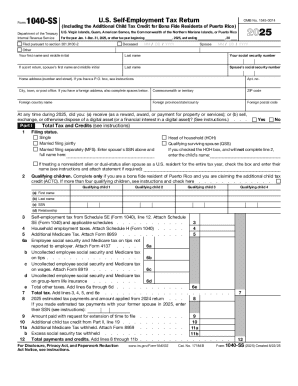

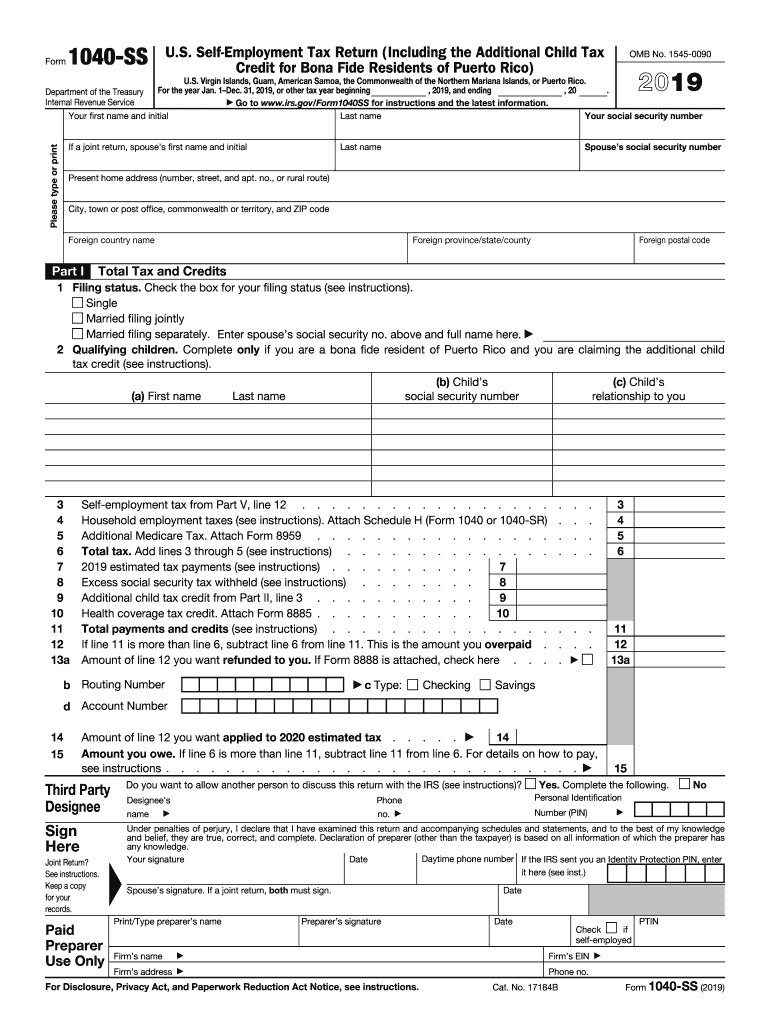

IRS 1040-SS 2019 free printable template

Instructions and Help about IRS 1040-SS

How to edit IRS 1040-SS

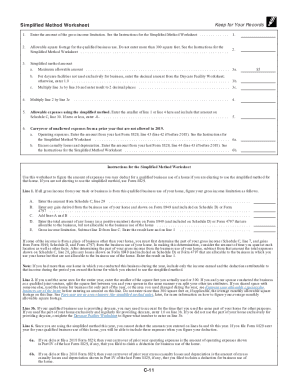

How to fill out IRS 1040-SS

About IRS 1040-SS 2019 previous version

What is IRS 1040-SS?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040-SS

What should I do if I realize I've made a mistake on my IRS 1040-SS?

If you find an error on your IRS 1040-SS after submission, you need to file an amended return using Form 1040-X. Make sure to clearly indicate the changes and provide explanations when necessary. It’s important to keep a copy of both the original and amended forms for your records.

How can I track the status of my IRS 1040-SS after I submit it?

To track your IRS 1040-SS, you can use the IRS 'Where's My Refund?' tool online, which provides updates on the status of your submission. If you filed electronically, you may receive notifications about acceptance or rejections, helping you address any issues promptly.

What are the common errors people make when submitting the IRS 1040-SS?

Common mistakes when filing the IRS 1040-SS include incorrect Social Security numbers, miscalculating tax amounts, and failing to sign the form. To avoid these issues, double-check all information before submitting and consider using e-filing software that can help catch errors.

Can I use an e-signature when filing my IRS 1040-SS?

Yes, the IRS accepts electronic signatures for the IRS 1040-SS when e-filing. Ensure you follow the specific requirements set by the IRS for e-signatures, which may include using a designated signing process within e-filing software.

What should I do if I receive an audit notice related to my IRS 1040-SS?

If you receive an audit notice regarding your IRS 1040-SS, read the notice carefully to understand what is being questioned. Prepare the requested records and documentation to substantiate your claims. It may also be beneficial to consult a tax professional for guidance through the audit process.

See what our users say