IRS W-3 2020 free printable template

Show details

Attention:

You may file Forms W2 and W3 electronically on the SSAS Employer

W2 Filing Instructions and Information web page, which is also accessible

at www.socialsecurity.gov/employer. You can create

pdfFiller is not affiliated with IRS

Instructions and Help about IRS W-3

How to edit IRS W-3

How to fill out IRS W-3

Instructions and Help about IRS W-3

How to edit IRS W-3

To edit the IRS W-3 form, you can utilize tools like pdfFiller, which allow you to input necessary information directly into the form. Start by uploading your W-3 to the platform, then select the fields you need to modify, and enter the correct data. After making changes, ensure to review the form for any errors before saving or printing.

How to fill out IRS W-3

Filling out the IRS W-3 form requires filling in accurate data from your W-2 forms. Follow these steps:

01

Gather all W-2 forms for your employees.

02

Transfer total wage and tax information from the W-2s.

03

Complete the identifying information for the employer.

04

Sign the form and provide any additional required documentation.

About IRS W-3 2020 previous version

What is IRS W-3?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS W-3 2020 previous version

What is IRS W-3?

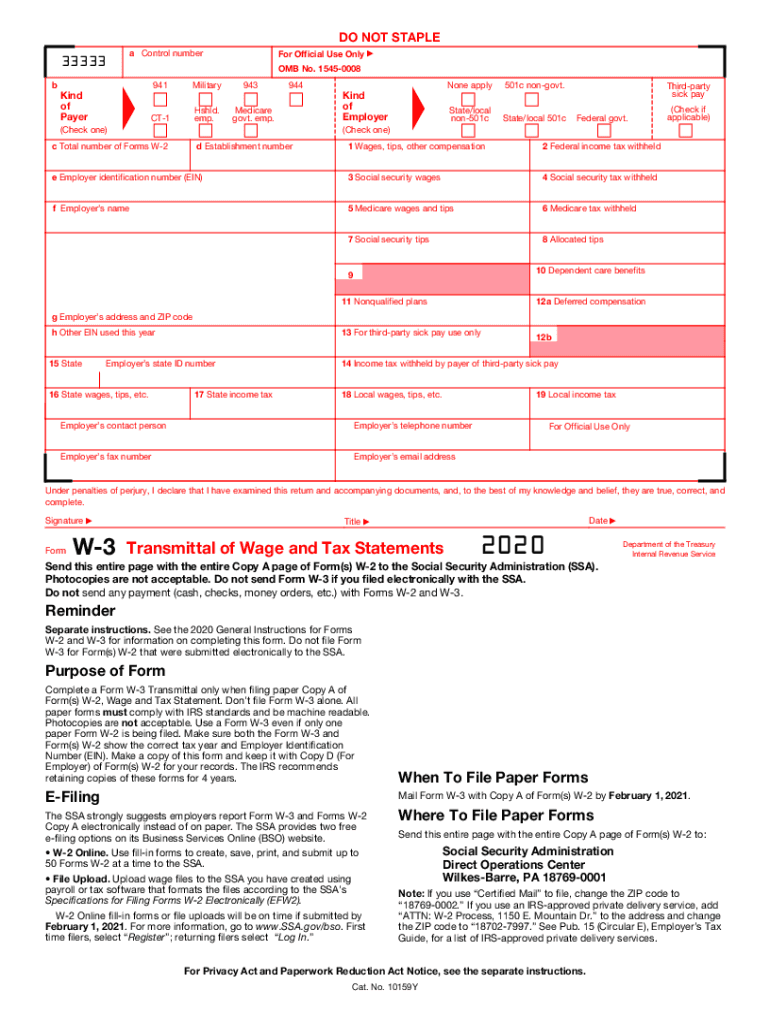

IRS W-3 is the transmittal form used to submit W-2 forms to the Social Security Administration (SSA). It summarizes the total wages, tips, and other compensation paid to employees for the tax year, as well as the total taxes withheld. Employers must file this form as part of the payroll process to ensure compliance with federal tax reporting requirements.

What is the purpose of this form?

The purpose of the IRS W-3 form is to provide the SSA with a summary of the W-2 forms that an employer submits. This helps the SSA maintain accurate records of earnings and contributions to social security and Medicare. Furthermore, it assists the IRS in tracking payroll taxes and ensuring proper employee tax documentation.

Who needs the form?

All employers who pay wages and issue W-2 forms to their employees are required to fill out the IRS W-3 form. This includes businesses, non-profit organizations, and government entities that report employee income and taxes withheld. If your organization has no employees but issues other types of compensation, a different form might be needed.

When am I exempt from filling out this form?

You may be exempt from filing the IRS W-3 if you did not issue any W-2 forms during the tax year. Additionally, certain government entities may have different reporting requirements based on specific instructions. It's vital to review the IRS guidelines or consult a tax professional to determine applicability.

Components of the form

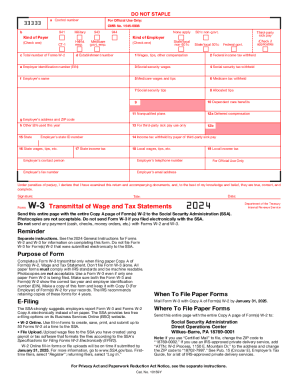

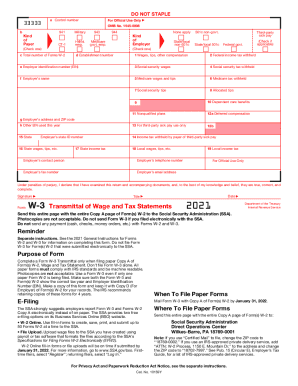

The IRS W-3 form includes several components, such as:

01

Employer's identification information (name and address).

02

Total number of W-2 forms submitted.

03

Total wages, tips, and other compensation.

04

Total federal income tax withheld.

These components ensure that all required information is submitted accurately to support the items reported on the W-2 forms.

Due date

The due date for filing the IRS W-3 form usually coincides with the W-2 forms, which is January 31 of the following tax year. If this date falls on a weekend or holiday, the due date may be adjusted accordingly. Timely filing ensures compliance and avoids penalties.

What are the penalties for not issuing the form?

Failure to issue the IRS W-3 form can result in significant penalties, including fines per form that is late, incorrect, or not filed at all. The IRS can impose penalties that escalate based on how late the form is submitted, emphasizing the importance of adhering to deadlines and ensuring accuracy in reporting.

What information do you need when you file the form?

When filing the IRS W-3 form, you will need:

01

The total number of W-2 forms being submitted.

02

Aggregate wage and tax information from the W-2s.

03

Employer name, address, and Employer Identification Number (EIN).

Having this information on hand is crucial for completing the W-3 accurately and ensuring a smooth filing process.

Is the form accompanied by other forms?

The IRS W-3 form is typically accompanied by the W-2 forms that detail the earnings and withholding for each employee. When submitting these forms to the SSA, they must all be included in one package to ensure accurate processing and record-keeping.

Where do I send the form?

The completed IRS W-3 form must be submitted to the Social Security Administration. Depending on how you file (paper or electronically), there are different submission addresses available. For paper submissions, refer to the instructions provided by the IRS for the correct mailing address based on your state.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Easy! Great product. Main issue is SAFETY. Latest encryption technology is important!

If the seminar was online, I could probably attend. Thanks, Noel

See what our users say