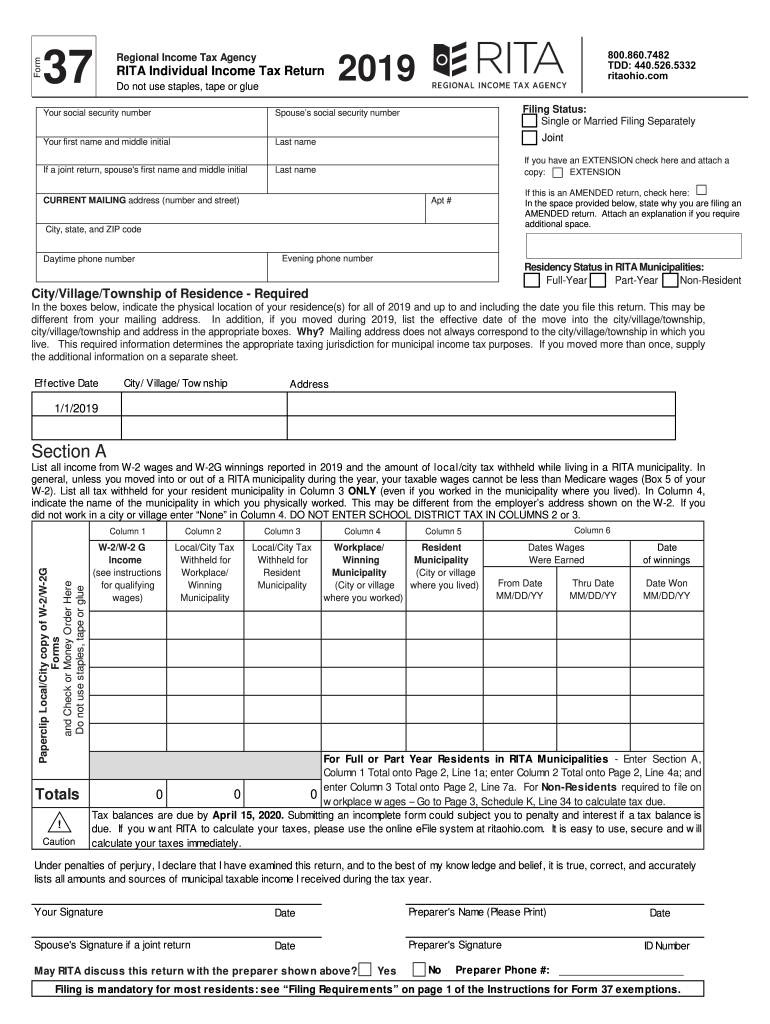

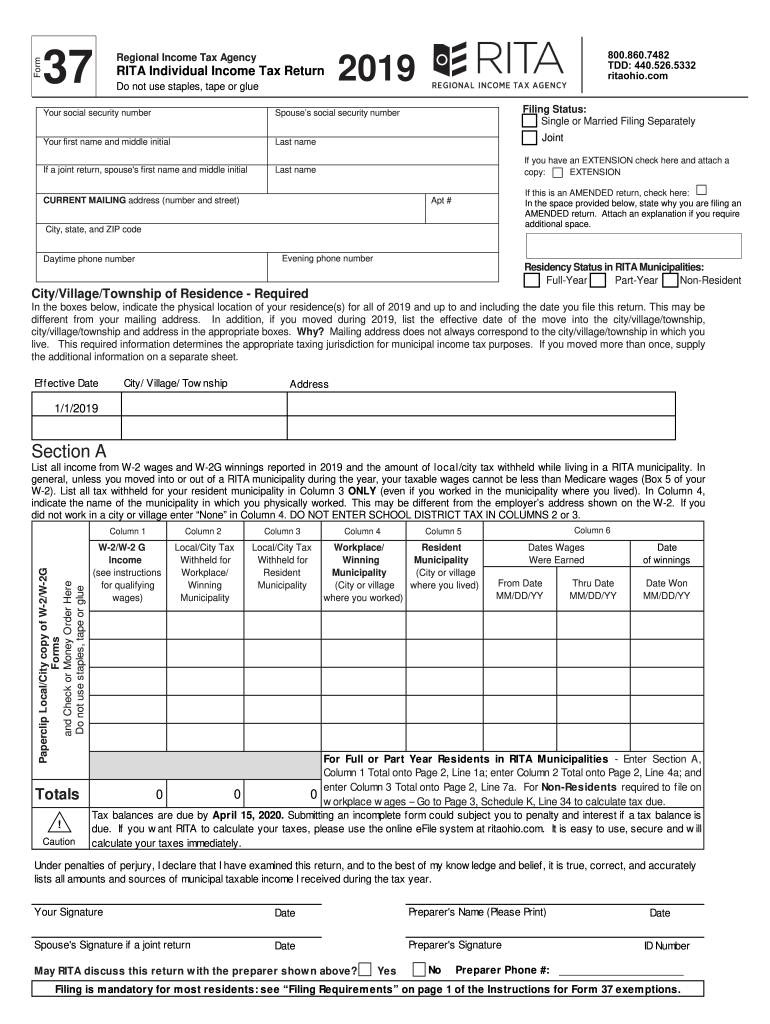

OH RITA 37 2019 free printable template

Get, Create, Make and Sign OH RITA 37

How to edit OH RITA 37 online

Uncompromising security for your PDF editing and eSignature needs

OH RITA 37 Form Versions

How to fill out OH RITA 37

How to fill out OH RITA 37

Who needs OH RITA 37?

Instructions and Help about OH RITA 37

Hey YouTube this is DIY with Donna, and today I'm going to talk about the 1040 EZ tax form as far as the documents that you will need you'll need the 1040 EZ form and the instruction book which has the tax table in it, you can get this at the website iron and the other document you will need is the w-2 form and this will come from your employer this will tell you how much money you made and how much tax has been withheld you may also receive a 1099 int or 1099 div which is the interest that you've made on your bank account or CDs, so these are the three main documents that you will need to fill out the 1040 EZ form as far as who can use the 1040 EZ form you can use it if you're single or married and have no dependents if you've made less than 100000 and your taxable interest is less than 1500 if you're under the age of 65, and you have no claim adjustments then you are eligible to use the EZ form so were going to use Packs scenario he's single age 40 no dependents wants to contribute to the presidential campaign he has no one to claim him as a dependent and his taxable income is 200 here is Pace Tyler's w-2 form on the 1040 EZ form were going to add Packs information in the first lot we put his first name Pace last name Tyler and then a social security number he's not married, so we don't have to fill in this spousal part then you have his home address and city in tan also you select the box that says you because you wanted to participate in the president election so under income we have one wages salaries and tips we get this information from our w-2 form for Pace wages and tips are in box 1 on your w-2 form and its 48500 so well add that here remember you're going to have to send your w-2 form in with your 1040 EZ form second line taxable interests we know that that was 200 from Packs scenario you will probably receive a 1099 int which would provide this information if not it's the interest you make on your bank accounts like your savings account or your CDs we know that Pace was employed so line 3 is not applicable unemployment compensation, and he doesn't live in at last in Alaska so now were going to add forces add lines 1 2 & 3, so our total is going to be forty-eight thousand seven hundred line five wants to know whether someone can claim you Dachas clay case no one can claim him and he's single so it says if no one can claim you enter ten thousand four hundred if single twenty thousand eight hundred if married filing jointly so were going to enter ten thousand four hundred for Pace the next line says subtract five from four if line five is greater than four which it is not they say then but that's not our case so were going to subtract ten thousand four hundred from forty-eight seven hundred and well get 38 3 so under payments credits and tax were going to determine how much tax you've paid and in Packs case were going to go to his w-2 form and it says he paid under box to six thousand eight hundred and thirty-five dollars so were going...

People Also Ask about

What is form 11 RITA Ohio?

What cities in Ohio have Rita tax?

What are RITA taxes in Ohio?

What is Ohio form 37?

Who pays Rita tax in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find OH RITA 37?

How do I fill out the OH RITA 37 form on my smartphone?

How do I complete OH RITA 37 on an iOS device?

What is OH RITA 37?

Who is required to file OH RITA 37?

How to fill out OH RITA 37?

What is the purpose of OH RITA 37?

What information must be reported on OH RITA 37?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.