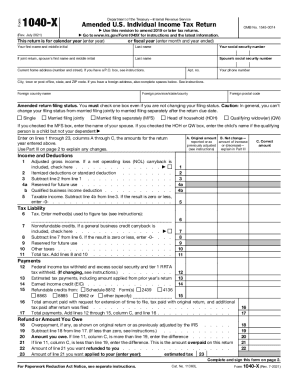

Who Needs Form 1040X Instructions?

The Internal Revenue Service prepared Instructions for Form 1040X to help taxpayers figure out how to properly make amendments to an already submitted Form 1040,1040A or 1040EZ.

What Kind of Information does the Instruction Provide?

The IRS Instructions cover all the basic details and provisions that the filer must pay due attention to and follow in order to avoid paying fines and high interest: the applicable cases of form 1040x, the due dates for submission, description of the possible fine and a line-by-line guide of how to complete the amended return.

When are the Form 1040X Instructions Due?

The Internal Revenue Service typically issues a revised instruction for every tax form that must be filed on an annual basis. The latest updated Form 1040X Instruction is dated January 2016.

Do I Need to File the Instruction?

No, there is no need to write anything on the instruction and to file it, as it is supposed to be used only for reference.