MD Comptroller 502 2019 free printable template

Show details

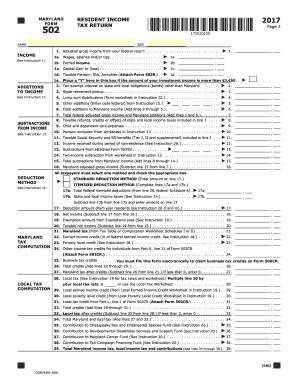

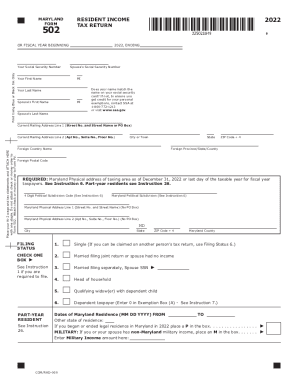

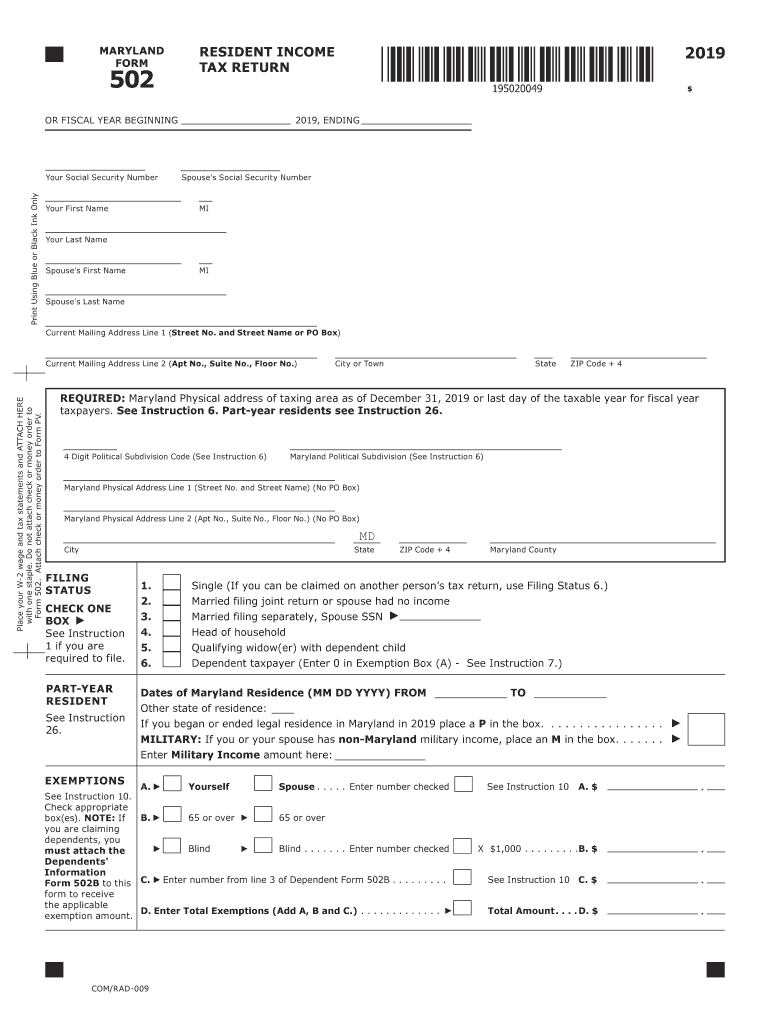

Do not attach check or money order to Form 502. Attach check or money order to Form PV. City or Town State ZIP Code 4 REQUIRED Maryland Physical address as of December 31 2018 or last day of the taxable year for fiscal year taxpayers. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Maryland Physical Address Line 1 Street No. and Street Name No PO Box MD City Single If you can be...claimed on another person s tax return use Filing Status 6. MARYLAND FORM OR FISCAL YEAR BEGINNING 2018 ENDING Your Social Security Number Print Using Blue or Black Ink Only RESIDENT INCOME TAX RETURN Spouse s Social Security Number Your First Name MI Your Last Name Spouse s First Name Spouse s Last Name Current Mailing Address Line 1 Street No. and Street Name or PO Box Place your W-2 wage and tax statements and ATTACH HERE with one staple. Do not attach check or money order to Form 502. Attach...check or money order to Form PV. City or Town State ZIP Code 4 REQUIRED Maryland Physical address as of December 31 2018 or last day of the taxable year for fiscal year taxpayers. Do not attach Form PV or check/ money order to Form 502. Place Form PV with attached check/money order on TOP of Form 502 and mail to Payment Processing PO Box 8888. 1a. Wages salaries and/or tips. 1a. 1b. Earned income. 1b. 1c. Capital Gain or loss. 1c. 1d. Taxable Pensions IRAs Annuities Attach Form 502R.. 1d. 1e....Place a Y in this box if the amount of your investment income is more than 3 500. 2. Tax-exempt interest on state and local obligations bonds other than Maryland. 20. 21. Maryland tax from Tax Table or Computation Worksheet Schedules I or II. 21. TAX 23. Poverty level credit See Instruction 18. 23. COMPUTATION 24. Other income tax credits for individuals from Part AA line 12 of Form 502CR Attach Form 502CR.. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision...Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Maryland Physical Address Line 1 Street No. and Street Name No PO Box MD City Single If you can be claimed on another person s tax return use Filing Status 6. Married filing joint return or spouse had no income FILING STATUS CHECK ONE BOX if you are required to file. PART-YEAR RESIDENT EXEMPTIONS Check appropriate box es. NOTE If you are claiming dependents you must attach the Dependents Information Form 502B to this form to...receive the applicable exemption amount. See Instruction 6. Part-year residents see Instruction 26. 4 Digit Political Subdivision Code See Instruction 6 Maryland Political Subdivision See Instruction 6 Maryland Physical Address Line 1 Street No* and Street Name No PO Box MD City Single If you can be claimed on another person s tax return use Filing Status 6. Married filing joint return or spouse had no income FILING STATUS CHECK ONE BOX if you are required to file. PART-YEAR RESIDENT EXEMPTIONS...Check appropriate box es. NOTE If you are claiming dependents you must attach the Dependents Information Form 502B to this form to receive the applicable exemption amount.

pdfFiller is not affiliated with any government organization

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

How to fill out MD Comptroller 502

Instructions and Help about MD Comptroller 502

How to edit MD Comptroller 502

You can edit the MD Comptroller 502 form using pdfFiller’s editing features. These tools allow you to make changes to your form directly in a digital format. Simply upload your completed form to pdfFiller, use the editing tools to adjust any necessary details, and save your changes before submitting.

How to fill out MD Comptroller 502

To fill out the MD Comptroller 502, follow these steps:

01

Gather all necessary documentation related to your payments or purchases.

02

Access the form either via the Comptroller's website or a tax preparation tool like pdfFiller.

03

Fill in your personal information as outlined in the form, ensuring accuracy.

04

List all transactions that require reporting and provide the related details.

05

Review all entries for correctness before finalizing the form.

About MD Comptroller previous version

What is MD Comptroller 502?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD Comptroller previous version

What is MD Comptroller 502?

MD Comptroller 502 is a tax form used in Maryland for reporting certain payments and purchases to the state. The form serves as a record of transactions that may be taxable and is essential for compliance with Maryland tax laws.

What is the purpose of this form?

The purpose of the MD Comptroller 502 form is to report payments made to vendors and service providers, as well as certain purchases that fall under the Maryland sales tax jurisdiction. This reporting assists the state in monitoring tax compliance and revenue generation.

Who needs the form?

Any individual or business in Maryland that makes qualifying payments or purchases needs to complete the MD Comptroller 502 form. This includes businesses that hire contractors or make significant purchases that could attract sales tax obligations.

When am I exempt from filling out this form?

You are exempt from filing the MD Comptroller 502 form if your transactions do not meet the reporting thresholds set by the Maryland Comptroller’s office. Government entities and certain nonprofit organizations may also be exempt, depending on their status and the nature of their transactions.

Components of the form

The MD Comptroller 502 form includes several key components, such as fields for taxpayer identification information, details regarding the payments made, and summaries of the types of purchases reported. Each component must be filled out accurately to ensure compliance with reporting requirements.

What are the penalties for not issuing the form?

Failing to issue the MD Comptroller 502 form can lead to penalties imposed by the Maryland Comptroller, which may include fines, interest on unpaid taxes, or further audit inquiries. Compliance with all tax reporting is vital to avoid such consequences.

What information do you need when you file the form?

When filing the MD Comptroller 502 form, you will need the following information:

01

Your personal and business identification details.

02

Accurate records of all transactions that require reporting.

03

Supporting documentation for any claims or deductions related to the payments or purchases.

Is the form accompanied by other forms?

The MD Comptroller 502 form may be submitted alongside other forms related to specific tax reporting needs, depending on your overall tax situation. It's important to check the Maryland Comptroller's guidelines regarding any additional forms required for comprehensive reporting.

Where do I send the form?

The completed MD Comptroller 502 form must be submitted to the Maryland Comptroller's office. This can typically be done via mail or electronically, depending on the submission procedures in place at the time of filing. Always verify the current submission guidelines to ensure compliance.

See what our users say