HI DoT N-30 2019 free printable template

Show details

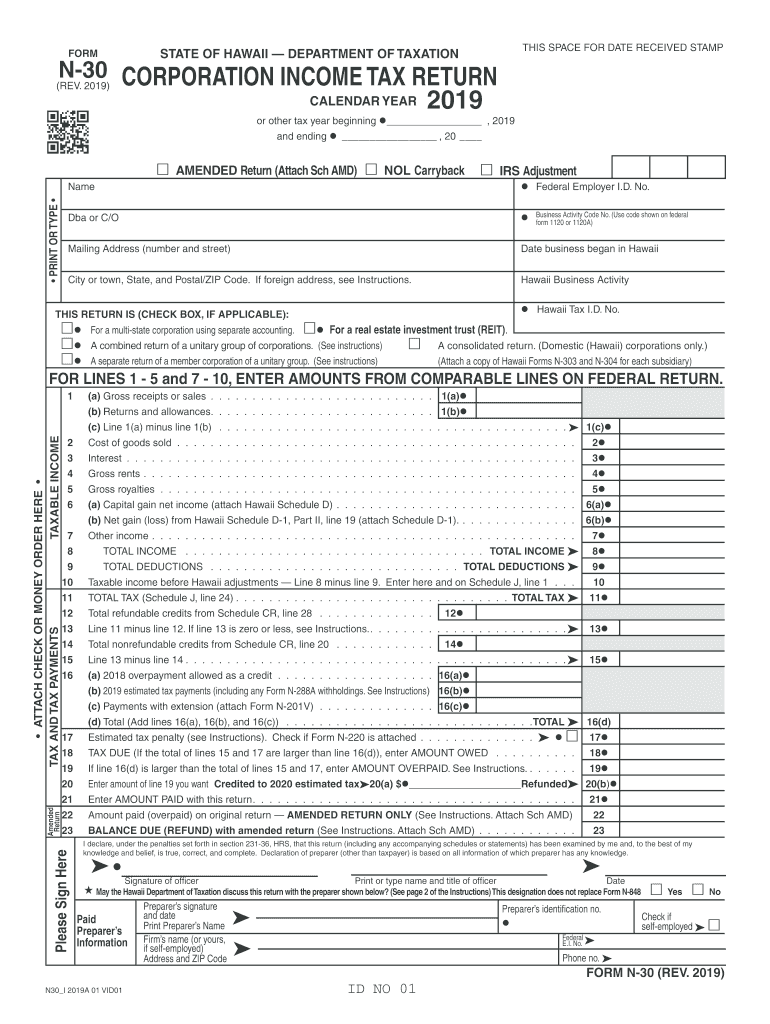

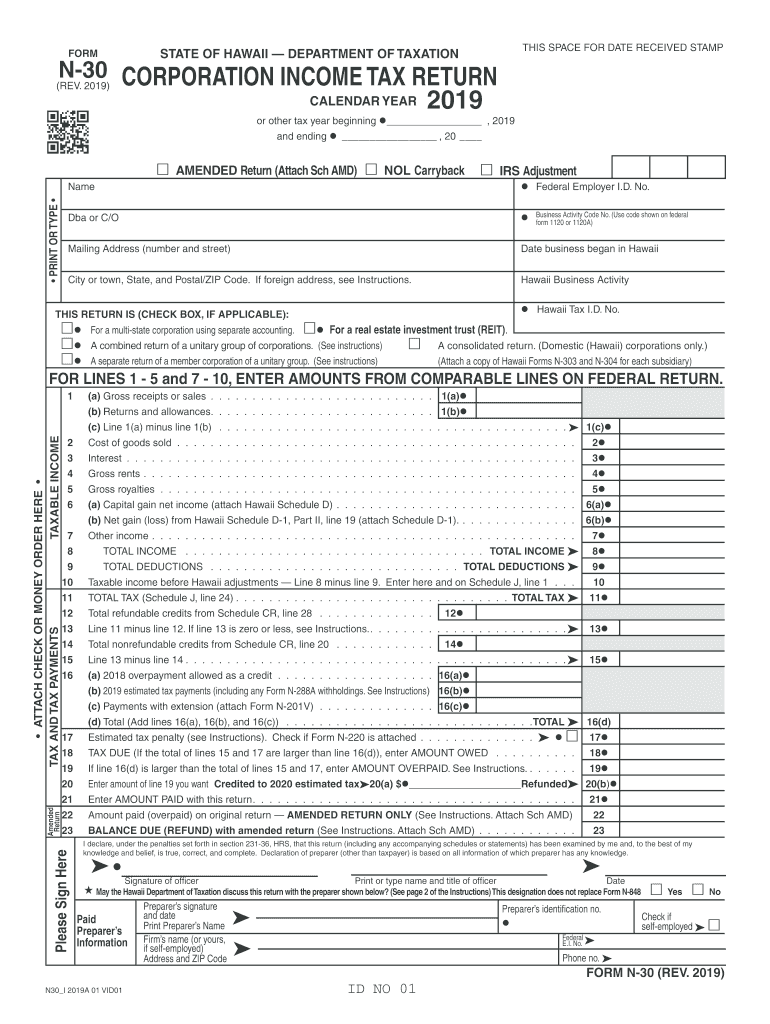

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM THIS SPACE FOR DATE RECEIVED STAMP N-30 REV. 6 7 Net income from sources outside Hawaii received by a foreign or domestic corporation except for unitary business taxpayers using Form N-30 Schedules O P. Address and ZIP Code FORM N-30 FORM N-30 REV. 2017 Page 2 Name as shown on return Schedule C Income From Dividends Classified for Hawaii Purposes DIVIDENDS 1 Name of declaring corporation Attach a separate sheet if more space is needed. 2...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT N-30

Edit your HI DoT N-30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT N-30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT N-30 online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI DoT N-30. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-30 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT N-30

How to fill out HI DoT N-30

01

Obtain the HI DoT N-30 form from the appropriate state department website or office.

02

Read the instructions carefully to understand the requirements and filling process.

03

Fill in the personal information section, including your name, address, and contact details.

04

Provide the necessary details about the vehicle or property as required in the form.

05

Include any relevant tax information that pertains to your situation.

06

Check the calculations for accuracy, if applicable, and ensure all necessary fields are completed.

07

Attach any required supporting documentation, such as identification or previous filings.

08

Review the form for any errors and make corrections as needed.

09

Submit the completed form by mail or online as specified in the submission guidelines.

Who needs HI DoT N-30?

01

Individuals or businesses who need to report their vehicle or property for tax purposes.

02

Residents of Hawaii who own a vehicle and are required to submit the HI DoT N-30 for compliance.

03

Those who have recently acquired a vehicle and need to register it with the state department.

Instructions and Help about HI DoT N-30

Fill

form

: Try Risk Free

People Also Ask about

What taxes does an LLC pay in Hawaii?

Every member or manager of the Hawaii LLC earning profit from the LLC has to pay the Federal Self-Employment Tax (also called the Social Security or Medicare Tax). The Federal Self-Employment Tax applies to all the earnings of an LLC member or manager. The Federal Self-Employment Tax rate in Hawaii is 15.3%.

Can I file my Hawaii state taxes online?

Hawaii Tax Online (HTO) Hawaii Tax Online is the convenient and secure way to e-file tax returns, make payments, review letters, manage your accounts, and conduct other common transaction online with DOTAX. Filing taxes and making debit payments through this system is free.

What is the number for withholding tax?

For more information, please call our Taxpayer Assistance Center at 1-888-745-3886. When determining your withholding allowances, you must consider your personal situation: — Do you claim allowances for dependents or blindness?

Does Hawaii have a state withholding form?

Yes. The state of Hawaii requires additional forms to file along with Form W2. Hawaii has an additional requirement of Form HW-3 (Annual reconciliation of Income tax withheld)to be sent only if there is a state tax withholding.

Can I file my taxes by myself online?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

How is Hawaii tax calculated?

Hawaii does not have a sales tax; instead, we have the GET, which is assessed on all business activities. The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others.

Do I need to file Hawaii state tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

How do you calculate taxable income from AGI?

The term taxable income refers to any gross income earned that is used to calculate the amount of tax you owe. Put simply, it is your adjusted gross income less any deductions. This includes any wages, tips, salaries, and bonuses from employers. Investment and unearned income are also included.

How do I file my taxes if I started my own business?

Filing taxes as a sole proprietor If you run your own company with no partners, filing taxes is incredibly simple. All you have to do is fill out a Schedule C when you file your annual personal tax return. The IRS Schedule C is a form that you attach to your main individual tax return on Form 1040.

What income is taxable in Hawaii?

The state of Hawaii requires you to pay taxes if you are a resident or nonresident and receive income from a Hawaii source. The state income tax rates range from 1.4% to 11%, and the Aloha State doesn't charge sales tax.

When can I file my Hawaii state taxes?

Hawaii State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a HI state return). The Hawaii tax filing and tax payment deadline is April 18, 2023.

How does Hawaii determine residency for tax purposes?

If an individual has been in Hawaii more than 200 days of the taxable year in the aggregate (not consecutive), the individual is presumed to have been a resident of Hawaii from the time of the individual's arrival.

When can I file my Hawaii state taxes 2022?

While the law requires taxpayers to file by April 20, taxpayers are granted an automatic 6-month extension (no form is required to request the extension) to file the return through October 20, 2022 if one of these two conditions is met: The taxpayer is due a refund, or.

How do I get a tax withholding certificate?

The payer is required to generate a withholding tax certificate on iTax which is automatically sent to the payee once the payer remits the withholding tax to KRA. Withholding tax deducted should be remitted to KRA by the 20th day of the month following the month in which the tax was deducted.

How do I get a Hawaii tax ID number?

Individuals can register online to receive their ID by filing Form BB-1 through Hawaii Business Express . To learn more about Hawaii Tax ID numbers, see items 12 - 19 of this edition of Hawaii's Tax Facts publication.

How do I get a Hawaii withholding tax number?

How do I get a withholding (WH) account number? Use Form BB-1 to request a withholding (WH) account number. You may also add a withholding account on Hawaii Tax Online if you already have a login.

How do I file my small business taxes in Hawaii?

You can register online through Hawaii Business Express or mail in Form BB-1. After you've registered, you'll be sent a GET license. Then, on a periodic basis—monthly, quarterly, semiannually—you must submit excise tax returns to the DOT. You can do this on paper (Form G-45) or online.

Does Hawaii have an LLC tax return?

Alternatively, an LLC may elect to be treated as a corporation. All LLCs (including disregarded entities) must obtain its own GET license, file tax returns, and pay GET on its gross business income.

Can I do my small business taxes myself?

The short answer is “yes,” you can do your return yourself. There is no legal or IRS requirement that business owners hire a tax professional to prepare their returns. That said, most business owners prefer to get tax pros to do their tax returns. Indeed, a majority of all taxpayers hire tax preparers.

How is Hawaii AGI calculated?

How Income Taxes Are Calculated. First, we calculate your adjusted gross income (AGI) by taking your total household income and reducing it by certain items such as contributions to your 401(k). Next, from AGI we subtract exemptions and deductions (either itemized or standard) to get your taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute HI DoT N-30 online?

With pdfFiller, you may easily complete and sign HI DoT N-30 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I fill out HI DoT N-30 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your HI DoT N-30. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit HI DoT N-30 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like HI DoT N-30. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is HI DoT N-30?

HI DoT N-30 is a form used by the Hawaii Department of Taxation for reporting and paying the General Excise Tax (GET) and the Transient Accommodations Tax (TAT).

Who is required to file HI DoT N-30?

Businesses and individuals who have a general excise tax and/or transient accommodations tax obligation in Hawaii are required to file HI DoT N-30.

How to fill out HI DoT N-30?

To fill out HI DoT N-30, you need to provide your taxpayer identification information, report your gross income, calculate your tax liability, and disclose any credits claimed, along with the total amount due.

What is the purpose of HI DoT N-30?

The purpose of HI DoT N-30 is to facilitate the reporting and payment of Hawaii's General Excise Tax and Transient Accommodations Tax by tax filers.

What information must be reported on HI DoT N-30?

HI DoT N-30 requires reporting of the taxpayer's identification, gross income, GET and TAT amounts due, any applicable credits, and the total amount owed for the reporting period.

Fill out your HI DoT N-30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT N-30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.