AZ DOR 82514 2019 free printable template

Show details

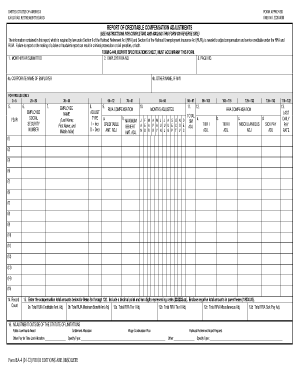

Most recent State Income Tax Return MUST accompany the filed DOR 82514 affidavit for the County Assessor s use in determining the applicant s initial eligibility. DOR FORM 82514 Rev. 12/2017 ASSESSED EXEMPT AMOUNT LIMITED PROPERTY OWNER DATE DEPUTY ASSESSOR/NOTARY DATE MY COMMISSION EXPIRES INSTRUCTIONS for completing the DOR 82514 AFFIDAVIT for INDIVIDUAL PROPERTY TAX EXEMPTION Read the information below the instructions for the DOR 82514 affidavit following and the information on the DOR...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ DOR 82514

Edit your AZ DOR 82514 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ DOR 82514 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AZ DOR 82514 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AZ DOR 82514. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DOR 82514 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ DOR 82514

How to fill out AZ DOR 82514

01

Obtain a copy of AZ DOR 82514 from the Arizona Department of Revenue website or local office.

02

Read the instructions on the form carefully to understand the required information.

03

Fill in your personal information, including your name, address, and taxpayer identification number.

04

Complete the section related to the specific tax credit or deduction you are applying for.

05

Provide any necessary financial information, such as income or expenses associated with your claim.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and accurate.

08

Submit the completed form to the appropriate Arizona Department of Revenue office by the specified deadline.

Who needs AZ DOR 82514?

01

Individuals or businesses in Arizona seeking to claim specific tax credits or deductions.

02

Taxpayers who have received notification from the Arizona Department of Revenue requiring them to submit AZ DOR 82514.

03

Anyone who needs to report and document their eligibility for specific tax benefits.

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from property tax in Arizona?

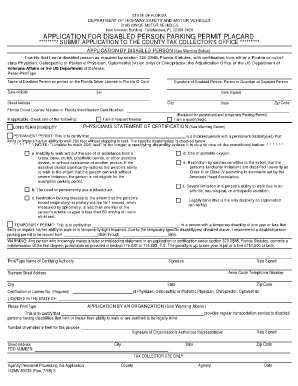

Arizona provides property tax exemptions, in varying dollar amounts, to qualifying disabled persons and widows/widowers, whose spouses passed away while residing in Arizona. Anyone with questions regarding deadlines and criteria for property tax exemptions may phone contact the Assessor's Office.

Does Arizona have a homeowners tax exemption?

Arizona provides property tax exemptions, in varying dollar amounts, to qualifying disabled persons and widows/widowers, whose spouses passed away while residing in Arizona. Anyone with questions regarding deadlines and criteria for property tax exemptions may phone contact the Assessor's Office.

Who qualifies for property tax exemption in Arizona?

You must be a permanent resident of Arizona and must present Arizona Driver's License or ID. Must be over the age of 17. Must not have property value (with State of Arizona) that Property's total assessed value does not exceed $27,498.

How do I avoid property taxes in Arizona?

Exemption from property taxation is automatically granted for property owned by government entities, which do not impose property taxes on one another. A.R.S. 42- 11102(A) and 42-11103(A) . ingly, government-owned property is not subject to any application provisions in order to obtain or maintain exempt status.

What benefits do disabled veterans get in Arizona?

Summary of Arizona Military and Veteran Benefits: Arizona offers special benefits for Service members, Veterans and their Families including, tax and license fee exceptions, education and tuition assistance, vehicle license plates, state park benefits, as well as hunting and fishing license privileges.

Are 100% disabled veterans exempt from property taxes in Arizona?

Arizona now allows a limited property tax exemption for qualified disabled veterans. To apply for the exemptions, veterans will need to submit their VA Disability Letter along with other documentation to the Assessor's Office in person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit AZ DOR 82514 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your AZ DOR 82514 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit AZ DOR 82514 straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing AZ DOR 82514 right away.

How do I edit AZ DOR 82514 on an Android device?

You can edit, sign, and distribute AZ DOR 82514 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is AZ DOR 82514?

AZ DOR 82514 is a tax form used by the Arizona Department of Revenue for individuals to report certain types of income and claim applicable credits or deductions.

Who is required to file AZ DOR 82514?

Any individual who has income that requires reporting under Arizona state tax laws, or those who wish to claim specific credits or deductions, is required to file AZ DOR 82514.

How to fill out AZ DOR 82514?

To fill out AZ DOR 82514, individuals should provide required personal information, income details, applicable deductions, and claim any credits by following the instructions provided with the form.

What is the purpose of AZ DOR 82514?

The purpose of AZ DOR 82514 is to provide the Arizona Department of Revenue with information necessary to assess individual tax liabilities and ensure compliance with state tax laws.

What information must be reported on AZ DOR 82514?

AZ DOR 82514 requires reporting personal identification information, income details, deductions claimed, and any tax credits that the individual is eligible for.

Fill out your AZ DOR 82514 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ DOR 82514 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.