US-02105BG free printable template

Show details

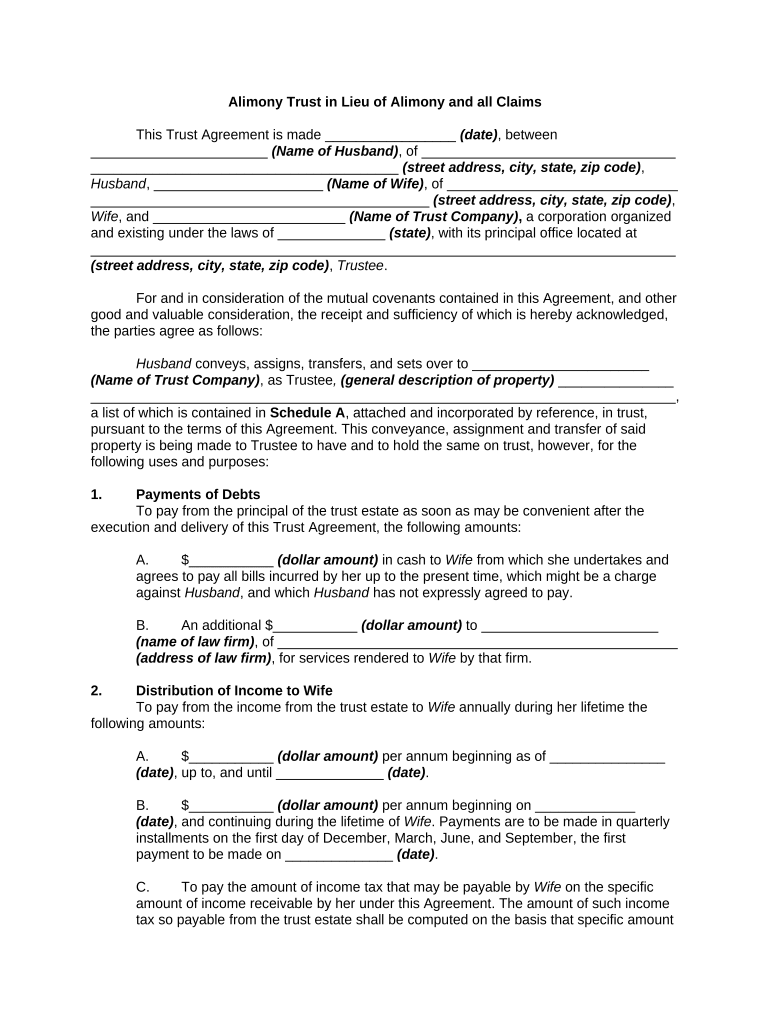

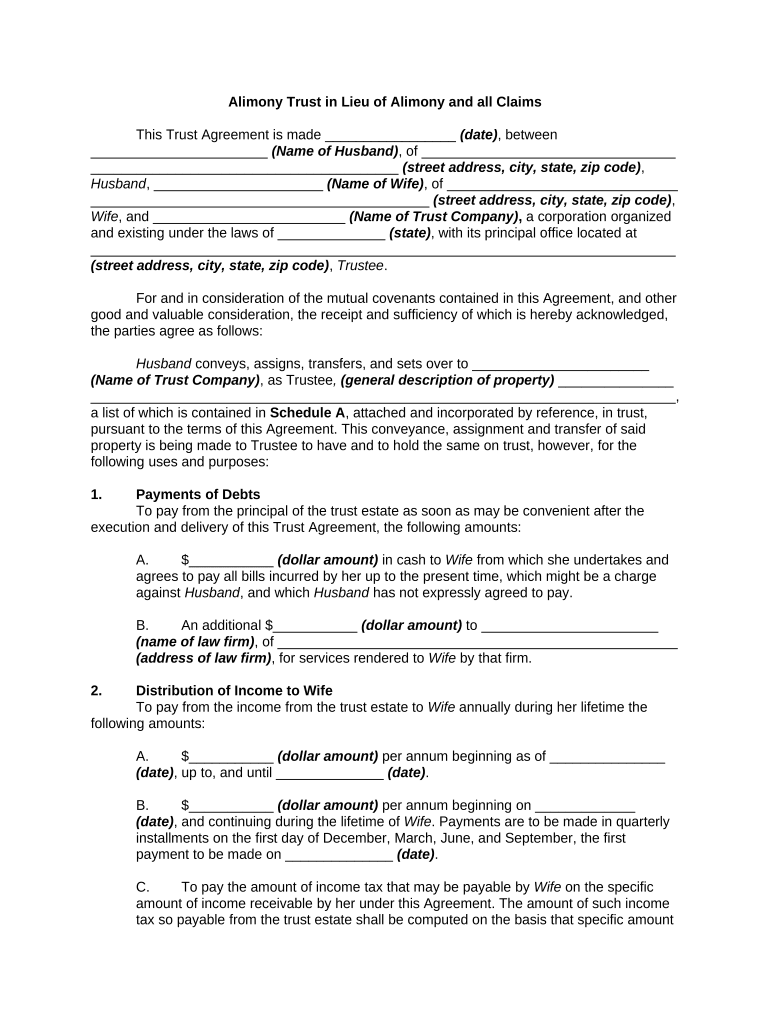

Alimony Trust in Lieu of Alimony and all Claims This Trust Agreement is made date between Name of Husband of Husband Name of Wife of Wife and Name of Trust Company a corporation organized and existing under the laws of state with its principal office located at street address city state zip code Trustee. Provisions in Lieu of Alimony and Claims It is agreed between the parties and more especially by Wife that the provisions made for her are in lieu of and in full settlement of alimony and of any...and all dower rights or statutory interests in the estate of Husband and in lieu of any and all claims for separate maintenance and allowance for her support. For and in consideration of the mutual covenants contained in this Agreement and other good and valuable consideration the receipt and sufficiency of which is hereby acknowledged the parties agree as follows Husband conveys assigns transfers and sets over to Name of Trust Company as Trustee general description of property a list of which...is contained in Schedule A attached and incorporated by reference in trust pursuant to the terms of this Agreement. This conveyance assignment and transfer of said property is being made to Trustee to have and to hold the same on trust however for the following uses and purposes Payments of Debts To pay from the principal of the trust estate as soon as may be convenient after the execution and delivery of this Trust Agreement the following amounts A. dollar amount in cash to Wife from which she...undertakes and agrees to pay all bills incurred by her up to the present time which might be a charge against Husband and which Husband has not expressly agreed to pay. B. An additional dollar amount to name of law firm of address of law firm for services rendered to Wife by that firm* Distribution of Income to Wife following amounts date up to and until date. date and continuing during the lifetime of Wife. Payments are to be made in quarterly installments on the first day of December March...June and September the first payment to be made on date. C. To pay the amount of income tax that may be payable by Wife on the specific amount of income receivable by her under this Agreement. The amount of such income tax so payable from the trust estate shall be computed on the basis that specific amount of income received by Wife from the trust estate is her total income. Investments Deficiency or Excess of Income Trustee shall have the right and is authorized to collect the interest and...principal from all assets and investments in the trust fund and reinvest the same as allowed by In case the net income from the trust fund is not sufficient at any time to pay the future payments above provided to be made to Wife at the time the same are due then Trustee shall request such deficiency to be made good by Husband. If Husband shall fail to make good the deficiency before the installment which becomes due next after the date of the notice is payable then Trustee shall make up the...deficiency from the principal of the trust fund.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

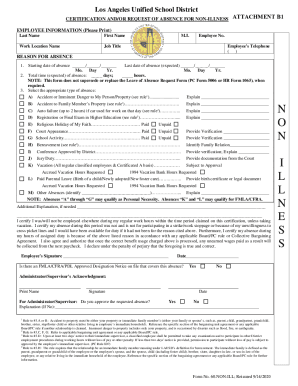

What is US-02105BG

The US-02105BG is a federal document used for reporting financial information related to grant funding.

pdfFiller scores top ratings on review platforms

Easy to use, allowed me to complete important documents safely

Simple and easy to use! As someone who is self-employed this keeps my overhead down. :) Thank you so much.

Who needs US-02105BG?

Explore how professionals across industries use pdfFiller.

How to fill out the US-02105BG

-

1.Download the US-02105BG form from the official website or access it through pdfFiller.

-

2.Open the form in pdfFiller and familiarize yourself with all sections.

-

3.Start by entering your organization’s name at the top of the form.

-

4.Fill in the grant number associated with the funding.

-

5.Provide necessary contact information, including email and phone number.

-

6.Complete the financial reporting sections by inputting accurate figures for income and expenditures.

-

7.Make sure to categorize each entry correctly, following the guidelines provided.

-

8.Review your entries for accuracy and completeness before submission.

-

9.Once the form is filled out, save your changes and download a copy for your records.

-

10.Finally, submit the completed form electronically if possible or print and mail it to the appropriate agency.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.