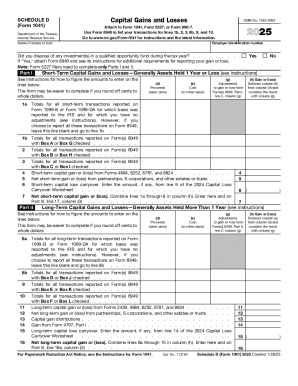

IRS 1041 - Schedule D 2024 free printable template

Instructions and Help about IRS 1041 - Schedule D

How to edit IRS 1041 - Schedule D

How to fill out IRS 1041 - Schedule D

Latest updates to IRS 1041 - Schedule D

About IRS 1041 - Schedule D 2024 previous version

What is IRS 1041 - Schedule D?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1041 - Schedule D

What should I do if I discover an error after filing my IRS 1041 - Schedule D?

If you find a mistake after submitting your IRS 1041 - Schedule D, it’s crucial to file an amended return. You can use Form 1041-X to correct errors, ensuring that you provide accurate information to the IRS. This helps avoid any potential issues during processing.

How can I track the status of my IRS 1041 - Schedule D submission?

To verify the receipt and processing of your IRS 1041 - Schedule D, you can use the IRS's online tracking tools. These tools provide updates on the status of your filing, which is essential for ensuring that everything is processed correctly and on time.

What common mistakes should I avoid when filing IRS 1041 - Schedule D?

Some frequent errors include misreporting income amounts, failing to accurately identify capital gains and losses, and overlooking required signatures. Reviewing your entries carefully can significantly reduce the chance of mistakes and issues with your filing.

Can I use electronic signatures for my IRS 1041 - Schedule D?

Yes, the IRS accepts electronic signatures for e-filed forms, including the IRS 1041 - Schedule D, as long as they meet specific criteria. Ensure that you follow the guidelines set by the IRS to guarantee that your submission is valid.

See what our users say