NJ DoT GIT/REP-3 2015 free printable template

Show details

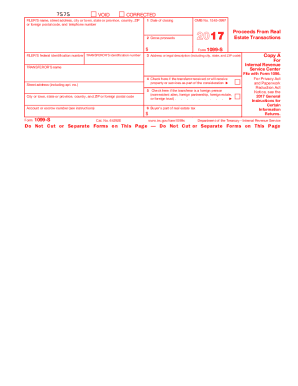

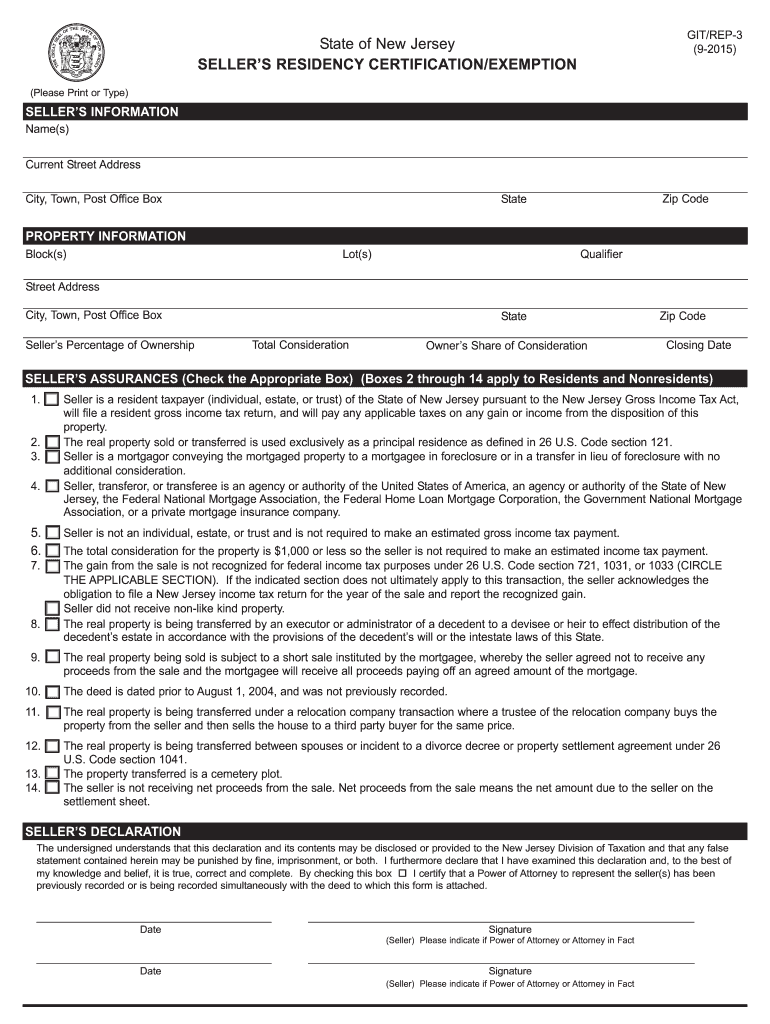

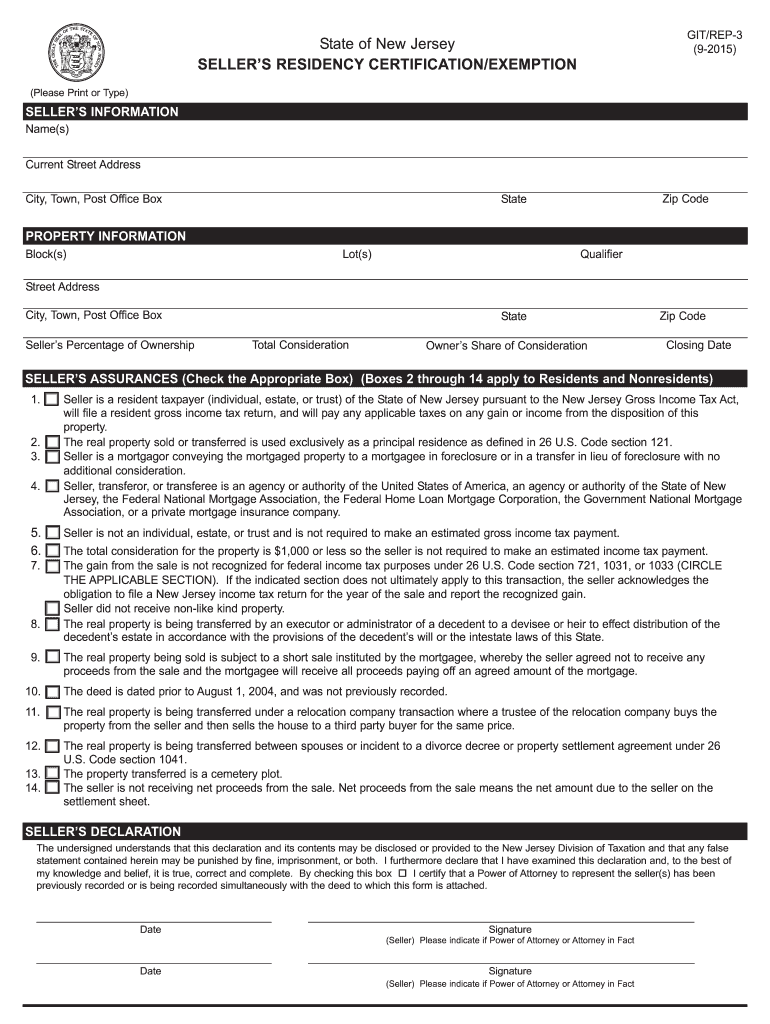

1031 like-kind exchange A nonresident who completes the GIT/REP-3 and claims exemption for a 1031 transaction box 7 must show the value of the like-kind property received. If the transaction includes non-like kind property i.e. money stocks etc the seller must also compete the GIT/REP-1 Nonresident Seller s Tax Declaration show the greater of the that amount. GIT/REP-3 9-2015 State of New Jersey SELLER S RESIDENCY CERTIFICATION/EXEMPTION Please Print or Type SELLER S INFORMATION Name s...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ DoT GITREP-3

Edit your NJ DoT GITREP-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ DoT GITREP-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ DoT GITREP-3 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NJ DoT GITREP-3. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ DoT GIT/REP-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ DoT GITREP-3

How to fill out NJ DoT GIT/REP-3

01

Obtain the NJ DoT GIT/REP-3 form from the New Jersey Department of Transportation website or your local office.

02

Fill in the contact information section at the top of the form, including your name, address, and phone number.

03

Specify the project type and purpose in the designated sections.

04

Provide detailed descriptions of the existing conditions and proposed changes.

05

Attach any required supporting documentation, such as maps or plans.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and correct.

08

Submit the form to the appropriate NJ DoT office as instructed.

Who needs NJ DoT GIT/REP-3?

01

Individuals or entities planning construction or development projects in New Jersey that may impact transportation systems.

02

Contractors and engineers working on public or private projects requiring approval from the New Jersey Department of Transportation.

03

Landowners seeking to change land use that could affect traffic patterns or safety.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a NJ tax ID number?

File Form NJ-REG (Business Registration Application) to register with the state to collect/remit New Jersey taxes such as sales tax or employee withholdings, and to obtain a New Jersey tax identification number. You can register online or file a paper application.

What is NJ non resident seller tax?

As part of the sale of a New Jersey home by a non-resident, the seller must pay an estimated gross income tax to the New Jersey Department of Taxation that is appropriate to the sale amount; NJ Rev Stat § 54A:8-10 through 8-10 note that that amount should be no less than 2 percent of the sale amount.

What is a seller's residency certification exemption in NJ for?

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

What is a git rep form?

A GIT/REP form is a Gross Income Tax form required to be recorded with a deed when real property is transferred or sold in New Jersey.

How do I pay my NJ gross income tax adjustment?

You will need your social security number and date of birth to pay online. Taxpayers who do not have Internet access can make a payment by e-check by contacting the Division's Customer Service Center at 609-292-6400. Credit card payments can also be made by phone (1-800-2PAYTAX, toll-free).

What is the withholding on a real estate sale in New Jersey?

New Jersey exit tax particulars The New Jersey exit tax requires you to withhold either 8.97 percent of the profit/capital gain you make on the sale of your home or 2 percent of the total sale price: whichever is higher.

What is seller's residency certification exemption?

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NJ DoT GITREP-3 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including NJ DoT GITREP-3. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit NJ DoT GITREP-3 online?

The editing procedure is simple with pdfFiller. Open your NJ DoT GITREP-3 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How can I edit NJ DoT GITREP-3 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing NJ DoT GITREP-3.

What is NJ DoT GIT/REP-3?

NJ DoT GIT/REP-3 is a reporting form required by the New Jersey Department of Transportation for certain businesses to report tax information related to gross income.

Who is required to file NJ DoT GIT/REP-3?

Entities engaging in business activities in New Jersey and earning gross income are typically required to file the NJ DoT GIT/REP-3.

How to fill out NJ DoT GIT/REP-3?

To fill out NJ DoT GIT/REP-3, applicants should gather their financial records, complete each section of the form accurately, ensuring all income and deductions are reported, and submit it by the due date.

What is the purpose of NJ DoT GIT/REP-3?

The purpose of NJ DoT GIT/REP-3 is to provide the New Jersey Department of Transportation with accurate reporting of the gross income earned by businesses for tax purposes.

What information must be reported on NJ DoT GIT/REP-3?

Information that must be reported includes the total gross income, deductions, business expenses, and any other relevant financial information as required by the form.

Fill out your NJ DoT GITREP-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ DoT GITREP-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.