IRS 8962 2019 free printable template

Show details

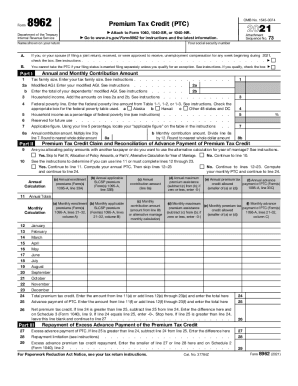

Cat. No. 37784Z Form 8962 2018 Page Allocation of Policy Amounts Complete the following information for up to four policy amount allocations. Form OMB No. 1545-0074 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Name shown on your return Attach to Form 1040 or Form 1040NR. Go to www.irs.gov/Form8962 for instructions and the latest information. Attachment Sequence No. 73 Your social security number You cannot take the PTC if your filing status is married filing...separately unless you qualify for an exception see instructions. If you qualify check the box Part I 2a b. Annual and Monthly Contribution Amount Tax family size. Enter your tax family size see instructions. Modified AGI. Enter your modified AGI see instructions. Enter the total of your dependents modified AGI see instructions. Household income. Add the amounts on lines 2a and 2b see instructions. 2b Federal poverty line. Enter the federal poverty line amount from Table 1-1 1-2 or 1-3 see...instructions. Check the appropriate box for the federal poverty table used* a Alaska Hawaii c Other 48 states and DC. Did you enter 401 on line 5 See instructions if you entered less than 100. No* Continue to line 7. Yes. You are not eligible to take the PTC. If advance payment of the PTC was made see the instructions for how to report your excess advance PTC repayment amount. Applicable Figure. Using your line 5 percentage locate your applicable figure on the table in the instructions 8a Annual...contribution amount. Multiply line 3 by line 7. Round to nearest whole dollar amount b Monthly contribution amount. Divide line 8a by 12. Round to nearest whole dollar amount 8b Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage see instructions Yes. Skip to Part IV Allocation of Policy Amounts or Part V Alternative Calculation for Year of Marriage. See the instructions to determine if you can use line 11 or must...complete lines 12 through 23. Yes. Continue to line 11. Compute your annual PTC. Then skip lines 12 23 and continue to line 24. your monthly PTC and continue to line 24. Annual Calculation a Annual enrollment premiums Form s 1095-A line 33A b Annual applicable SLCSP premium Form s 1095-A line 33B d Annual maximum premium assistance subtract c from b if zero or less enter -0- contribution amount line 8a e Annual premium tax f Annual advance credit allowed payment of PTC Form s smaller of a or d...Annual Totals Monthly a Monthly enrollment b Monthly applicable 1095-A lines 21 32 Form s 1095-A lines column A 21 32 column B amount from line 8b or alternative marriage monthly calculation d Monthly maximum f Monthly advance e Monthly premium tax January February March April May June July August September October November December Total premium tax credit. Enter the amount from line 11 e or add lines 12 e through 23 e and enter the total here Advance payment of PTC. Enter the amount from line...11 f or add lines 12 f through 23 f and enter the total here Net premium tax credit.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 8962

How to edit IRS 8962

How to fill out IRS 8962

Instructions and Help about IRS 8962

How to edit IRS 8962

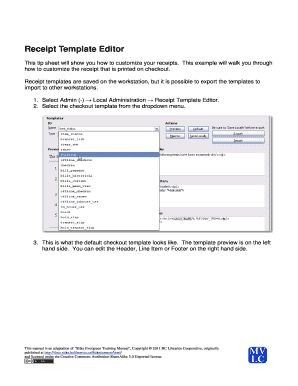

To edit IRS 8962, you can use pdfFiller's tools that allow you to modify forms easily. Simply upload your IRS 8962 form to the pdfFiller platform. Once uploaded, use the editing features to adjust any information as needed before printing or submitting the form.

How to fill out IRS 8962

To fill out IRS 8962, you must gather all relevant information regarding your health coverage and any premium tax credits received throughout the year. Follow these steps to complete the form:

01

Enter personal information such as your name, Social Security Number, and tax filing status.

02

Provide details on your health coverage for the year, including the months covered.

03

Calculate the premium tax credits you are eligible for based on the coverage details.

Ensure all information is accurate to avoid delays in processing your tax return.

About IRS 8 previous version

What is IRS 8962?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 8 previous version

What is IRS 8962?

IRS 8962 is the form used to report the Premium Tax Credit (PTC) and to reconcile the advance payments of the PTC with the actual credit amount taxpayers are eligible to claim. It enables eligible taxpayers to reduce their health insurance premium costs under the Affordable Care Act.

What is the purpose of this form?

The purpose of IRS 8962 is to determine a taxpayer's eligibility for the Premium Tax Credit and to record any advance payments that were made to the insurance provider on their behalf. Completing this form accurately is essential for ensuring that you receive the correct amount of tax credits during your tax filing.

Who needs the form?

Taxpayers who enrolled in a health plan through the Health Insurance Marketplace and received advance payments of the Premium Tax Credit must file IRS 8962. Additionally, those eligible for the PTC but did not receive advance payments should also complete and submit this form with their tax return.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 8962 if you did not have health coverage through the Marketplace, did not receive any advance payments of the Premium Tax Credit, or if you are a dependent on someone else's tax return. Always review your specific tax situation or consult with a tax professional for guidance.

Components of the form

The IRS 8962 consists of several parts, including personal information, a section to report your health coverage specifics, calculations for the Premium Tax Credit, and information reconciliation for advance payments received. Each component requires detailed attention to ensure all entries match correspondingly with information provided by the Marketplace.

Due date

The due date for filing IRS 8962 aligns with your tax return deadline. Generally, the deadline for most individual taxpayers to file their returns falls on April 15. However, if you file for an extension, ensure that IRS 8962 is submitted by the extended due date.

What are the penalties for not issuing the form?

Failing to file IRS 8962 can lead to penalties, including delayed tax refunds or the denial of the Premium Tax Credit. Additionally, taxpayers might have to repay any advance credits received if they do not file this form, resulting in increased tax liability. It's crucial to submit this form accurately to avoid potential financial consequences.

What information do you need when you file the form?

When filing IRS 8962, you will need your Social Security Number, information from Form 1095-A (Health Insurance Marketplace Statement), and details regarding your household size and income. Ensure that all relevant documents are organized to streamline the filing process and guarantee accurate reporting.

Is the form accompanied by other forms?

IRS 8962 is often filed along with Form 1040 or Form 1040-SR. If you received Form 1095-A, you should attach it as well, as it provides essential details about your coverage and advance payments received, which are necessary to complete IRS 8962 accurately.

Where do I send the form?

IRS 8962, along with your completed tax return, should be submitted to the address specified in the instructions for Form 1040 or Form 1040-SR. The mailing address may vary based on whether you are enclosing a payment or expecting a refund, so check the IRS guidelines to ensure your forms reach the appropriate location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

easy to use and takes the hassle out of trying to sort documents

The Best !, I did not expect this to be par excellence, It meet my expectations and even more - I will recommend, the engine, design and it covers the Business requirements and needs.

P.Patrick

See what our users say