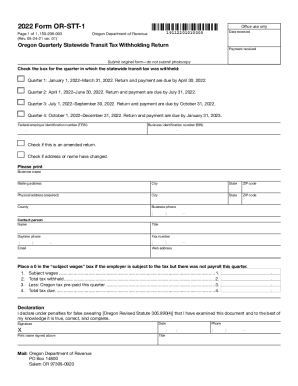

OR OR-STT-1 2020 free printable template

Get, Create, Make and Sign OR OR-STT-1

How to edit OR OR-STT-1 online

Uncompromising security for your PDF editing and eSignature needs

OR OR-STT-1 Form Versions

How to fill out OR OR-STT-1

How to fill out OR OR-STT-1

Who needs OR OR-STT-1?

Instructions and Help about OR OR-STT-1

Music hello and welcome to how to make an app for beginners in this video Im going to show you how to make an app even if youve never programmed a single line of code before now by the end of these next 10 lessons youll have built these apps and user interfaces and Ill also show you how to put them on your phone so that you can show your friends and family but more importantly Im going to teach you the fundamental skills that youll need to build any sort of app so by taking these beginner lessons youre going to get a really nice and solid foundation in iOS app development from there youll want to grab my free seven-day app action plan where you can create a customized app roadmap just to build your app you also want to join our active Facebook community where you can get help and support from myself and the team and tons of other people learning iOS just like you so that youre never stuck or alone on your journey to create apps now the last time I taught this it was viewed by over 12 million people and tons of success stories came out of it ton of people created their own mobile apps as you can see some of them on the wall behind me now I know thats all going to come for you too but it all starts right here right now are you ready lets do it welcome to code with Kris the place to be if you want to learn how to make an app Im Chris and Im so glad youre here first things first how do you create an app from scratch well it all starts with a program called Xcode where you design the user interface for your app and write your code that gets turned into an iPhone app which you can publish to the App Store where millions of people can download and use it before that lets backtrack a bit though Xcode is a program you can download for free and the code Ill be teaching you how to write is called the Swift programming language dont be intimidated if youve never coded before because I guarantee youll get the hang of it next Xcode can only be installed on Mac computers but if you dont have access to one you do not need to spend thousands of dollars to buy one instead check out my video on Xcode for Windows using Mac Stadium first alright so with that out of the way lets dive in and let me show you around Xcode so the first thing youre going to want to do is to download Xcode if you havent already and all you have to do is hit command spacebar on your keyboard to launch spotlight type in App Store to launch it and then in the search bar type in Xcode and thats going to find it now Ive already got it installed so if you dont you want to go ahead and do that Im gonna warn you though its a pretty big application so it does take a little while to install and if you cant if it gives you an error message or something like that scroll down check on the compatibility if you click it it tells you what version of Mac OS it needs for this one it needs ten point thirteen point six but whenever they upgrade Xcode this number gets higher and higher so your you might have...

People Also Ask about

Who needs to file Oregon statewide transit tax?

What is the statewide transit tax in Oregon 2020?

Who needs to file Oregon Statewide transit Individual Tax Return?

Who is exempt from Oregon statewide transit tax?

Do I need to file an Oregon Statewide transit Individual STI tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get OR OR-STT-1?

How do I execute OR OR-STT-1 online?

How do I edit OR OR-STT-1 on an iOS device?

What is OR OR-STT-1?

Who is required to file OR OR-STT-1?

How to fill out OR OR-STT-1?

What is the purpose of OR OR-STT-1?

What information must be reported on OR OR-STT-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.