for qualifying properties or assets in Pennsylvania.

What information must be reported on PA REV-775 EX?

The information that must be reported on PA REV-775 EX includes the decedent's details, the heir's information, a description of the property, its value, and the reason for claiming the exemption.

Fill out your pa rev tax employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa Rev Tax Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.