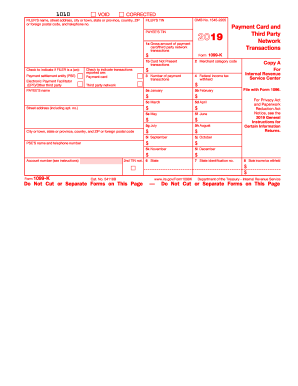

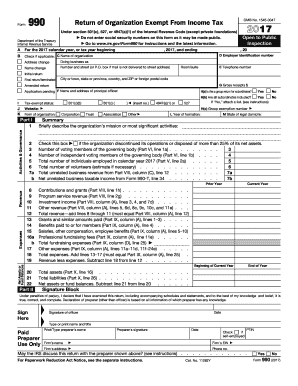

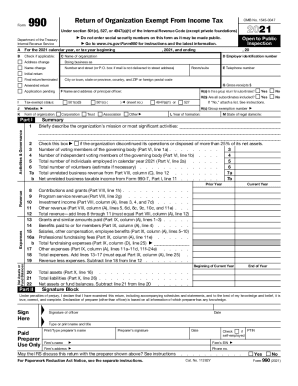

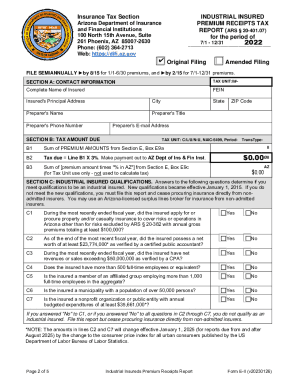

IRS 990 2019 free printable template

FAQ about IRS 990

What should I do if I realize there’s an error in my IRS 990 after submission?

If you discover a mistake in your IRS 990 after submission, you can file an amended return using Form 990 or Form 990-EZ. It is crucial to ensure that the corrections are clearly indicated and properly supported with documentation to avoid any penalties or delays in processing.

How can I track the status of my filed IRS 990?

To verify the receipt and processing status of your IRS 990, you can contact the IRS directly or check their online resources. If you e-filed, you may also receive a confirmation email indicating its acceptance or details regarding any issues, including common rejection codes.

What are some common errors to avoid when filing the IRS 990?

Common errors when filing the IRS 990 include incorrect financial data entries, failure to report revenue accurately, and overlooking essential schedules. Double-checking calculations and ensuring all required documentation is included can help you avoid these pitfalls.

How should I respond if I receive a notice from the IRS after submitting my IRS 990?

If you receive an IRS notice regarding your IRS 990, analyze the document to understand the issue and respond promptly. Gather necessary documentation to support your case and submit your response according to the notice's instructions to resolve any discrepancies.

See what our users say