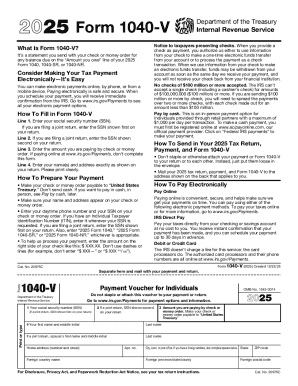

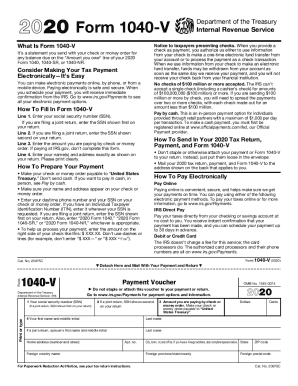

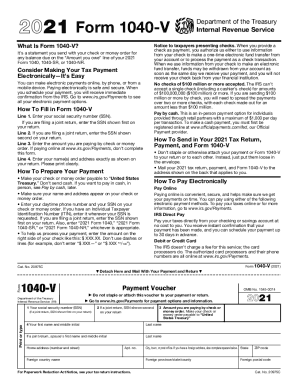

IRS 1040-V 2019 free printable template

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

How to fill out IRS 1040-V

About IRS 1040-V previous version

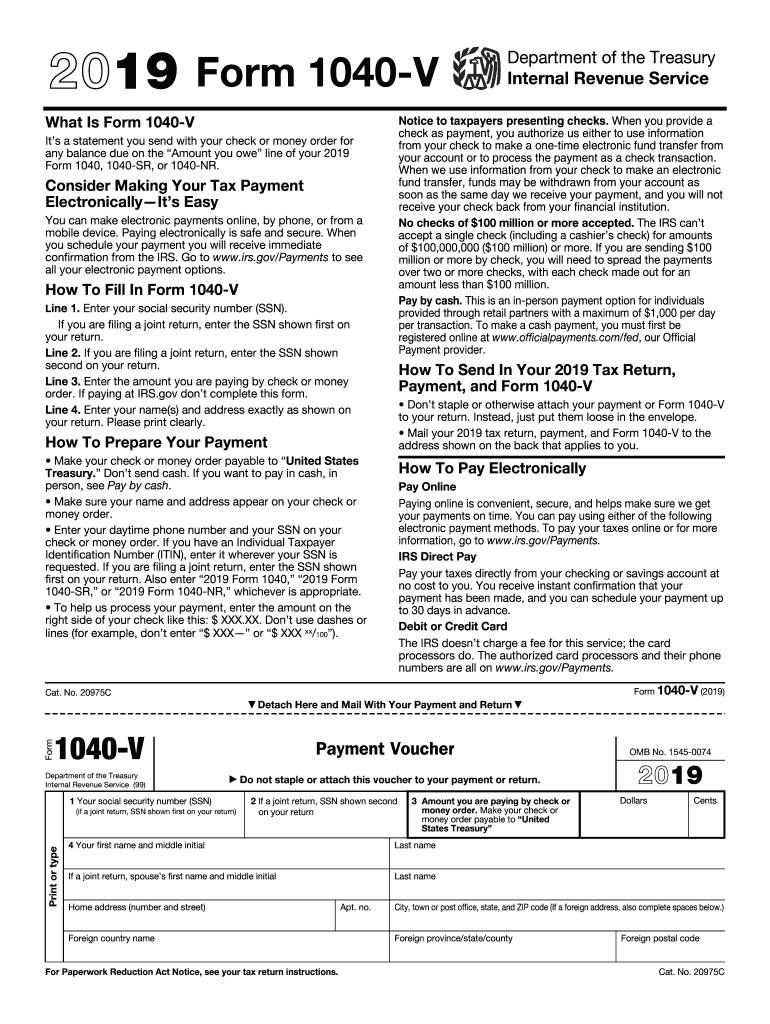

What is IRS 1040-V?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

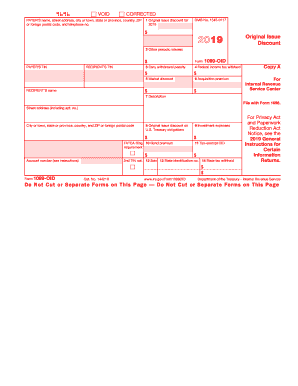

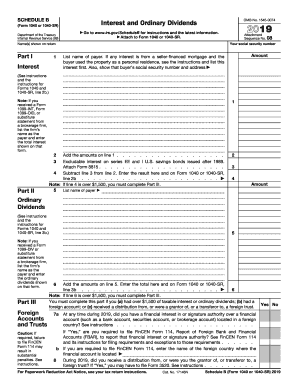

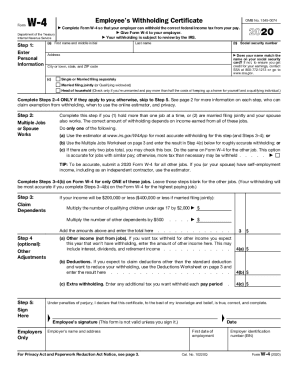

Is the form accompanied by other forms?

FAQ about IRS 1040-V

What should you do if you realize there's an error in your IRS 1040-V after submission?

If you discover an error on your IRS 1040-V after submitting it, you should file an amended form to correct the mistake. Ensure that any changes are clearly documented and send the updated form to the appropriate address. Remember to keep copies of any correspondence and forms for your records.

How can you verify that the IRS received your 1040-V submission?

To verify receipt of your IRS 1040-V, you can check your IRS account online or contact the IRS directly by phone. Keeping track of submission confirmation emails and e-filing receipts can also provide assurance of your filing status.

What are common mistakes to avoid when filing the IRS 1040-V?

Common mistakes when filing the IRS 1040-V include failing to sign the form, incorrect payment amounts, or sending it to the wrong address. Double-check your information for accuracy and completeness to reduce the likelihood of rejection or delays.

What should you do if your IRS 1040-V submission is rejected?

In the event your IRS 1040-V is rejected, carefully review the rejection notice to understand the reasons. Correct any identified issues and resubmit the form as soon as possible to avoid further complications. Always keep a record of your submission attempts.

How do legal or operational nuances affect the filing of IRS 1040-V for nonresidents?

Nonresidents may face different legal and operational requirements when filing the IRS 1040-V. It's important to ensure compliance with specific regulations that apply to foreign payees and consult a tax professional to understand obligations and forms needed for accurate reporting.

See what our users say