HI DoT N-30 2015 free printable template

Show details

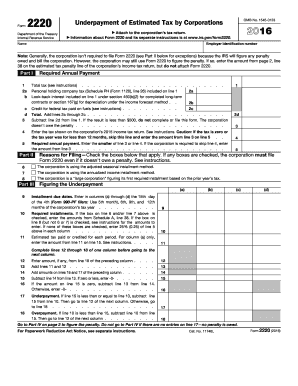

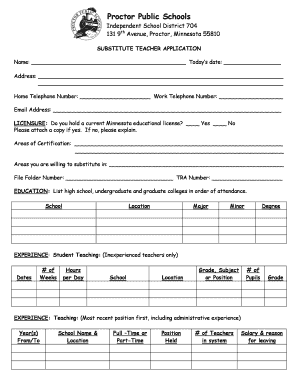

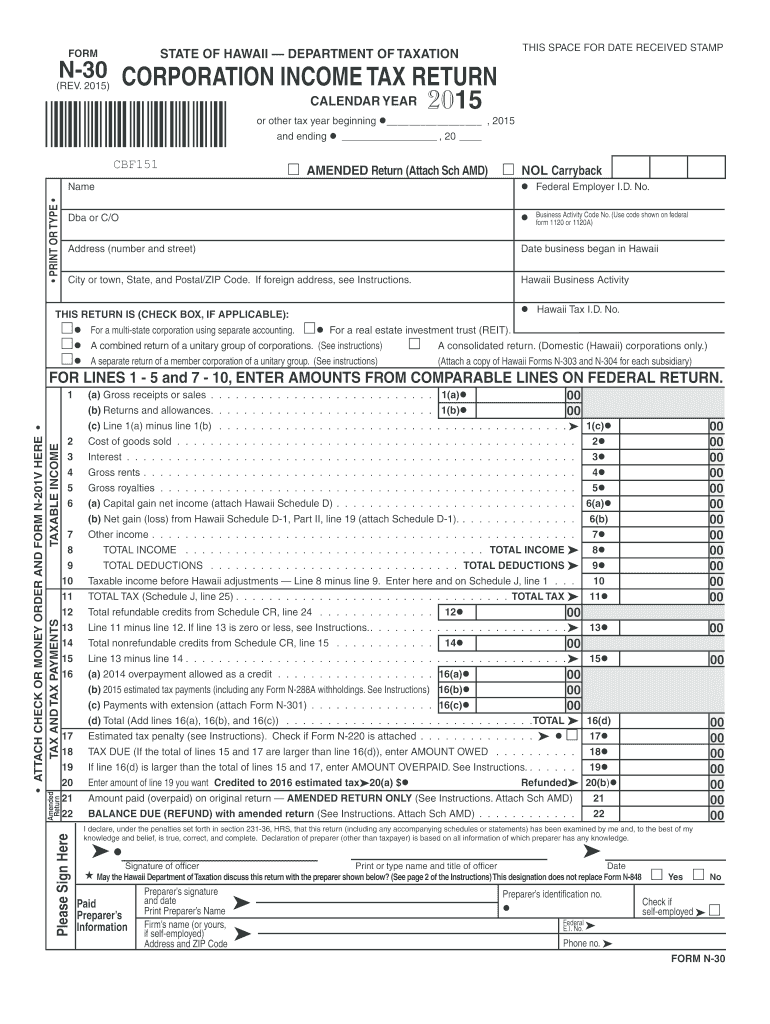

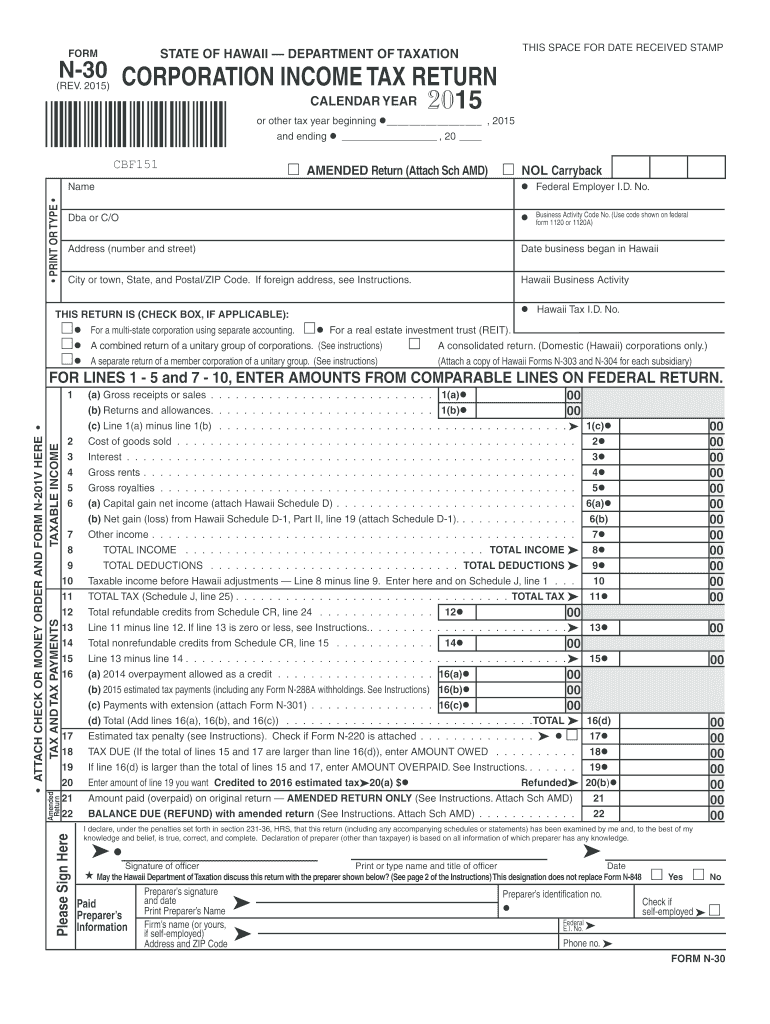

Clear Form STATE OF HAWAII DEPARTMENT OF TAXATION FORM THIS SPACE FOR DATE RECEIVED STAMP N-30 REV. 6 7 Net income from sources outside Hawaii received by a foreign or domestic corporation except for unitary business taxpayers using Form N-30 Schedules O P. Address and ZIP Code FORM N-30 FORM N-30 REV. 2015 Page 2 Name as shown on return Schedule C Income From Dividends Classified for Hawaii Purposes DIVIDENDS 1 Name of declaring corporation Attach a separate sheet if more space is needed. 2...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign HI DoT N-30

Edit your HI DoT N-30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your HI DoT N-30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit HI DoT N-30 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit HI DoT N-30. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

HI DoT N-30 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out HI DoT N-30

How to fill out HI DoT N-30

01

Obtain the HI DoT N-30 form from the official website or local Department of Transportation office.

02

Complete the applicant's information section, including name, address, and contact information.

03

Provide details about the vehicle, including make, model, year, and VIN (Vehicle Identification Number).

04

Indicate the reason for filling out the form, specifying whether it's for registration, renewal, or other purposes.

05

If applicable, include information about any previous registrations or violations.

06

Review all information for accuracy and completeness before submission.

07

Sign and date the form where indicated.

08

Submit the completed form via mail, online submission, or in person at the local Department of Transportation office, along with any required fees.

Who needs HI DoT N-30?

01

Individuals or businesses registering a vehicle in Hawaii.

02

Owners of vehicles requiring renewal of their registration.

03

Anyone seeking to report changes to their vehicle information or ownership.

Instructions and Help about HI DoT N-30

Fill

form

: Try Risk Free

People Also Ask about

What is form N 30?

Form N-30, Rev. 2021, Corporation Income Tax Return.

Who is required to file a Hawaii tax return?

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

Can I still file my taxes from 2015?

You can still file 2015 tax returns Even though the deadline has passed, you can file your 2015 taxes online in a few simple steps. Our online income tax software uses the 2015 IRS tax code, calculations, and forms.

Can I still file my 2015 taxes in 2022?

Unfortunately, there is a limit on how far back you can file a tax return to claim tax refunds and tax credits. This IRS only allows you to claim refunds and tax credits within three years of the tax return's original due date.

Can I still file my 2015 taxes in 2021?

You can still file 2015 tax returns Even though the deadline has passed, you can file your 2015 taxes online in a few simple steps. Our online income tax software uses the 2015 IRS tax code, calculations, and forms. File late taxes today with our Maximum Refund Guarantee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the HI DoT N-30 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your HI DoT N-30 in minutes.

Can I create an eSignature for the HI DoT N-30 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your HI DoT N-30 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete HI DoT N-30 on an Android device?

On Android, use the pdfFiller mobile app to finish your HI DoT N-30. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is HI DoT N-30?

HI DoT N-30 is a tax form used in Hawaii for reporting the general excise tax and use tax.

Who is required to file HI DoT N-30?

Businesses and individuals who are engaged in taxable activities in Hawaii and have earned income are required to file HI DoT N-30.

How to fill out HI DoT N-30?

To fill out HI DoT N-30, you must provide income information, deductions, and calculate the amount of general excise tax owed. Follow the instructions provided with the form carefully.

What is the purpose of HI DoT N-30?

The purpose of HI DoT N-30 is to report the general excise tax liabilities and ensure compliance with Hawaii state tax laws.

What information must be reported on HI DoT N-30?

The information that must be reported on HI DoT N-30 includes total gross income, any allowable deductions, the amount of tax owed, and details about the taxpayer.

Fill out your HI DoT N-30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HI DoT N-30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.