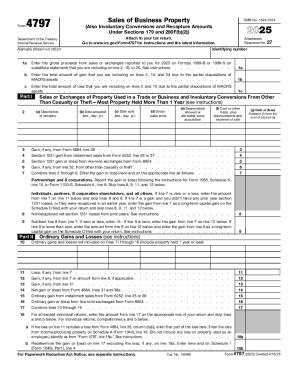

IRS 4797 2019 free printable template

Instructions and Help about IRS 4797

How to edit IRS 4797

How to fill out IRS 4797

About IRS 4 previous version

What is IRS 4797?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 4797

What should I do if I discover an error after filing IRS 4797?

If you find an error on your IRS 4797 after filing, you should file an amended return using Form 1040-X. Ensure you specify the corrections made on the IRS 4797. This helps in accurately reflecting the transaction in your tax records.

How can I track the status of my IRS 4797 submission?

To track the status of your IRS 4797 submission, you can use the IRS 'Where's My Refund?' tool if e-filed or contact the IRS directly for paper submissions. Keep your details handy, such as your Social Security number and filing status.

What should I do if my IRS 4797 e-filing is rejected?

In case your IRS 4797 e-filing is rejected, the IRS typically provides a rejection code indicating the reason. Review the error, correct the information, and resubmit the form electronically or by paper as needed.

Are there any specific rules for filing IRS 4797 for foreign payees?

When filing IRS 4797 for foreign payees, it's crucial to understand the unique rules that apply, including potential withholding tax obligations. Consult IRS guidelines or a tax professional familiar with international tax compliance for proper procedures.

What common mistakes should I watch for when filing IRS 4797?

Common mistakes when filing IRS 4797 include misreporting the sale amounts or incorrect asset categorization. Double-check all entries for accuracy, and ensure you have the correct transaction identifiers to avoid issues with your filing.

See what our users say