IRS 1099-C 2019 free printable template

Show details

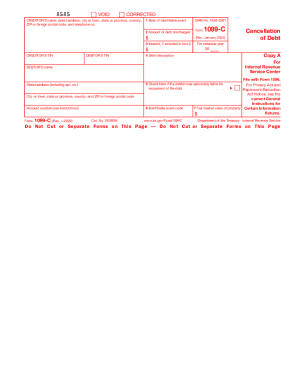

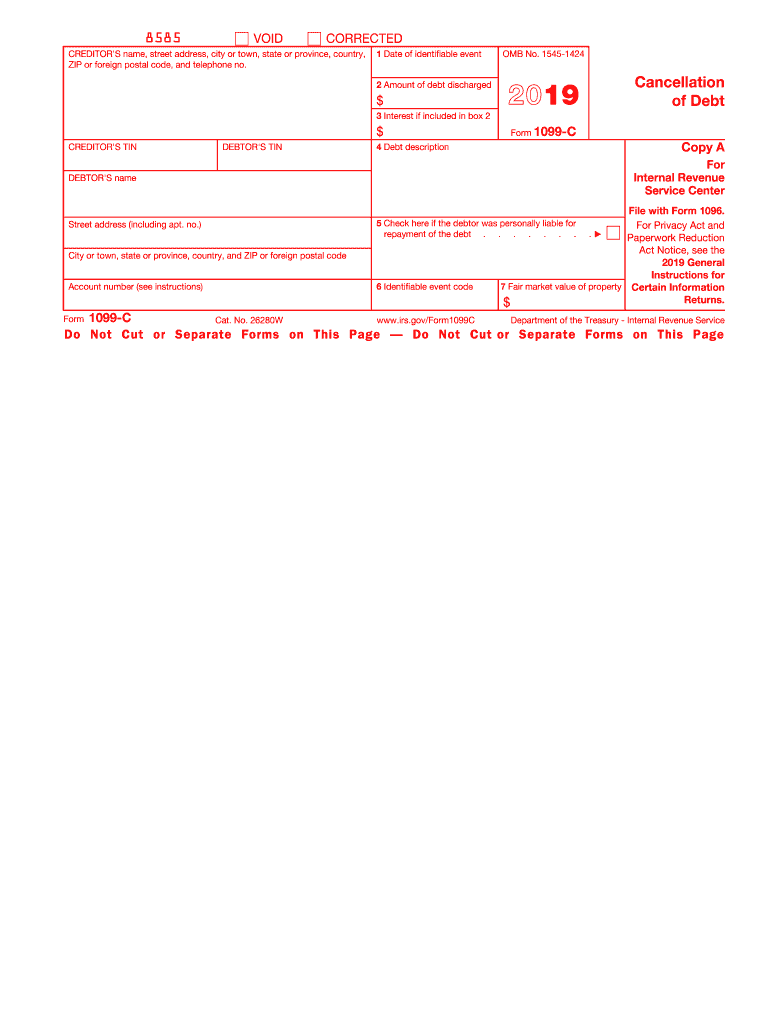

Copy C For Creditor and Paperwork Reduction Act Certain Information To complete Form 1099-C use Returns and the 2018 Instructions for Forms 1099-A and 1099-C. For the latest information about developments related to Form 1099-C and its instructions such as legislation enacted after they were published go to www.irs.gov/Form1099C. 1220. The IRS does not provide a fill-in form option for Need help If you have questions about reporting on Form 1099-C call the information reporting customer service...site toll free at 866-455-7438 or 304-263-8700 not toll free. 1 Date of identifiable event 2 Amount of debt discharged 3 Interest if included in box 2 CREDITOR S TIN DEBTOR S TIN OMB No. 1545-1424 Form 1099-C Copy A 4 Debt description For Internal Revenue Service Center DEBTOR S name Street address including apt. no. File with Form 1096. 4681. A Bankruptcy B Other judicial debt relief C Statute of limitations or expiration of deficiency period D Foreclosure election E Debt relief from probate or...similar proceeding F By agreement G Decision or policy to discontinue collection or H Other actual discharge before identifiable event. Box 7. If in the same calendar year a foreclosure or abandonment of property occurred in connection with the cancellation of the debt the fair market value FMV of the property will be shown or you will receive a separate Form 1099-A. For Privacy Act and. Paperwork Reduction Act Notice see the 2018 General 7 Fair market value of property Certain Information...Returns. 5 Check here if the debtor was personally liable for repayment of the debt. City or town state or province country and ZIP or foreign postal code Account number see instructions Cancellation of Debt 6 Identifiable event code 1099-C Cat. No. 26280W www.irs.gov/Form1099C Department of the Treasury - Internal Revenue Service Do Not Cut or Separate Forms on This Page Do Not Cut or Separate Forms on This Page CORRECTED if checked Copy B For Debtor This is important tax information and is...being furnished to the IRS. If you are required to file a return a negligence 5 If checked the debtor was personally liable for penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines that it has not been reported. keep for your records You received this form because a Federal Government agency or an applicable financial entity a creditor has discharged canceled or forgiven a debt you owed or because an identifiable event has...occurred that either is or is deemed to be a discharge of a debt of 600 or more. 5 Check here if the debtor was personally liable for repayment of the debt. City or town state or province country and ZIP or foreign postal code Account number see instructions Cancellation of Debt 6 Identifiable event code 1099-C Cat. No. 26280W www.irs.gov/Form1099C Department of the Treasury - Internal Revenue Service Do Not Cut or Separate Forms on This Page Do Not Cut or Separate Forms on This Page CORRECTED...if checked Copy B For Debtor This is important tax information and is being furnished to the IRS. If you are required to file a return a negligence 5 If checked the debtor was personally liable for penalty or other sanction may be imposed on you if taxable income results from this transaction and the IRS determines that it has not been reported. keep for your records You received this form because a Federal Government agency or an applicable financial entity a creditor has discharged canceled or...forgiven a debt you owed or because an identifiable event has occurred that either is or is deemed to be a discharge of a debt of 600 or more. If a creditor has discharged a debt you owed you are required to include the discharged amount in your income even if it is less than 600 on the Other income line of your Form 1040. However you may not have to include all of the canceled debt in your income. There are exceptions and exclusions such as bankruptcy and insolvency. However you may not have to...include all of the canceled debt in your income. There are exceptions and exclusions such as bankruptcy and insolvency. See Pub. 4681 available at IRS.gov for more details. If an identifiable event has occurred but the debt has not actually been discharged then include any discharged debt in your income in the year that it is actually discharged unless an exception or exclusion applies to you in that year. Debtor s taxpayer identification number TIN. For your protection this form may show only...the last four digits of your TIN social security number SSN individual taxpayer identification number ITIN adoption taxpayer identification number ATIN or employer identification number EIN.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

How to fill out IRS 1099-C

Instructions and Help about IRS 1099-C

How to edit IRS 1099-C

To edit the IRS 1099-C form, you can utilize pdfFiller. Begin by uploading your existing form to the platform. Once uploaded, use the editing tools to make necessary changes such as correcting amounts or updating debtor information. After making edits, ensure all fields are accurately filled before saving and downloading the revised document.

How to fill out IRS 1099-C

Filling out the IRS 1099-C requires careful attention to detail. First, gather necessary information including creditor and debtor details, the date of cancellation of debt, and the amount forgiven. Next, accurately input this information into the designated fields of the form. Review the completed form for accuracy, ensuring that all entries are correctly aligned with IRS requirements. For added convenience, pdfFiller can assist in guiding you through this process.

About IRS 1099-C 2019 previous version

What is IRS 1099-C?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-C 2019 previous version

What is IRS 1099-C?

The IRS 1099-C form, formally known as the "Cancellation of Debt," is used to report the cancellation of a debt of $600 or more. This form is important for both lenders and borrowers as it documents when a debtor’s obligation is discharged. When a debt is canceled, the IRS may consider this cancellation as income to the borrower unless exceptions apply.

What is the purpose of this form?

The purpose of the IRS 1099-C is to inform the IRS and the debtor about the cancellation of a significant debt. This documentation helps the IRS track income that may not have been reported by the debtor. It's essential for understanding tax obligations that arise from the cancellation of debt, as canceled debt may be treated as taxable income.

Who needs the form?

Creditors must issue the IRS 1099-C form to any borrower whose debt they have forgiven if the amount forgiven is $600 or greater. This form is typically required for banks, credit unions, and other financial institutions that cancel debt. Debtors receiving a 1099-C should ensure that they report this income on their tax return.

When am I exempt from filling out this form?

You may be exempt from filing the IRS 1099-C if the debt cancellation does not meet the $600 threshold. Additionally, certain types of debts may be excluded, such as certain student loans forgiven under specific programs. Always consult with a tax professional to determine your specific circumstances.

Components of the form

The IRS 1099-C contains several critical components, including the creditor’s information, debtor's information, the amount of debt canceled, the date of cancellation, and the applicable codes that signal the reason for cancellation. Each section must be accurately filled to avoid penalties and ensure proper reporting to the IRS.

What are the penalties for not issuing the form?

Failure to issue the IRS 1099-C when required can result in substantial penalties for creditors. The penalty may vary depending on how late the form is filed, with the maximum penalty for noncompliance reaching $550 per form. Additionally, failing to issue this form may complicate tax filings for the debtor.

What information do you need when you file the form?

When filing the IRS 1099-C, you need specific information about the creditor and debtor, including names, addresses, social security numbers or Employer Identification Numbers (EINs), the amount of debt canceled, and the date of cancellation. Accurate entry of this data is critical for compliance and proper processing by the IRS.

Is the form accompanied by other forms?

The IRS 1099-C does not typically require accompanying forms unless additional information is necessary for reporting specific types of cancellations. In some cases, such as insolvency or bankruptcy, other documentation may be necessary to substantiate the tax implications of the cancellation.

Where do I send the form?

The completed IRS 1099-C form must be sent to the IRS, along with the appropriate transmittal form (Form 1096 if filing by mail). Depending on the volume of forms being filed, you can send it to different addresses specified by the IRS according to your location. It is crucial to verify the correct mailing address on the IRS website.

See what our users say