AZ DOR 82514 2024 free printable template

Show details

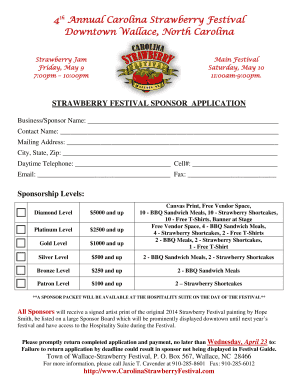

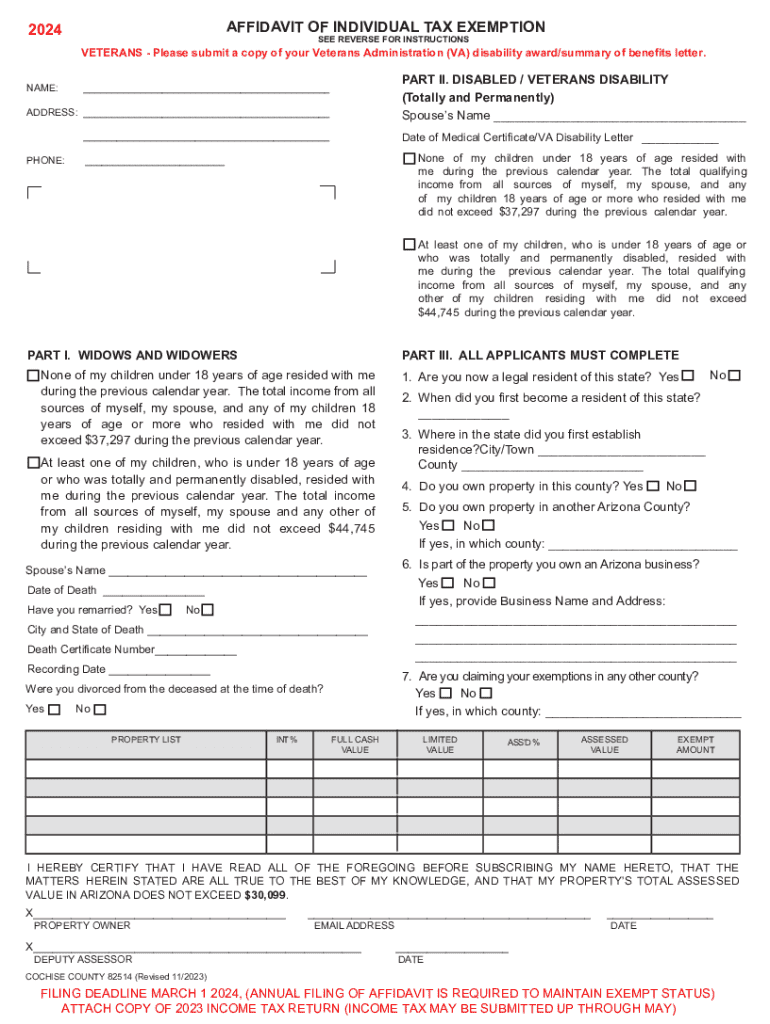

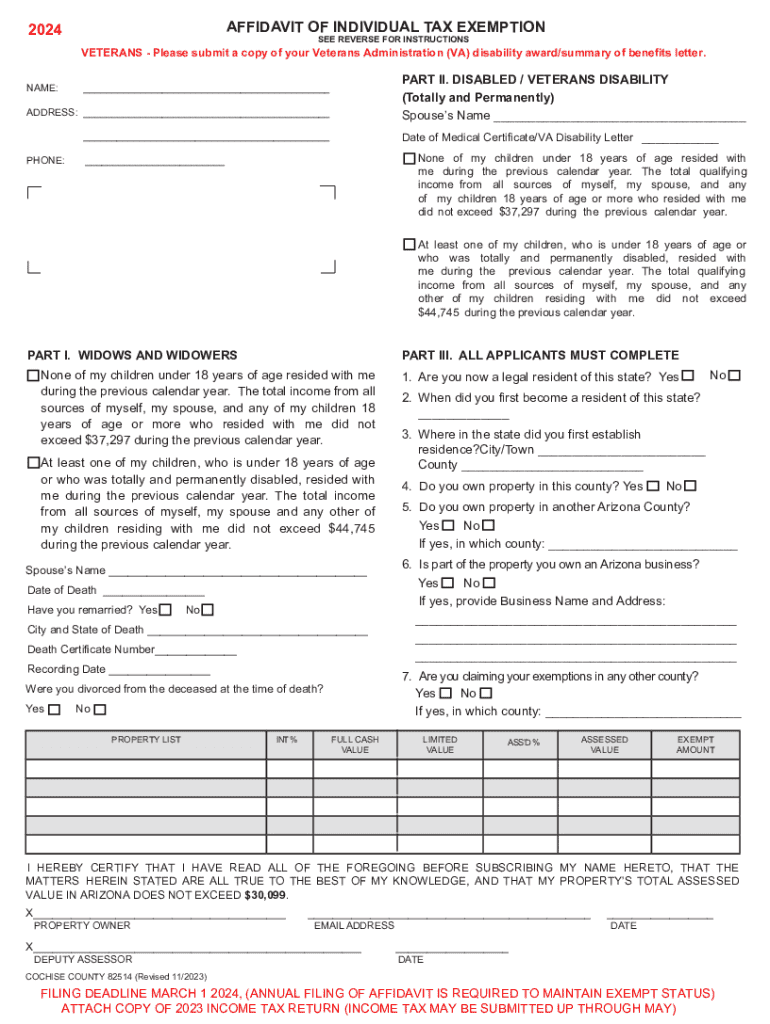

PrintAFFIDAVIT OF INDIVIDUAL TAX EXEMPTION2024Clear FormSEE REVERSE FOR INSTRUCTIONSVETERANS Please submit a copy of your Veterans Administration (VA) disability award/summary of benefits letter.

NAME:PART

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dor 82514 affidavit of individual exemption form

Edit your form 82514v form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona dor form 82514 affidavit individual exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 82514 affidavit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 82514. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ DOR 82514 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 82514 form

How to fill out AZ DOR 82514

01

Download the AZ DOR 82514 form from the Arizona Department of Revenue website.

02

Begin by filling out your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide your filing status by checking the appropriate box (e.g., single, married, etc.).

04

Enter your total income for the year in the designated section.

05

Deduct any applicable exemptions and adjustments as outlined in the form instructions.

06

Calculate your taxable income by subtracting deductions from your total income.

07

Fill out any credit information as necessary to reduce your tax liability.

08

Carefully review all entries for accuracy.

09

Sign and date the form before submitting it to the Arizona Department of Revenue.

Who needs AZ DOR 82514?

01

Any taxpayer who is a resident of Arizona and is required to file a state income tax return may need to complete AZ DOR 82514.

02

Individuals who have income from sources within Arizona that exceed the state's minimum filing thresholds will also need to fill out this form.

Fill

form 82514 form

: Try Risk Free

People Also Ask about dor 82514 affidavit individual

Are 100% disabled veterans exempt from property taxes in Arizona?

Arizona now allows a limited property tax exemption for qualified disabled veterans. To apply for the exemptions, veterans will need to submit their VA Disability Letter along with other documentation to the Assessor's Office in person.

Who is exempt from disabled property taxes in Arizona?

Qualifications for Disabled Persons Exemption You must be a permanent resident of Arizona and must present Arizona Driver's License or ID. Must be over the age of 17. Must not have property value (with State of Arizona) that Property's total assessed value does not exceed $27,498.

What benefits do disabled veterans get in Arizona?

Summary of Arizona Military and Veteran Benefits: Arizona offers special benefits for Service members, Veterans and their Families including, tax and license fee exceptions, education and tuition assistance, vehicle license plates, state park benefits, as well as hunting and fishing license privileges.

Who is exempt from property tax in Arizona?

Arizona provides property tax exemptions, in varying dollar amounts, to qualifying disabled persons and widows/widowers, whose spouses passed away while residing in Arizona. Anyone with questions regarding deadlines and criteria for property tax exemptions may phone contact the Assessor's Office.

Does Arizona freeze property taxes for seniors?

The Senior Property Valuation Protection Option (Senior Freeze) is available to residential homeowners, 65 years of age or older, who meet specific guidelines based on income, ownership, and residency (Arizona Constitution, Article 9, Section 18.)

At what age do you stop paying property tax in AZ?

Age: At least one property owner must be the minimum qualifying age of 65 at the time of application. Residence: The property must be the owner(s) primary residence.

Do senior citizens have to pay property taxes in Arizona?

Are Seniors in Arizona entitled to some property tax relief? Yes. The relief comes in several forms. First, there is an exemption for widows, widowers and totally disabled persons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 82514 affidavit individual tax exemption from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including dor 82514 pdf, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send dor 82514 affidavit individual exemption form for eSignature?

When your affidavit individual tax exemption is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find arizona form 82514?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific az dor form 82514 and other forms. Find the template you need and change it using powerful tools.

What is AZ DOR 82514?

AZ DOR 82514 is a form used by the Arizona Department of Revenue for reporting income tax withheld and other tax-related information.

Who is required to file AZ DOR 82514?

Employers who withhold state income tax from employees' wages or make certain types of payments are required to file AZ DOR 82514.

How to fill out AZ DOR 82514?

To fill out AZ DOR 82514, gather employee wage information, ensure accuracy in the amounts withheld, and follow the instructions provided for each section of the form.

What is the purpose of AZ DOR 82514?

The purpose of AZ DOR 82514 is to report the amount of income tax withheld from employees' pay and to reconcile those amounts with the Arizona Department of Revenue.

What information must be reported on AZ DOR 82514?

AZ DOR 82514 requires reporting of wages paid, tax withheld, employer identification information, and other pertinent details related to income tax withholding.

Fill out your AZ DOR 82514 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Az Dor 82514 is not the form you're looking for?Search for another form here.

Keywords relevant to affidavit individual exemption

Related to 82514 dor

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.