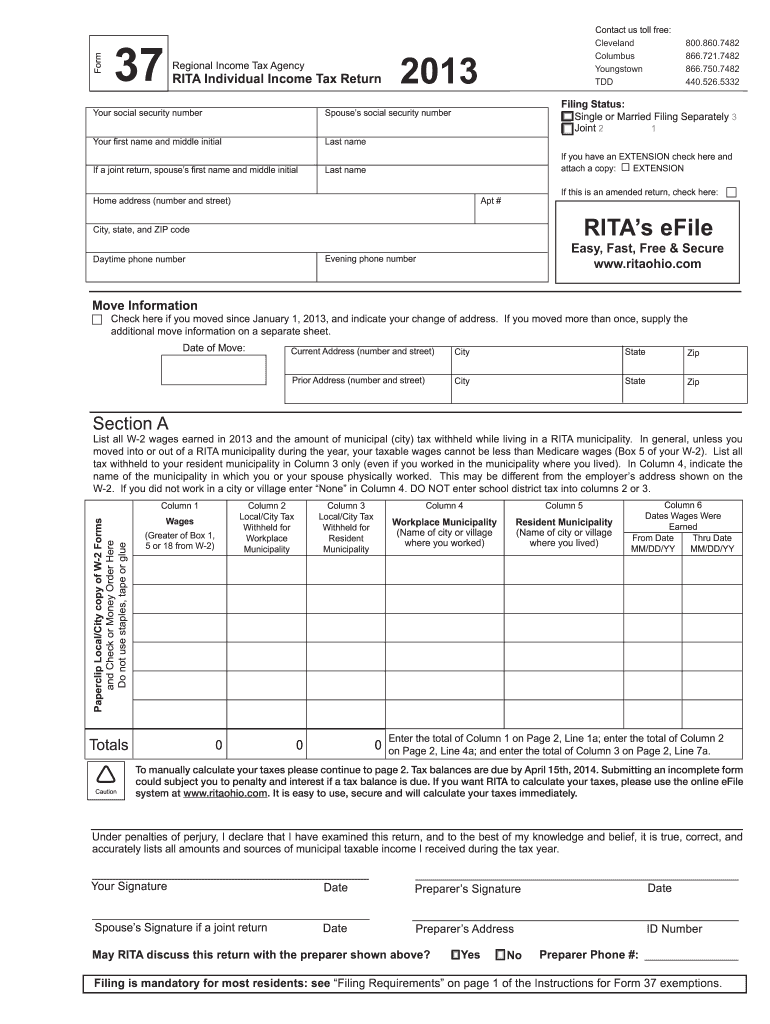

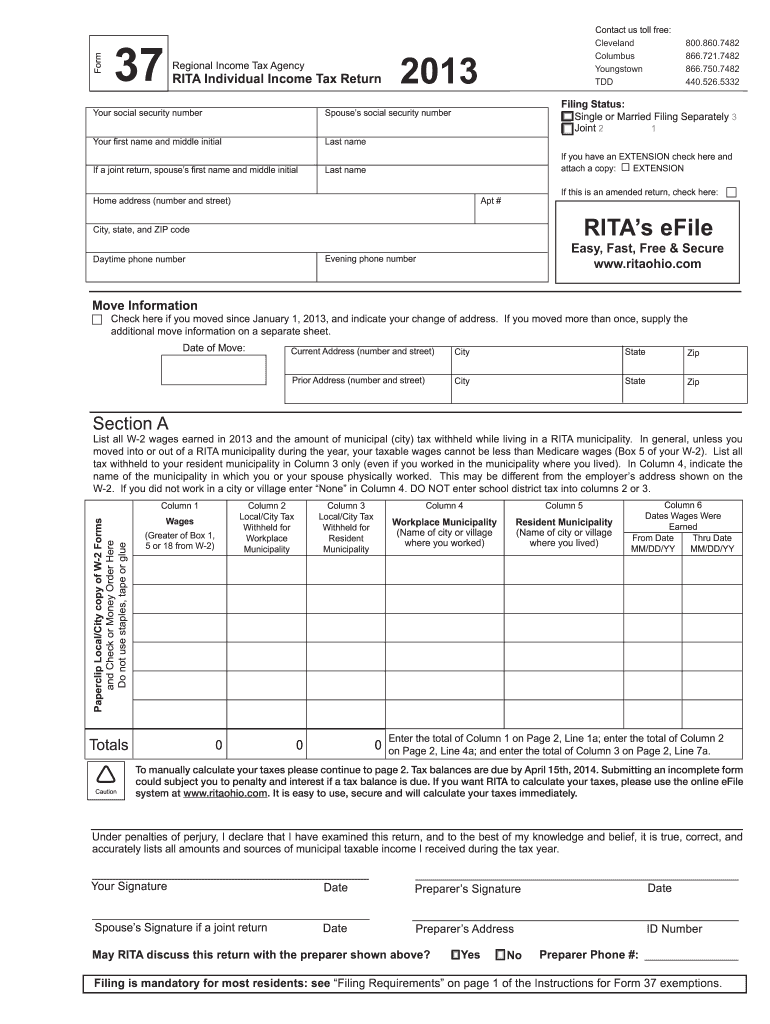

OH RITA 37 2013 free printable template

Get, Create, Make and Sign OH RITA 37

How to edit OH RITA 37 online

Uncompromising security for your PDF editing and eSignature needs

OH RITA 37 Form Versions

How to fill out OH RITA 37

How to fill out OH RITA 37

Who needs OH RITA 37?

Instructions and Help about OH RITA 37

Hello guys welcome once again in the last video I have shown you how can you retrieve image from database and in this video I will be talking about how to create a PDF file so in my video number 26 if you are following my previous videos I have told you how to open a PDF file so in now to the video number 36 we have learned about PDF that how can we open a PDF file in our c-sharp application, but now I will tell you how can you create a co-op application okay sorry you how can you create a PDF file okay so now for creating a PDF file you will be needing some third party DLL files so for that go to your favorite browser open google.com and in the bar type here I text sharp and the very first link that is Sourceforge.net flash projects if you remember that while creating SQLite video or working with SQLite I have also used forge dot Sourceforge.net projects' website, and I have used some files of hold from there, so same like that in order to create PDF file I will be using the library the PDF library from Sourceforge.net, and then you will open that you will have an option to download I text shark a botnet PDF library, so you just need to download hit download, and then it will ask you whether you want to download or not or your download will be started shortly okay, so you will wait and there you go this is 6.91 MBS file, so you need to start downloading and in a while your file will be downloaded so until the file downloads okay, so we do one thing that we go to our solution Explorer and here we select the name of our project that is first seen our program will right-click on that, and we will go here open folder in File Explorer because we are going to copy or some DLL files in our File Explorer where our project is located so here you can see that our project Explorer file is open and here our project resides, so now I will see if my download has been completed or not, so I will wait, so now you can see the download is almost complete okay so when this download will get completed you will have a zip file so when you will open that ok so there you have a text shop so when you will open that you will have these kinds of files right here ok, so these are those files, so you need to extract a few of them not all of them so for that I will go to my this is my solution Explorer of my project I will go to this first file that is I text shop DLL core dot fit so double-click on that, and I have two files over here, so I will copy both of them and I will drag them to my solution Explorer and you can see that it has been added to my solution Explorer, so now I need to go to the next one I don't need that because this is for drying purposes and the next file that I actually need is this one I texture DLL PDF a got sit, so I will click on that, and you can see I have one file inside that, so I will extract or drag it right here, and you can see that it has been added so now the next file that I need is this one I took shop DLL extra dot zip ok, so I will...

People Also Ask about

Do I have to pay Rita tax in Ohio?

What is Form 37 Ohio?

What is Form 11 RITA Ohio?

What is a Form 37 on Ohio tax return?

What is the minimum income to file taxes in 2013?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OH RITA 37 from Google Drive?

Can I create an electronic signature for the OH RITA 37 in Chrome?

Can I edit OH RITA 37 on an Android device?

What is OH RITA 37?

Who is required to file OH RITA 37?

How to fill out OH RITA 37?

What is the purpose of OH RITA 37?

What information must be reported on OH RITA 37?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.