ME MRS W-3ME 2020 free printable template

Show details

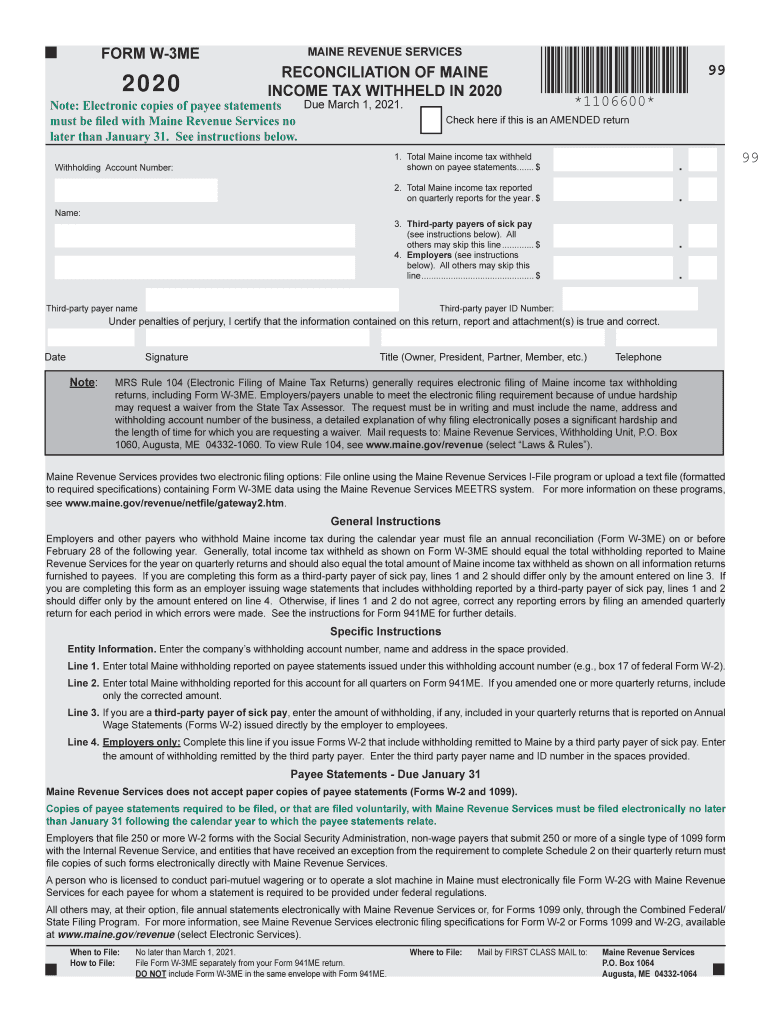

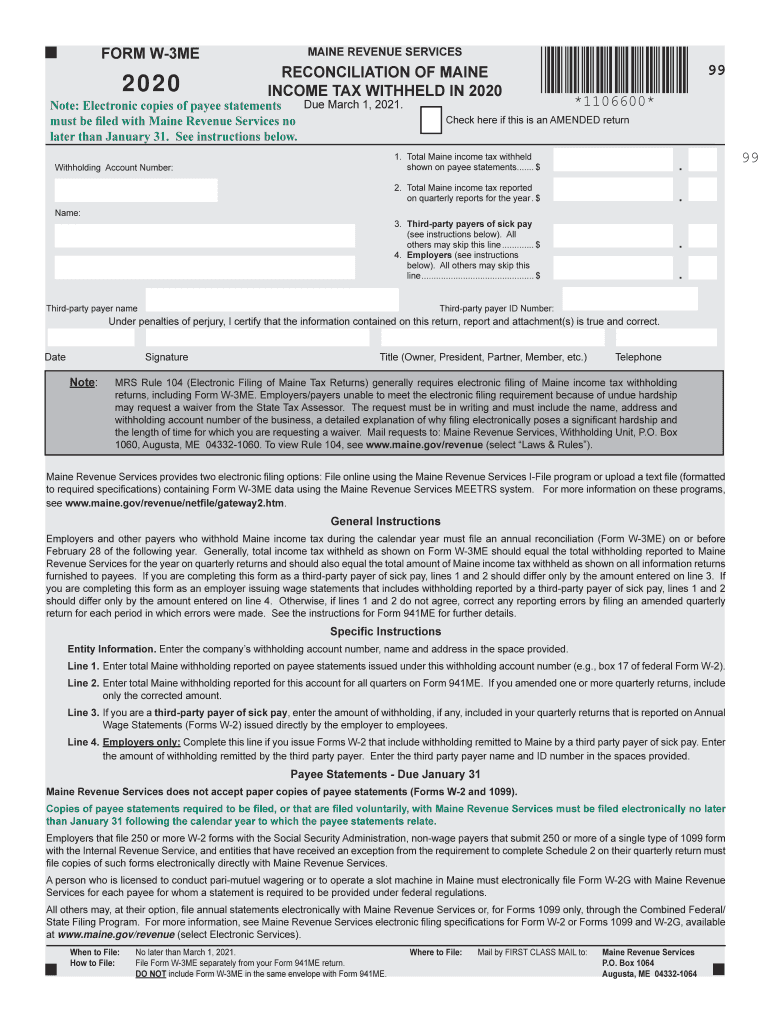

Mail by FIRST CLASS MAIL to File Form W-3ME separately from your Form 941ME return. DO NOT include Form W-3ME in the same envelope with Form 941ME. P. FORM W-3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE INCOME TAX WITHHELD IN 2019 Note Electronic copies of payee statements Due February 28 2020. Maine. gov/revenue/netfile/gateway2. htm. General Instructions Employers and other payers who withhold Maine income tax during the calendar year must file an annual reconciliation Form W-3ME on...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME MRS W-3ME

Edit your ME MRS W-3ME form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME MRS W-3ME form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ME MRS W-3ME online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ME MRS W-3ME. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS W-3ME Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME MRS W-3ME

How to fill out ME MRS W-3ME

01

Obtain the ME MRS W-3ME form from the appropriate administrative office or website.

02

Fill in your personal information including your name, address, and identification number.

03

Provide information about the total amount of income you are reporting for the tax year.

04

Include details of any taxes withheld and deductions applied.

05

Review all filled-out sections for accuracy.

06

Sign and date the form where indicated.

07

Submit the form by the specified deadline to the relevant tax authority.

Who needs ME MRS W-3ME?

01

Individuals who are required to report income for tax purposes.

02

Employers who need to reconcile employee wage and tax reports.

03

Businesses that must submit comprehensive wage information for tax remittance.

Instructions and Help about ME MRS W-3ME

Laws dot-com legal forms guide form W — 3 is United States Internal Revenue Service tax form used for electronic transmittal of reported income from an employer the W — 3 must be used when the employer files a paper W

Fill

form

: Try Risk Free

People Also Ask about

When can I start filing taxes for 2022 in Canada?

Filing your tax return You should file a tax return before the April 30 deadline after the end of the tax year. You'll need your social insurance number and T4 or final payslip to file. While the deadline is April 30, you can file your tax return in February after the end of the tax year.

Does Maine require quarterly tax payments?

Maine follows the IRS standards for estimated payments. If you will owe $1000 or more in tax for the current year, you are required to make 90% of the tax due, over quarterly payments.

Can you order tax forms online?

You can place your order here for tax forms, instructions and publications. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2023.

How to order Maine income tax forms?

To request a single copy of a tax form(s), tax booklet(s) or instructions enter your name and address in the form below and check off the tax year using your mouse. To order forms not listed on this page, call 207-624-7894.

Can I file an amended return online?

Can I file my Amended Return electronically? If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Where can I pick up Canadian income tax forms?

view, download, and print the package from canada.ca/taxes-general-package. order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Is there a penalty for filing an amended return?

Although the IRS appreciates when taxpayers file an amended return to correct a mistake, they can still assess a penalty or charge interest for not paying the proper amount when the taxes were originally due.

How do I make estimated tax payments automatically?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do I file an amended tax return myself?

Here's a step-by-step guide. Step 1: Collect your documents. Gather your original tax return and any new documents needed to prepare your amended return. Step 2: Get the right forms. The IRS form for amending a return is Form 1040-X. Step 3: Fill out Form 1040-X. Step 4: Submit your amended forms.

What is the easiest way to pay estimated taxes?

Making payments online is the fastest, easiest way to pay quarterly taxes. If you prefer, you can also make payments by mail. To avoid any tax penalties, take time to learn how much you'll need to pay in quarterly taxes, when quarterly tax payments are due and how to make your payments to the IRS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ME MRS W-3ME in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ME MRS W-3ME and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I fill out ME MRS W-3ME using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign ME MRS W-3ME. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How can I fill out ME MRS W-3ME on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your ME MRS W-3ME from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is ME MRS W-3ME?

ME MRS W-3ME is a form used in the state of Maine for reporting annual wages and withholding information for employees to the Maine Revenue Services.

Who is required to file ME MRS W-3ME?

Employers who have withheld state income tax from their employees' wages and reported those wages on Maine employment tax forms are required to file ME MRS W-3ME.

How to fill out ME MRS W-3ME?

To fill out ME MRS W-3ME, employers should gather total wages paid, total taxes withheld, and complete each section of the form, ensuring accuracy in reporting employee and company information.

What is the purpose of ME MRS W-3ME?

The purpose of ME MRS W-3ME is to provide the Maine Revenue Services with a summary of wage and tax information for the tax year, ensuring compliance with state tax reporting requirements.

What information must be reported on ME MRS W-3ME?

ME MRS W-3ME requires reporting of total wages paid, total state income tax withheld, and identifying information for both the employer and the employees covered by the form.

Fill out your ME MRS W-3ME online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME MRS W-3me is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.