Who needs an SSA-795 form?

If you claim supplemental security income (SSI) benefits, you have to fill out the Application for Supplemental Security Income form that suits your case. While completing the form you (or the person who completes the form on your behalf) may need additional space for remarks and statements. In this case, you have to use the SSA-796 form — Statement of a Claimant or Other Person.

Why should I use the SSA-795?

This form is used whenever there is a need to provide a signed statement. The claimant or other person may need to make a statement on the following occasions: on legal and equitable adoption, about divorce and termination of prior marriage, if there is a conflict in the evidence, etc. The form will help the Social Security Administration make the right decision on the individual’s case.

Is the SSA-795 accompanied by other forms?

The statement is always accompanied by other forms, as it serves as just a part (evidence) of the certain claim or application.

Does the SSA-795 have a validity period?

The statement is valid only with the form it supports.

What information should be provided in the SSA-795 form?

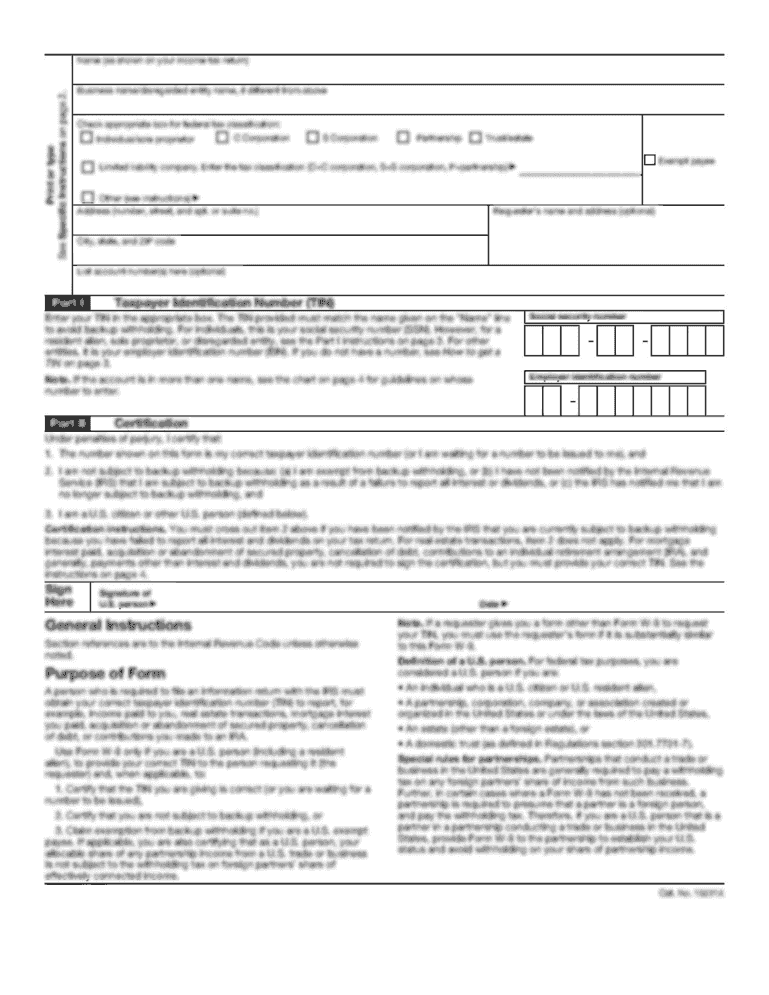

The filler must type the name of the wage earner, self-employed person or claimant, and his/her Social Security Number. If the claimant and person who is making the statement are different people, the filler adds his/her personal information as well. Then there is a space for the statement text.

The person who is making the statement must sign and date the form and add the appropriate phone number and mailing address. If a witness is required, he should also sign the form and type his addresses.

Where do I send the SSA-795 form?

The statement is forwarded to the local Social Security Office