HI DoT N-30 2013 free printable template

Show details

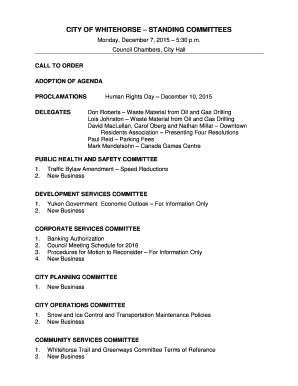

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM THIS SPACE FOR DATE RECEIVED STAMP N-30 REV. 6 7 Net income from sources outside Hawaii received by a foreign or domestic corporation except for unitary business taxpayers using Form N-30 Schedules O P. Address and ZIP Code FORM N-30 FORM N-30 REV. 2013 Page 2 Name as shown on return Schedule C Income From Dividends Classified for Hawaii Purposes DIVIDENDS 1 Name of declaring corporation Attach a separate sheet if more space is needed. 2...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT N-30

Edit your HI DoT N-30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT N-30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing HI DoT N-30 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit HI DoT N-30. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-30 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT N-30

How to fill out HI DoT N-30

01

Obtain the HI DoT N-30 form from the official website or your local Department of Transportation office.

02

Fill out the top section with your personal information, including your name, address, and contact information.

03

Select the type of application you are submitting by checking the appropriate box.

04

Complete any required sections related to your vehicle information, including make, model, year, and VIN.

05

Provide details pertaining to any additional documents or information that may be required depending on your specific situation.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form, then submit it according to the instructions provided, whether online or in person.

Who needs HI DoT N-30?

01

Individuals seeking to register a vehicle in Hawaii.

02

Anyone applying for a driver's license or permit that requires vehicle information.

03

Residents of Hawaii needing to update their vehicle registration details.

04

People involved in transferring ownership of a vehicle in Hawaii.

Fill

form

: Try Risk Free

People Also Ask about

What is the non resident income tax form for Hawaii?

How to determine which form to file. Hawaiʻi nonresidents or part-year residents should file state Form N-15.

What is the form N 356 in Hawaii?

A tax credit that exceeds the taxpayer's income tax liability may be used as a credit against the taxpayer's income tax liability in subsequent years until exhausted. Use Form N-356 to figure and claim the earned income tax credit under section 235- 55.75, Hawaii Revised Statutes.

What is Hawaii tax Form N 15?

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.

Where can I get Hawaii state tax forms?

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

What is form N 163 in Hawaii?

Purpose of Form Use Form N-163 to figure and claim the fuel tax credit for commercial fishers under sections 235-110.6, HRS, and 18-235- 110.6, Hawaii Administrative Rules.

What form do I use for Hawaii estimated taxes?

1040ES. Estimated Tax for Individuals. Estimated tax is the method used to pay tax on income that is not subject to withholding (for example, earnings from self-employment, interest, dividends, rents, or alimony).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit HI DoT N-30 from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including HI DoT N-30, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out the HI DoT N-30 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign HI DoT N-30 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I fill out HI DoT N-30 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your HI DoT N-30. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is HI DoT N-30?

HI DoT N-30 is a tax form used in Hawaii for the reporting and payment of the general excise tax for businesses operating within the state.

Who is required to file HI DoT N-30?

Businesses that have received a general excise tax license and have taxable income from conducting business in Hawaii are required to file HI DoT N-30.

How to fill out HI DoT N-30?

To fill out HI DoT N-30, taxpayers need to provide detailed information about their gross income, deductions, and calculate the amount of general excise tax owed based on the applicable tax rate.

What is the purpose of HI DoT N-30?

The purpose of HI DoT N-30 is to report business income and calculate the general excise tax liability for businesses operating in Hawaii.

What information must be reported on HI DoT N-30?

On HI DoT N-30, businesses must report their gross receipts, exemptions, deductions, and any other relevant income details to accurately calculate their general excise tax obligation.

Fill out your HI DoT N-30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT N-30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.