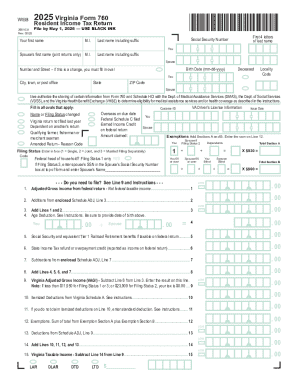

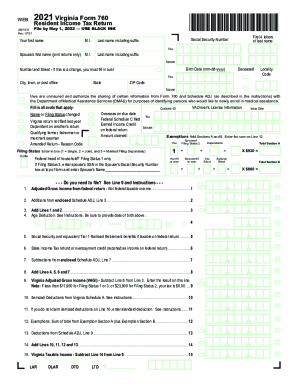

VA DoT 760 2019 free printable template

Instructions and Help about VA DoT 760

How to edit VA DoT 760

How to fill out VA DoT 760

About VA DoT previous version

What is VA DoT 760?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

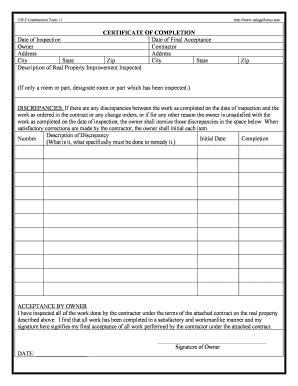

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about VA DoT 760

What should I do if I discover an error after submitting my virginia state 760 form?

If you find an error after you've submitted your virginia state 760 form, you can file an amended return to correct the mistakes. It's important to clearly indicate the changes on the amended form and include any necessary documentation. Remember that timely filing is crucial to avoid additional penalties.

How can I check the status of my virginia state 760 form submission?

To verify the status of your virginia state 760 form, you can use the Virginia Department of Taxation's online tracking system. You will need to provide some identifying information, such as your Social Security number and the filing year, to access your filing status.

Are there any common errors I should watch out for when filing my virginia state 760 form?

Yes, common errors when filing the virginia state 760 form include incorrect Social Security numbers, misreported income, and failing to sign the form. Double-checking the entries before sending can help mitigate these issues and ensure your form is processed smoothly.

What should I do if my virginia state 760 form is rejected after e-filing?

If your virginia state 760 form is rejected during e-filing, you should carefully review the rejection code provided. This will guide you in correcting the specific issue. After making the necessary adjustments, you can resubmit your form electronically or by mail.

Can I use an e-signature on my virginia state 760 form?

Yes, the Virginia Department of Taxation accepts e-signatures on the virginia state 760 form, as long as the e-filing method used complies with their guidelines. Ensure your e-signature service is compatible with the requirements for electronic submissions.