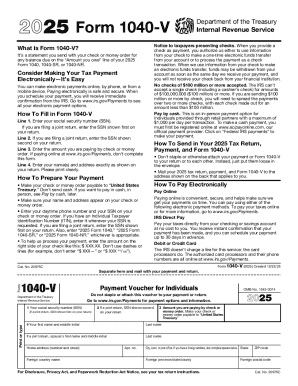

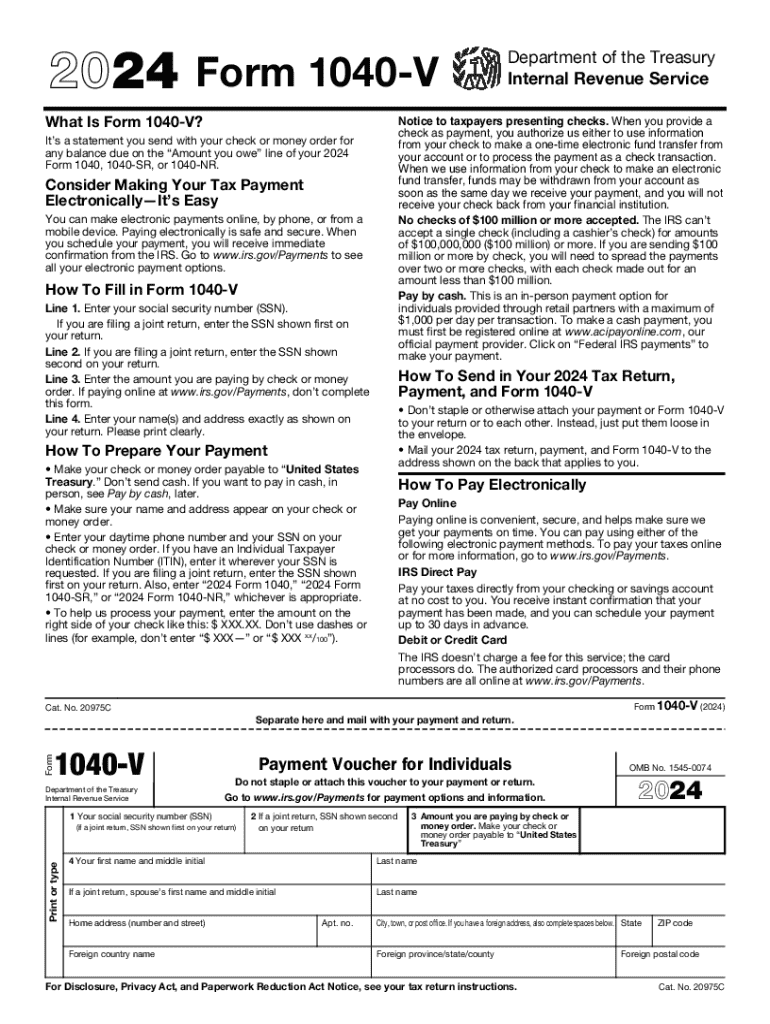

IRS 1040-V 2024 free printable template

Instructions and Help about IRS 1040-V

How to edit IRS 1040-V

How to fill out IRS 1040-V

Latest updates to IRS 1040-V

About IRS 1040-V 2024 previous version

What is IRS 1040-V?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040-V

What should I do if I made a mistake on my IRS 1040-V after submission?

If you discover an error after submitting your IRS 1040-V, you can correct it by submitting an amended form. Be sure to follow the IRS guidelines for amendments, which typically involve filing Form 1040-X. Always maintain a copy of your original and amended forms for your records.

How can I check the status of my IRS 1040-V submission?

To verify the status of your IRS 1040-V, you can use the IRS 'Where's My Refund' tool online or contact the IRS directly. Be prepared with your Social Security number, filing status, and refund amount for a smooth inquiry.

What should I do if my IRS 1040-V gets rejected during e-filing?

In case your IRS 1040-V is rejected during e-filing, check the rejection codes provided by the software. Typically, these codes indicate specific errors that need correction. Make the necessary adjustments and resubmit your form to ensure proper processing.

Are there special considerations for nonresidents filing an IRS 1040-V?

Yes, nonresidents filing an IRS 1040-V must adhere to specific regulations that differ from those applicable to residents. Ensure that you understand the additional requirements and forms needed, such as the IRS Form 1040-NR, to comply with U.S. tax laws properly.

How long should I keep records of my IRS 1040-V?

You should retain records related to your IRS 1040-V for at least three years from the date you filed the return or the due date of the return, whichever is later. This retention period helps in case of any audits or discrepancies that may arise.

See what our users say