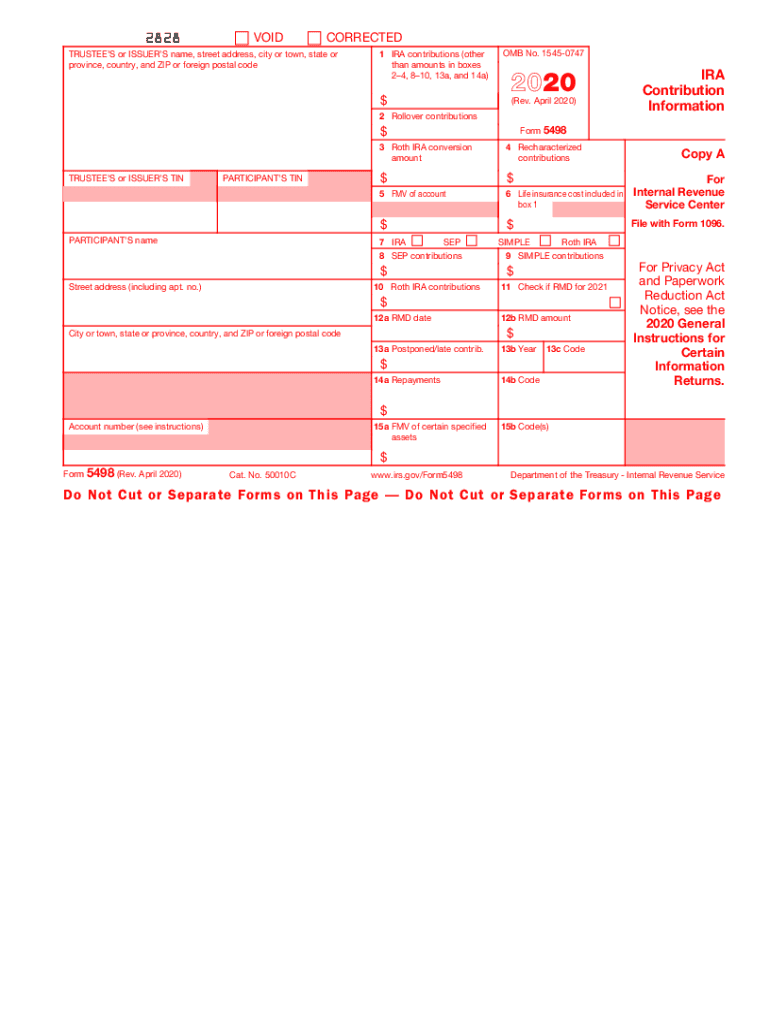

IRS 5498 2020 free printable template

Instructions and Help about IRS 5498

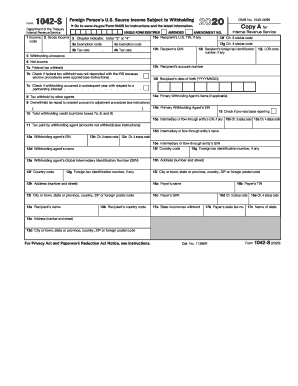

How to edit IRS 5498

How to fill out IRS 5498

About IRS 5 previous version

What is IRS 5498?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 5498

What should I do if I notice an error after submitting my IRS 5498?

If you notice an error on your submitted IRS 5498, you should file a corrected version of the form. Ensure that you indicate it as a correction on the new form, and provide accurate information to rectify the mistake. It's important to maintain clear records of both the original and corrected forms for your records.

How can I verify the status of my IRS 5498 submission?

To verify the status of your IRS 5498, you can contact the IRS directly or use the IRS e-file status tool if you submitted electronically. You may need to provide your identifying information and tax year details to check the processing status of your form.

Are there any privacy or data security concerns with filing the IRS 5498 electronically?

Yes, when filing the IRS 5498 electronically, it's crucial to ensure that you are using a secure network and trusted software. E-signatures are generally accepted, but always follow best practices for data security, including using strong passwords and encryption where necessary to protect sensitive information.

What are some common mistakes that can occur when filing an IRS 5498?

Common mistakes include incorrect taxpayer identification numbers, missing important required fields, and failing to check the form specifics for different account types. To avoid these errors, double-check your entries and consider consulting the IRS guidelines specific to the IRS 5498 for your filing requirements.

What steps should I take if I receive a notice regarding my IRS 5498 from the IRS?

If you receive a notice from the IRS regarding your IRS 5498, first carefully review the notice for details about the issue. Gather any necessary documentation to support your case and respond within the specified period mentioned in the notice. If the issue is complex, you may want to consult a tax professional for guidance.

See what our users say