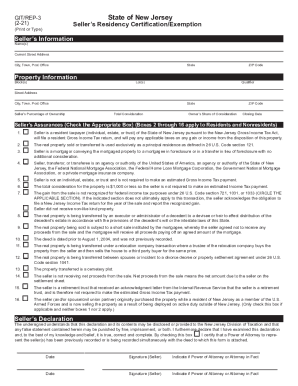

NJ DoT GIT/REP-3 2019 free printable template

Get, Create, Make and Sign NJ DoT GITREP-3

How to edit NJ DoT GITREP-3 online

Uncompromising security for your PDF editing and eSignature needs

NJ DoT GIT/REP-3 Form Versions

How to fill out NJ DoT GITREP-3

How to fill out NJ DoT GIT/REP-3

Who needs NJ DoT GIT/REP-3?

Instructions and Help about NJ DoT GITREP-3

Do it just do it don't let your dreams be dreams yesterday you said tomorrow so just do it make your dreams come true just do it some people dream of success while you're gonna wake up and work hard at it nothing is impossible you should get to the point where anyone else would quit and you're not going to stop there no what are you waiting for do it just do it yes you can just do it if you're tired of starting over stop giving up

People Also Ask about

How do I get a NJ tax ID number?

What is NJ non resident seller tax?

What is a seller's residency certification exemption in NJ for?

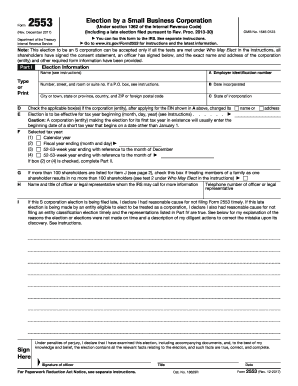

What is a git rep form?

How do I pay my NJ gross income tax adjustment?

What is the withholding on a real estate sale in New Jersey?

What is seller's residency certification exemption?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NJ DoT GITREP-3 for eSignature?

How do I edit NJ DoT GITREP-3 straight from my smartphone?

How can I fill out NJ DoT GITREP-3 on an iOS device?

What is NJ DoT GIT/REP-3?

Who is required to file NJ DoT GIT/REP-3?

How to fill out NJ DoT GIT/REP-3?

What is the purpose of NJ DoT GIT/REP-3?

What information must be reported on NJ DoT GIT/REP-3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.