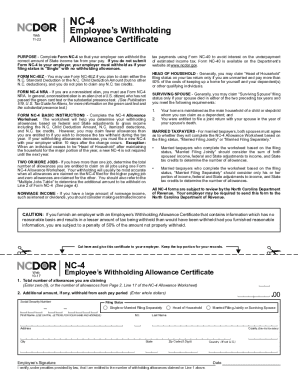

NC DoR NC-4 2018 free printable template

Get, Create, Make and Sign NC DoR NC-4

Editing NC DoR NC-4 online

Uncompromising security for your PDF editing and eSignature needs

NC DoR NC-4 Form Versions

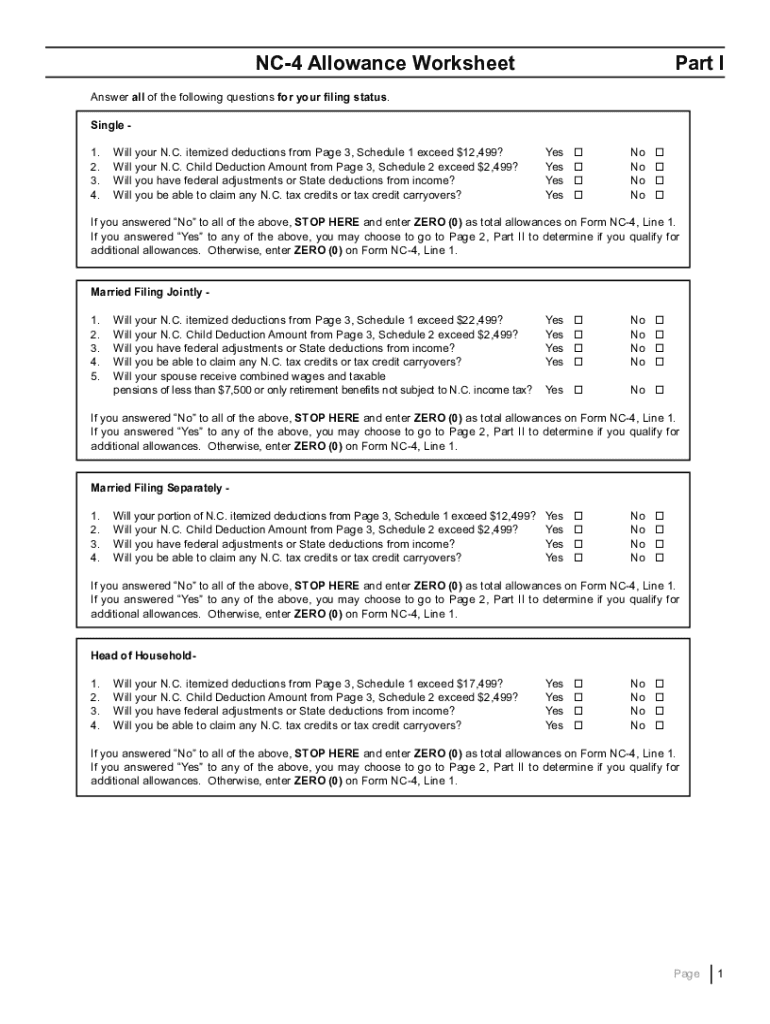

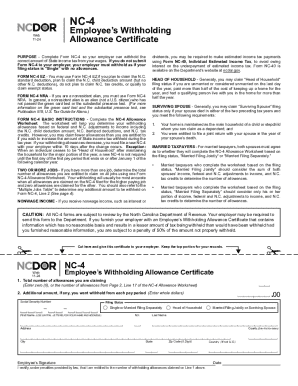

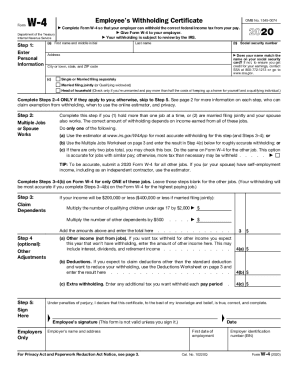

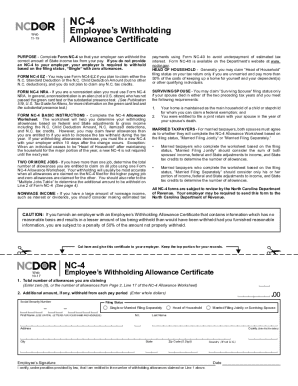

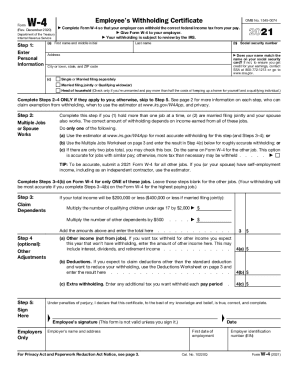

How to fill out NC DoR NC-4

How to fill out NC DoR NC-4

Who needs NC DoR NC-4?

Instructions and Help about NC DoR NC-4

Music the following video shows the steps you will need to take in order to file a new unemployment insurance claim and how to file your dynamic fact-finding information while completing that claim the first step is to set up an account on the division of Employment Security website at DES NC gov click sign up to create your account after you set up your username and password you will receive an email you will then go into your email to activate the account once you click on the hyperlink in the email it will take you to the claimant registration page to register and file a claim enter the information on screen including contact information and demographic information next you will come to the customer menu page to select a function such as filing a claim weekly certification or to complete a fact-finding click on the file a new unemployment claim link you will come to the before you begin information page please read this information carefully before proceeding next you will go through the eligibility and employment history questions read each question carefully and answer truthfully next you will come to a page to provide separation information this is the dynamic fact-finding click on the hyperlink to provide additional information after you complete all questions you will get a summary page where you can edit responses go to the bottom of the page and click Next the next page will be an acknowledgement page click that you acknowledge and continue now you are presented with the separation fact-finding you will need to check the additional information link after completing the fact-finding you will reach the confirmation page and receive a confirmation number you also have the option to print or return to the home page for more instructional videos on how to navigate the new unemployment insurance benefits computer system please visit our YouTube page you

People Also Ask about

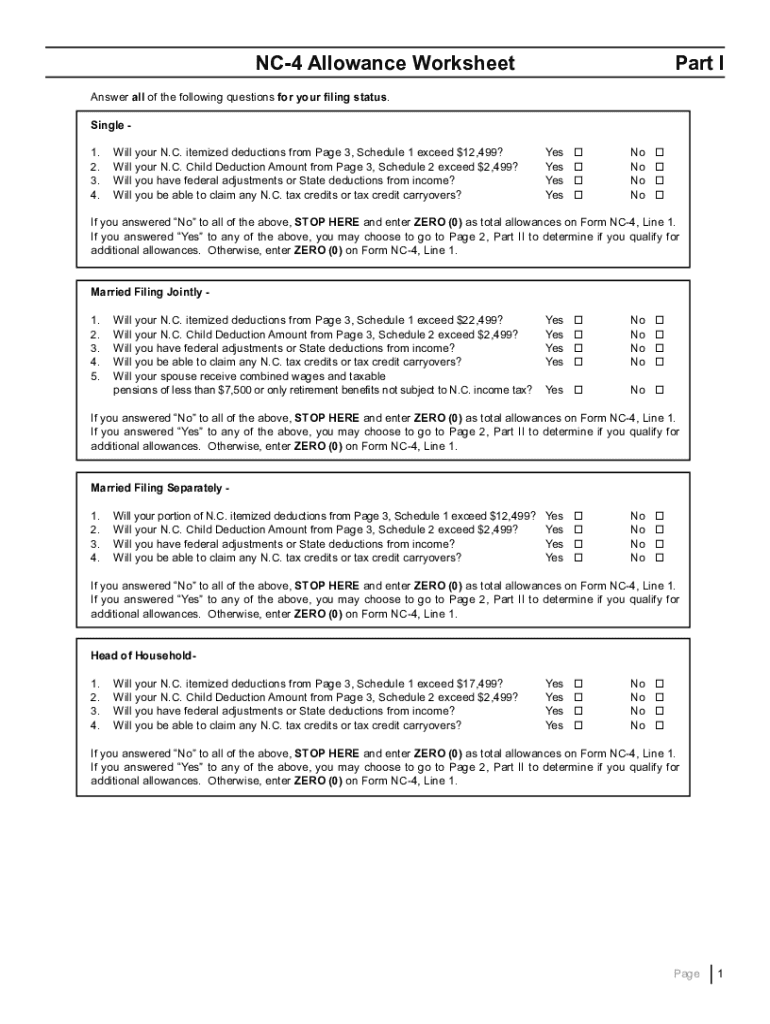

How many allowances should I claim on my NC 4?

Where can I find NC tax forms?

What is the NC withholding for 2023?

How do I get my tax forms mailed?

Where can I get tax forms in my area?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NC DoR NC-4 in Chrome?

How do I edit NC DoR NC-4 straight from my smartphone?

How can I fill out NC DoR NC-4 on an iOS device?

What is NC DoR NC-4?

Who is required to file NC DoR NC-4?

How to fill out NC DoR NC-4?

What is the purpose of NC DoR NC-4?

What information must be reported on NC DoR NC-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.