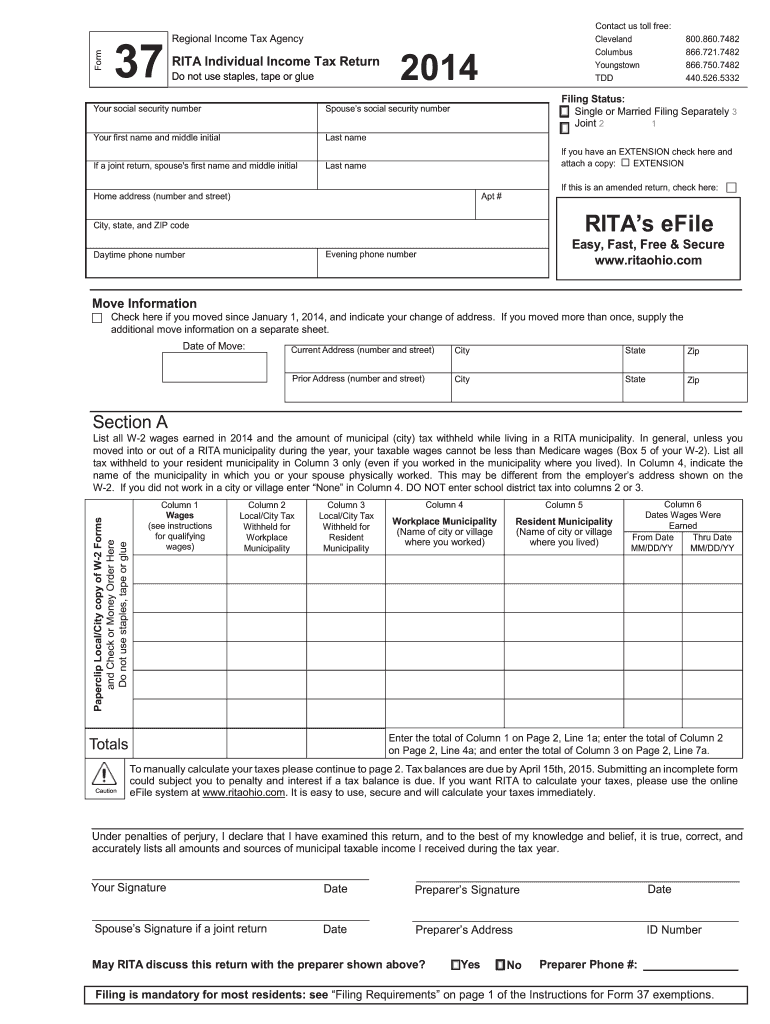

OH RITA 37 2014 free printable template

Get, Create, Make and Sign OH RITA 37

How to edit OH RITA 37 online

Uncompromising security for your PDF editing and eSignature needs

OH RITA 37 Form Versions

How to fill out OH RITA 37

How to fill out OH RITA 37

Who needs OH RITA 37?

Instructions and Help about OH RITA 37

Hello this is Sarah and this is another episode of how to do your own taxes thanks for joining us today we're going to talk about the main form every individual has to file when they do their taxes every year and that form is called the 1040 form 1040 where you find that is the IRS.gov website other places you can find it is you can call the IRS 800 number and tell me which one to send you go to the local post office they do have that form and a few other forms unless they run out they often do you can also go to the local tax office obviously if you have a computer the easiest thing to do is to look at an IRS gov any of the tax forms that the IRS wants you to fill out you can put the form number and the form whatever description is right in here in the search box, and you will find it like that we're going to go find 1040 form right here now when you do your taxes, and it's all done you can come back to the same page and click right here click on your refund you can also click over here about your refund you can click here about free filing now the way it is with free filing this is the first year that the IRS has kind of gone together with a quite a number of tax companies Camp;R Block a number of other online companies the IRS is giving them money for doing your basic tax form and the basic one is this 1040 form but keep in mind that when you do that if you have extra forms you may be charged more for extra forms so don't assume that all your whole taxes filing your taxes is going to be totally free it may not be, and you don't even qualify for the free filing if you make over fifty-eight thousand dollars so just keep that in mind here we go to this to the form right now you'll see right here the first thing you do is your name and address social security number as always the good thing to do is to just plain print out this form the reason why I do this is I can make notes in the side I do a rough draft of it first, and so I go down all kind of fill it all in loosely and then see what I need to find if I have forgotten something, or I need more information than I've sort of loosely filled in the filing status of course is single or married or filing jointly exemptions is yourself and your spouse and your children's names or anybody who is dependent on you the first big category here is of course your income is any place that you get money from now if you get any kind of form from any source that says this is income it needs to show up on right here because what the IRS does is they take the forms like them the w-2 form you put the number of the amount of money over there or if you got a 1099 form they take those numbers, and they add them all together I mean they kind of coordinate if somebody said you make some money in you didn't report it then not a good thing they're going to now audit you which is not a good idea you don't want that taxable interest that of course comes from places like banks or some places here's a little thing you need...

People Also Ask about

What are RITA taxes in Ohio?

What is RITA relocation income tax allowance?

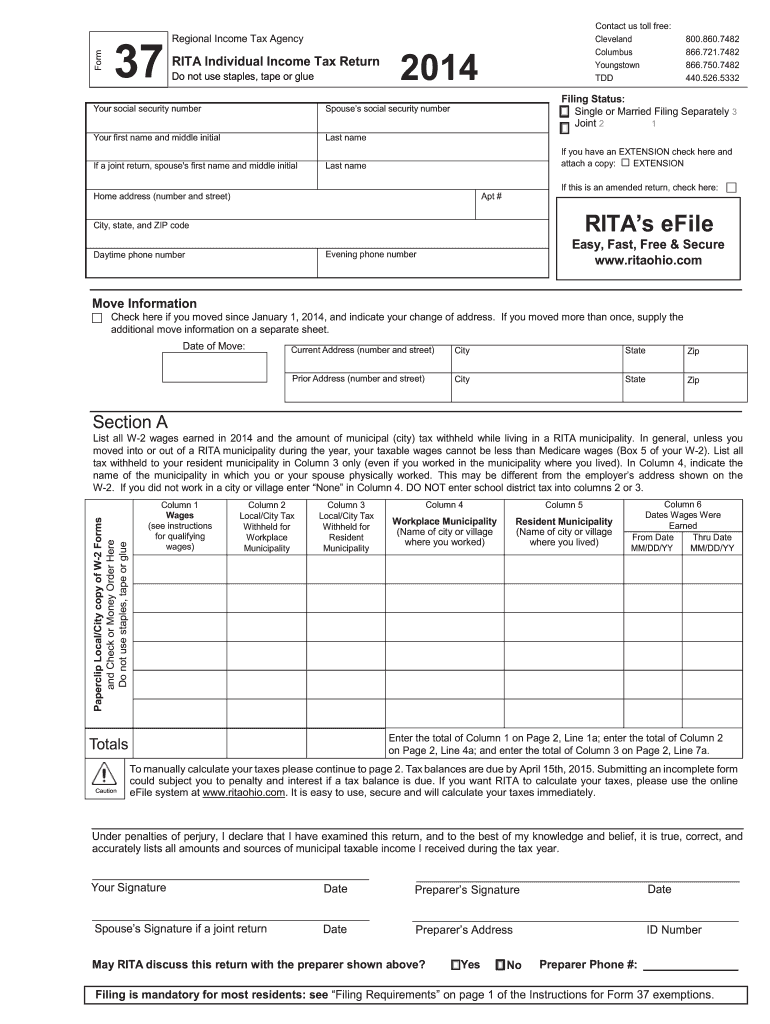

What is Ohio Form 37?

Do I have to pay Rita tax in Ohio?

What is a form 37 on Ohio tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the OH RITA 37 in Chrome?

Can I create an eSignature for the OH RITA 37 in Gmail?

Can I edit OH RITA 37 on an Android device?

What is OH RITA 37?

Who is required to file OH RITA 37?

How to fill out OH RITA 37?

What is the purpose of OH RITA 37?

What information must be reported on OH RITA 37?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.