AZ DOR 82514 2013 free printable template

Show details

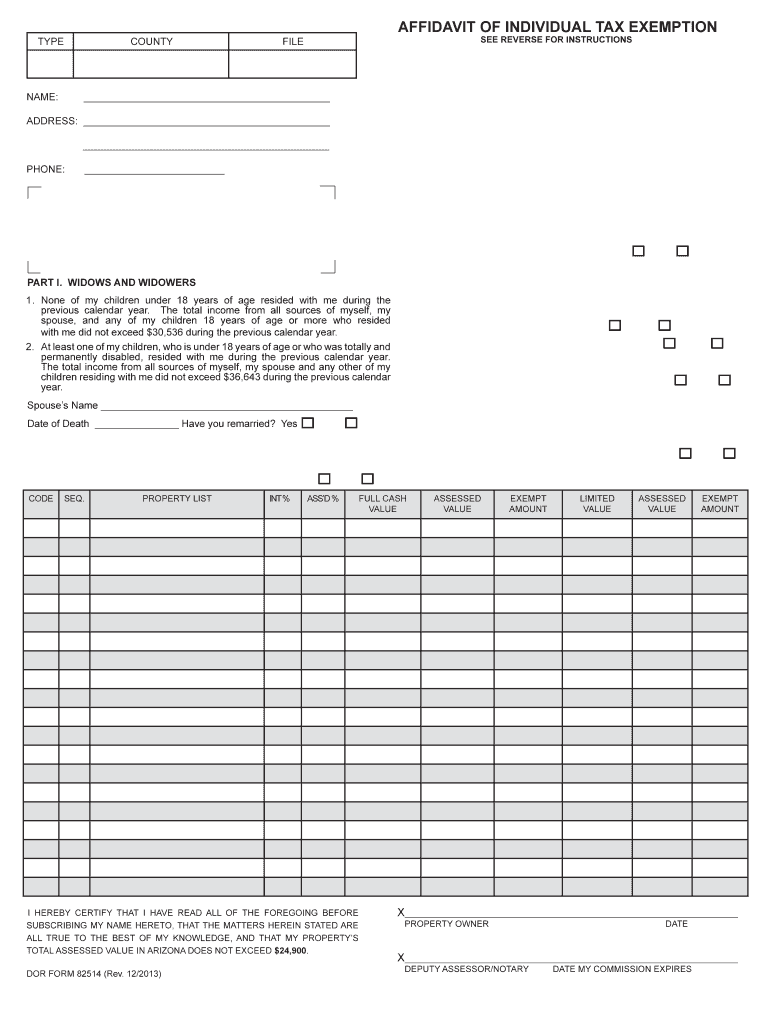

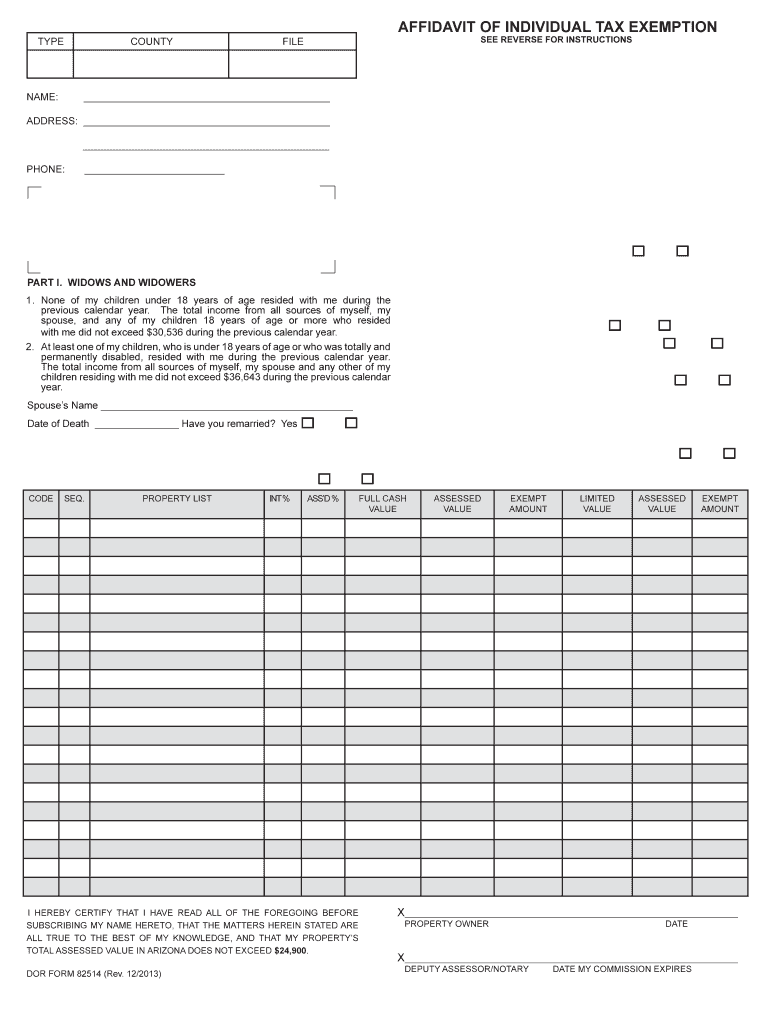

Most recent State Income Tax Return MUST accompany the filed DOR 82514 affidavit for the County Assessor s use in determining the applicant s initial eligibility. When did you first become a resident of this state PART I. WIDOWS AND WIDOWERS CODE FULL CASH VALUE ASSESSED EXEMPT AMOUNT LIMITED PROPERTY OWNER DATE DEPUTY ASSESSOR/NOTARY DATE MY COMMISSION EXPIRES INSTRUCTIONS for completing the DOR 82514 AFFIDAVIT for INDIVIDUAL PROPERTY TAX EXEMPTION Read the information below the instructions...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ DOR 82514

Edit your AZ DOR 82514 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ DOR 82514 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ DOR 82514 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AZ DOR 82514. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DOR 82514 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ DOR 82514

How to fill out AZ DOR 82514

01

Download the AZ DOR 82514 form from the Arizona Department of Revenue website.

02

Fill in your personal information at the top of the form, including name, address, and taxpayer identification number.

03

Indicate the specific tax year for which you are filing.

04

Complete the sections related to your income and deductions accurately.

05

Attach any necessary supporting documents, such as W-2 forms or 1099s.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form either electronically or by mail to the appropriate address provided on the form.

Who needs AZ DOR 82514?

01

Individuals and entities in Arizona who need to report income or claim tax credits related to withholding taxes.

02

Businesses that need to report employee withholding amounts to the Arizona Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Are 100% disabled veterans exempt from property taxes in Arizona?

In Arizona, totally and permanently disabled Veterans may qualify for a property tax exemption of up to $4,188 on their primary residence. Veterans must be permanent residents of Arizona, and the property's assessed value cannot exceed $28,458.

Do disabled veterans have to pay property taxes in Arizona?

Arizona now allows a limited property tax exemption for qualified disabled veterans. To apply for the exemptions, veterans will need to submit their VA Disability Letter along with other documentation to the Assessor's Office in person.

What is the person with disability exemption in Cook County?

A Person with Disabilities Exemption is for persons with disabilities and provides an annual $2,000 reduction in the equalized assessed value (EAV) of the property.

What is the disability exemption for property taxes in Illinois?

Homestead Exemption for Persons with Disabilities This exemption is an annual $2,000 reduction in the EAV of the primary residence that is owned and occupied by a person with a disability who is liable for the payment of property taxes.

Who qualifies for homeowners exemption in Illinois?

Most homeowners are eligible for this exemption if they own and occupy their property as their principal place of residence. Once the exemption is applied, the Assessor's Office auto-renews it for you each year.

Who is exempt from disabled property taxes in Arizona?

Qualifications for Disabled Persons Exemption You must be a permanent resident of Arizona and must present Arizona Driver's License or ID. Must be over the age of 17. Must not have property value (with State of Arizona) that Property's total assessed value does not exceed $27,498.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AZ DOR 82514 online?

pdfFiller has made it easy to fill out and sign AZ DOR 82514. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in AZ DOR 82514?

With pdfFiller, it's easy to make changes. Open your AZ DOR 82514 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for signing my AZ DOR 82514 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your AZ DOR 82514 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

What is AZ DOR 82514?

AZ DOR 82514 is a form used by the Arizona Department of Revenue for reporting certain types of income and taxes owed.

Who is required to file AZ DOR 82514?

Individuals or entities that report specific income types, including non-residents or contractors who earned income in Arizona but are not residents, are required to file AZ DOR 82514.

How to fill out AZ DOR 82514?

To fill out AZ DOR 82514, provide identification details, report income amounts, calculate the tax owed, and include any deductions or credits applicable before submitting it to the Arizona Department of Revenue.

What is the purpose of AZ DOR 82514?

The purpose of AZ DOR 82514 is to ensure that individuals and entities report income earned in Arizona and pay the appropriate state taxes.

What information must be reported on AZ DOR 82514?

The information that must be reported includes the taxpayer's identification information, the type and amount of income earned, any deductions, and the total tax liability.

Fill out your AZ DOR 82514 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ DOR 82514 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.