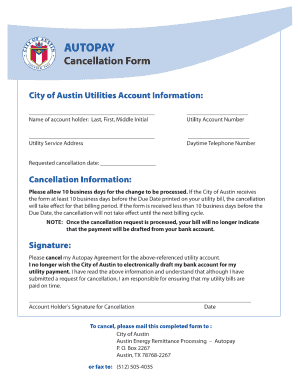

ET-2700 2019 free printable template

Show details

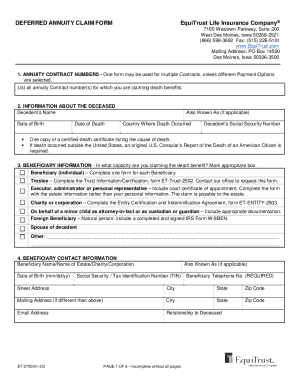

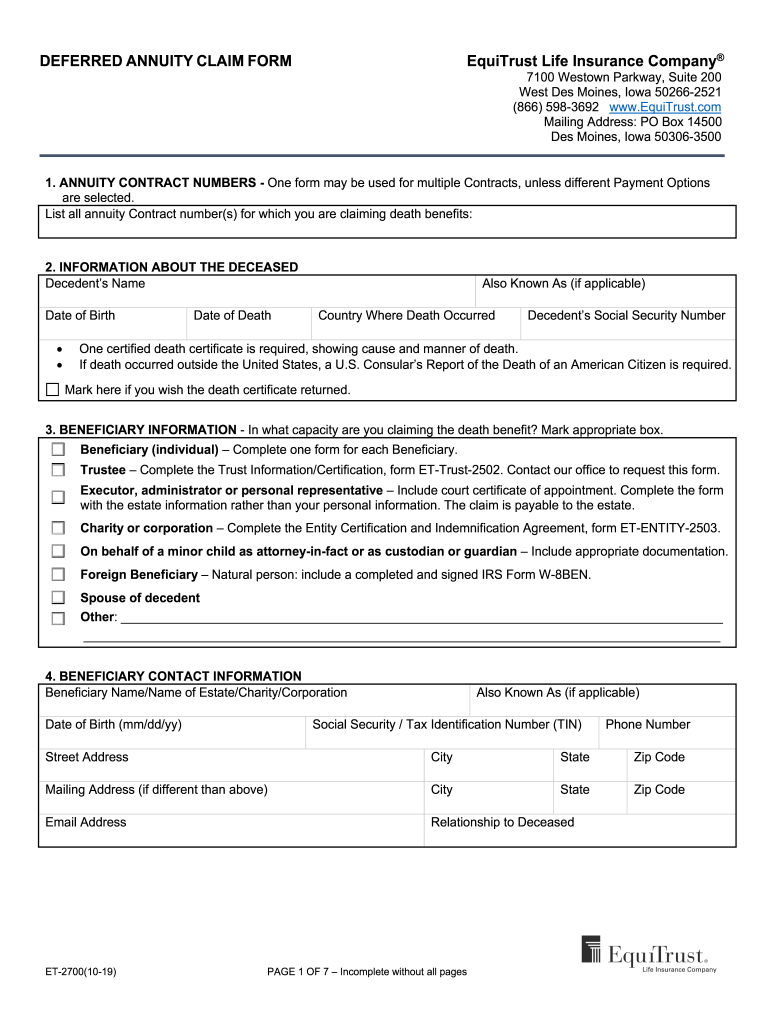

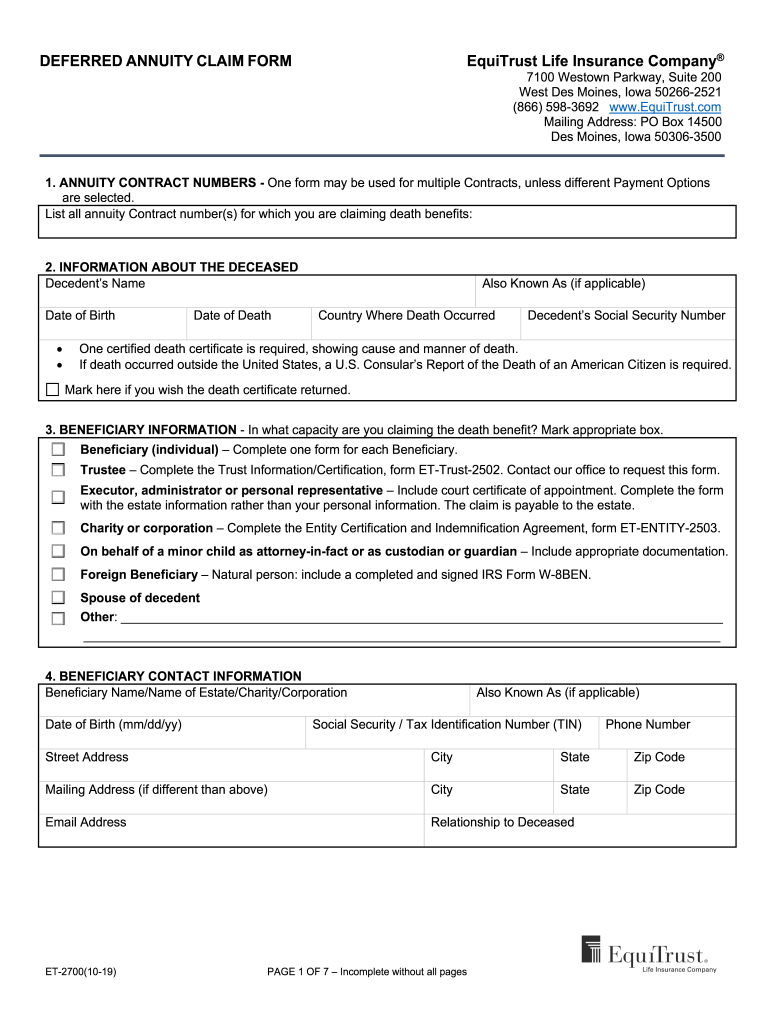

Antitrust Life Insurance CompanyDEFERRED ANNUITY CLAIM FORM7100 Weston Parkway, Suite 200 West Des Moines, Iowa 502662521 (866) 5983692 www.EquiTrust.com Mailing Address: PO Box 14500 Des Moines,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ET-2700

Edit your ET-2700 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ET-2700 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ET-2700 online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ET-2700. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ET-2700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ET-2700

How to fill out ET-2700

01

Gather necessary documentation: Collect all relevant information about the estate property.

02

Access the ET-2700 form: Obtain the ET-2700 form either online or from a relevant office.

03

Fill in personal information: Provide your name, address, and contact details in the required sections.

04

Enter estate details: Include information about the estate, such as its location and assessment data.

05

Specify the reason for filing: Clearly indicate the reason you are submitting the ET-2700 form.

06

Review for accuracy: Double-check all filled information to ensure there are no errors.

07

Submit the form: Send the completed ET-2700 form to the appropriate authority or office as instructed.

Who needs ET-2700?

01

Individuals who are responsible for settling an estate and need to address estate tax obligations.

02

Executors or administrators of estates who are required to file estate tax returns.

03

Beneficiaries who need to understand the tax implications of the inherited property.

Fill

form

: Try Risk Free

People Also Ask about

What are the main types of dividend policies?

There are three types of dividend policies—a stable dividend policy, a constant dividend policy, and a residual dividend policy.

What are the three types of dividend policy?

Types of Dividend Policy Residual Dividend Policy: In this type of dividend distribution, the company pays dividends based on the number of leftover earnings. Regular Dividend Policy: In this type of dividend policy, profit distribution to the shareholders is made at the usual rate.

What are the 4 types of dividend policy?

There are four types of dividend policy. First is a regular dividend policy, the second is an irregular dividend policy, the third is a stable dividend policy, and lastly no dividend policy.

What is dividend policy form?

A company's dividend policy dictates the amount of dividends paid out by the company to its shareholders and the frequency with which the dividends are paid out.

How do you establish a dividend policy?

Developing a dividend policy requires balancing the interests of shareholders, who want to maximize their investment returns, with those of the company itself, which must remain solvent while also ensuring its future financial success and growth.

What are the 5 factors of dividend policy?

The factors that impact a company's dividend policy are profitability of the company, availability of funds, growth plans, dividend history of the company and dividend trends in the industry.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ET-2700 online?

With pdfFiller, you may easily complete and sign ET-2700 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I complete ET-2700 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your ET-2700, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out ET-2700 on an Android device?

Complete your ET-2700 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is ET-2700?

ET-2700 is a specific type of tax form used for reporting certain tax information in the United States.

Who is required to file ET-2700?

Entities or individuals who meet specific criteria set forth by the tax authorities must file ET-2700.

How to fill out ET-2700?

To fill out ET-2700, complete all required sections accurately, provide the necessary financial information, and follow the instructions provided by the tax authorities.

What is the purpose of ET-2700?

The purpose of ET-2700 is to report specific tax-related information for compliance with tax regulations.

What information must be reported on ET-2700?

The ET-2700 form typically requires information such as income details, deductions, and other relevant tax data as specified by the tax authority.

Fill out your ET-2700 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ET-2700 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.