AZ AZ-140V 2019 free printable template

Show details

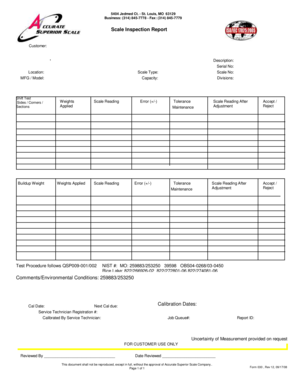

AZ140V Your First Name and Middle Initially Espouses First Name and Middle Initially Carpenter your SSN(s).1 1 Current Home Address number and street, rural route. No. State ZIP Code32019 Your Social

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

How to fill out AZ AZ-140V

Instructions and Help about AZ AZ-140V

How to edit AZ AZ-140V

To edit the AZ AZ-140V form, you can utilize a PDF editing tool like pdfFiller. This platform allows you to make necessary modifications easily. Follow these steps:

01

Upload the AZ AZ-140V form to pdfFiller.

02

Select the text or areas you wish to edit.

03

Make the desired changes or updates.

04

Save the edited version for future use or submission.

This method is especially useful if you need to correct any errors before filing the form.

How to fill out AZ AZ-140V

Filling out the AZ AZ-140V form requires attention to detail and accuracy. Here’s a step-by-step guide:

01

Obtain a blank AZ AZ-140V form, ideally from a reliable source like the official state website.

02

Review the specific instructions provided with the form.

03

Complete each section carefully, ensuring that all necessary information is included.

04

Double-check your entries for accuracy, particularly your identification details and amounts.

05

Sign and date the form before submission.

About AZ AZ-140V 2019 previous version

What is AZ AZ-140V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ AZ-140V 2019 previous version

What is AZ AZ-140V?

AZ AZ-140V is a specific tax form used by Arizona taxpayers for reporting certain tax-related information. It plays a crucial role in the overall state tax compliance ecosystem.

What is the purpose of this form?

The primary purpose of the AZ AZ-140V form is to document tax information accurately. It is typically used to report payments and other related transactions required by Arizona tax laws.

Who needs the form?

Arizona taxpayers, specifically those who are obligated to report specific payments or transactions, need to fill out the AZ AZ-140V form. This can include businesses or individuals who have made certain qualifying purchases or received specific types of payments.

When am I exempt from filling out this form?

You are exempt from filling out the AZ AZ-140V form if your financial transactions do not meet the thresholds defined by Arizona tax regulations. Additionally, certain small businesses or individuals with minimal transactions may not be required to submit this form.

Components of the form

The AZ AZ-140V form consists of various sections designed to capture vital information related to tax reporting. These sections typically include identification details, transaction specifics, and any relevant financial amounts.

What are the penalties for not issuing the form?

Failure to issue the AZ AZ-140V form when required may result in penalties imposed by the Arizona Department of Revenue. These penalties can include fines and interest on unpaid tax amounts.

What information do you need when you file the form?

When filing the AZ AZ-140V form, you need the following information:

01

Your Tax Identification Number (TIN).

02

Details of the payments or transactions to report.

03

Accurate totals for any reported amounts.

Having this information ready will streamline the filing process and help ensure accuracy.

Is the form accompanied by other forms?

In certain instances, the AZ AZ-140V form may need to be accompanied by additional forms or documentation depending on the nature of the transaction being reported. Always check the latest filing guidelines to ensure compliance.

Where do I send the form?

The completed AZ AZ-140V form should be sent to the Arizona Department of Revenue. Ensure that you use the correct mailing address, which you can typically find on the state tax department's official website.

See what our users say