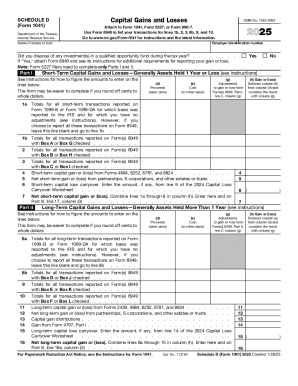

IRS 1041 - Schedule D 2019 free printable template

Instructions and Help about IRS 1041 - Schedule D

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

About IRS 1041 - Schedule D 2019 previous version

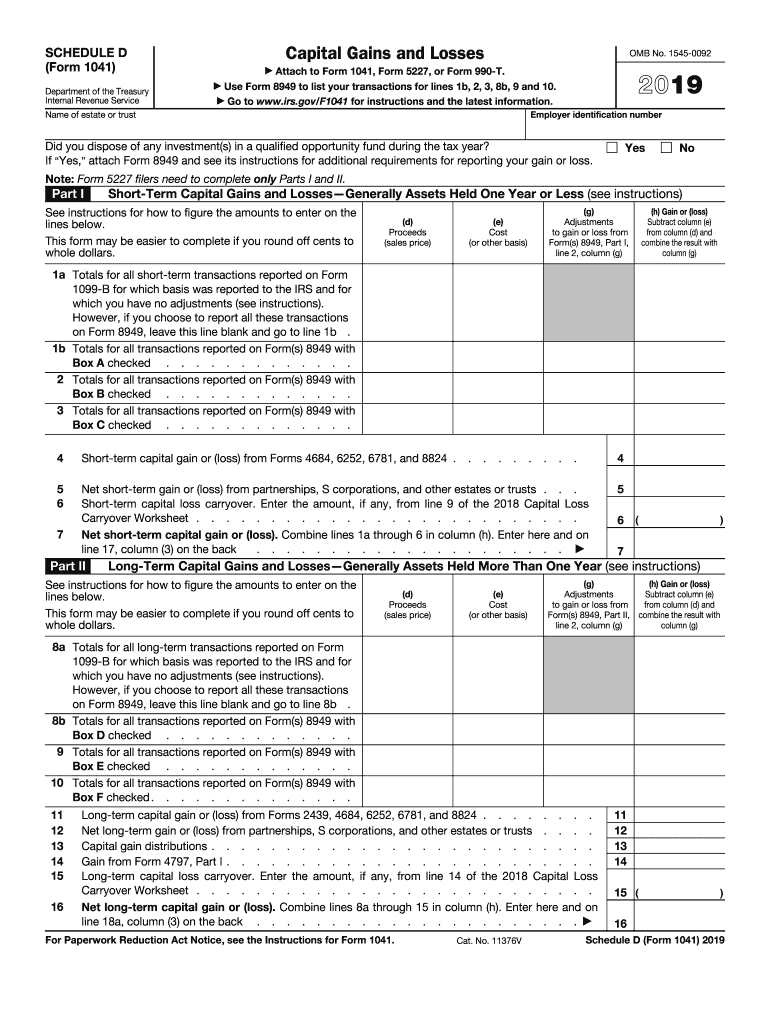

What is IRS 1041 - Schedule D?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1041 - Schedule D

What should I do if I find an error after filing my 2018 schedule d?

If you discover an error on your filed 2018 schedule d, you should file an amended return using Form 1040-X. This form allows you to correct mistakes and ensure your information is accurate. Make sure to include the revised schedule with your amended return and clearly indicate the changes made.

How can I track the status of my 2018 schedule d submission?

To track the status of your 2018 schedule d, you can use the IRS 'Where's My Refund?' tool if you filed a return that includes it. For e-filed returns, you should receive a confirmation email from your tax software provider. If you encounter any e-file rejection codes, refer to the provided guidelines to rectify them.

Are there any legal considerations for filing the 2018 schedule d electronically?

When e-filing your 2018 schedule d, ensure you're using IRS-approved software that meets security standards for data protection. An electronic signature may be acceptable; confirm its validity with your software provider. Additionally, maintain records of your submission for at least three years to comply with IRS retention policies.

What if I need to file a 2018 schedule d on behalf of someone else?

If you're filing a 2018 schedule d for another individual, you must have their written authorization, typically through a Power of Attorney (POA). Ensure all information is accurate and complete, as you’ll be responsible for any errors. It's also vital to include all necessary documentation to support the filing.

What common errors should I avoid when submitting my 2018 schedule d?

Common errors when submitting your 2018 schedule d include incorrect calculations and failure to report all transactions. Ensure you've double-checked all entries and that you're using the latest guidelines. It's also essential to review e-file guidelines to minimize rejection chances due to technical mistakes.

See what our users say