IRS 433-D (SP) 2020 free printable template

Show details

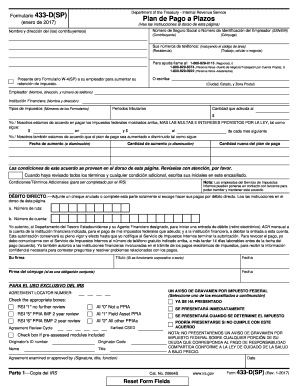

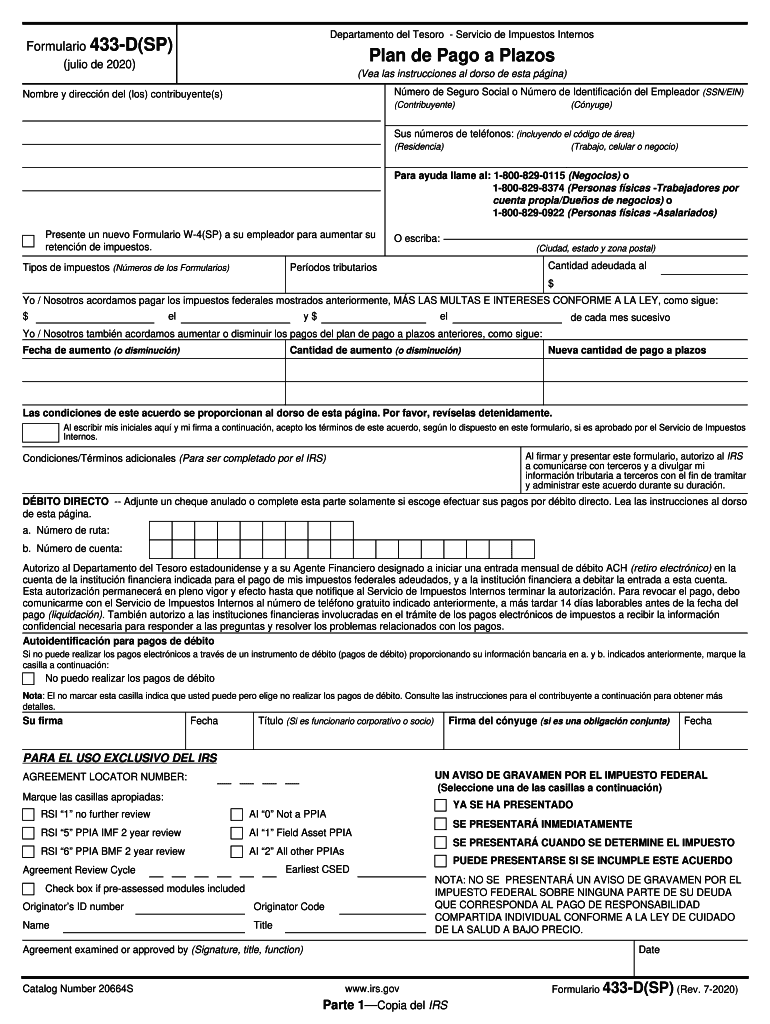

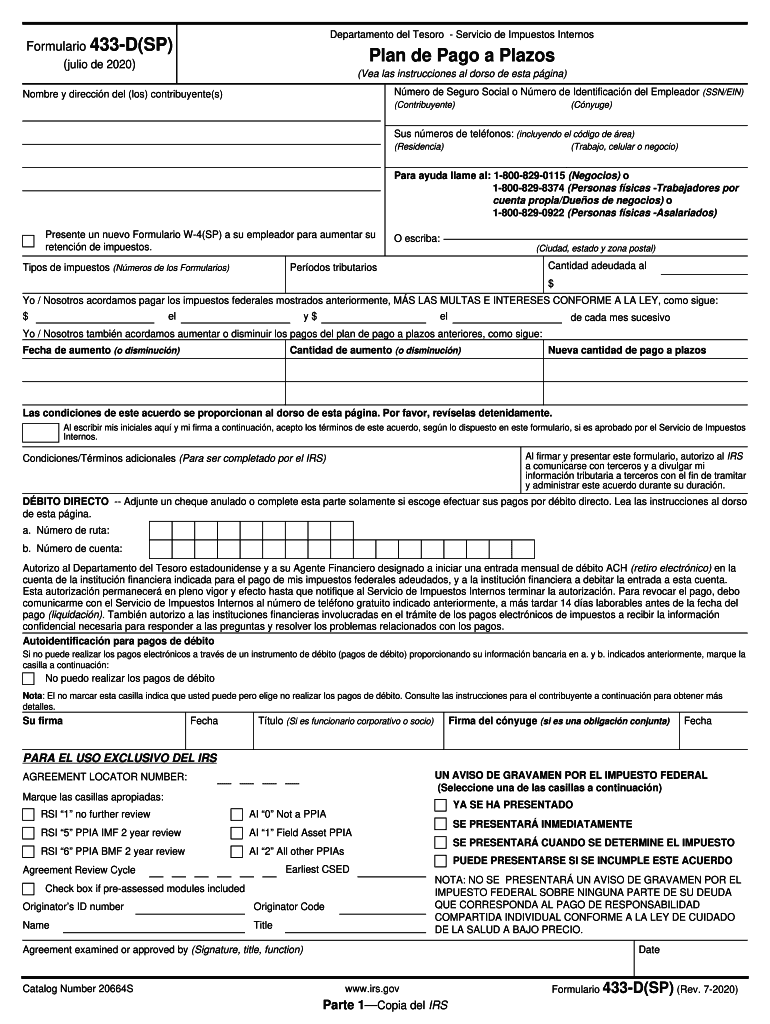

Department Del Resort Service de Impuestos InternosFormulario 433D(SP) (Julio de 2020)Plan de Pago a Plazas (Ve alas instructions all torso de ESTA Gina) Nero de Seguro Social o Nero de Identificacin

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 433-D SP

Edit your IRS 433-D SP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 433-D SP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 433-D SP online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 433-D SP. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 433-D (SP) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 433-D SP

How to fill out IRS 433-D (SP)

01

Obtain IRS Form 433-D (SP) from the IRS website or your local IRS office.

02

Begin completing the form by providing your personal information, including your name, address, and Social Security number.

03

Indicate the type of payment plan you are requesting—this form is typically used for direct debit installment agreements.

04

List all your income sources and monthly expenses in the designated sections to show your financial situation.

05

Provide details about your bank account(s) since direct debit arrangements will be set up to withdraw payments automatically.

06

Review the form for accuracy, making sure all information is complete and correct.

07

Sign and date the form at the end to authenticate your application.

08

Submit the completed form via mail or fax as instructed on the form.

Who needs IRS 433-D (SP)?

01

Individuals or businesses that owe back taxes to the IRS and wish to establish a direct debit installment agreement to pay off their tax debt.

02

Taxpayers who have been offered or selected to set up a payment plan for their overdue tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

Can I fax an installment agreement to the IRS?

Can you fax 9465? Unfortunately, the IRS no longer has a published FAX number for Form 9465 submissions. Your only option is to send your Installment Agreement Request to the relevant address shown under "Where To File" in the Instructions for Form 9465.

Can I fill out form 433-D online?

If you'd prefer to fill out the form online, you can do so directly on the IRS website. First, enter identifying information like your name, address, Social Security number, phone number, employer information, and the kinds of taxes you filed for.

How to fill out form 433-D installment agreement?

0:00 1:22 Next print out the resulting document. Share it with anybody via email fax sms usps or shareable.MoreNext print out the resulting document. Share it with anybody via email fax sms usps or shareable. Link send it out for signature.

How to submit Form 433 F?

How to Submit Form 433-F (Collection Information Statement) Once you complete the financial information statement, sign it and send it to the IRS. If you are applying for a payment plan, also include Form 9465 (Installment Agreement Request) and a copy of your tax return. Don't include any supporting documentation.

Where is my amended Ohio return?

To obtain the refund status of your 2022 tax return, you must enter your social security number, your date of birth, the type of tax and whether it is an amended return. If you do not wish to submit your personal information over the Internet, you may call our automated refund hotline at 1-800-282-1784.

What documents do I need to mail with my tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other tax-deductible expenses if you are itemizing your return.

Can I mail 1040X to IRS?

If you are amending more than one tax return, prepare a Form 1040X for each year's return and mail them to the IRS in separate envelopes. You will find the appropriate IRS address to mail your return to in the Form 1040X instructions.

Where do I mail my 1040x in Ohio?

If you live in Ohio and you are filing a Formand you are not enclosing a payment, then use this address1040-ES(NR)N/A1040-VN/A1040-XDepartment of the Treasury Internal Revenue Service Ogden, UT 84201-00524868Department of the Treasury Internal Revenue Service Ogden, UT 84201-00452 more rows • 13 Dec 2022

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 433-D SP?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific IRS 433-D SP and other forms. Find the template you need and change it using powerful tools.

How do I execute IRS 433-D SP online?

With pdfFiller, you may easily complete and sign IRS 433-D SP online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the IRS 433-D SP form on my smartphone?

Use the pdfFiller mobile app to fill out and sign IRS 433-D SP on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is IRS 433-D (SP)?

IRS 433-D (SP) is a form used by taxpayers to enter into a direct debit installment agreement with the IRS for the payment of tax owed.

Who is required to file IRS 433-D (SP)?

Taxpayers who wish to set up a direct debit payment plan for their tax liabilities or who have been offered this option as part of their tax resolution process are required to file IRS 433-D (SP).

How to fill out IRS 433-D (SP)?

To fill out IRS 433-D (SP), taxpayers must provide their personal information, including name, address, Social Security Number, and details regarding their bank account to facilitate direct debit payments, as well as the amount they owe and the proposed payment terms.

What is the purpose of IRS 433-D (SP)?

The purpose of IRS 433-D (SP) is to formalize a direct debit installment agreement, allowing taxpayers to pay their tax debts over time through automatic deductions from their bank accounts.

What information must be reported on IRS 433-D (SP)?

The information that must be reported on IRS 433-D (SP) includes the taxpayer's name, address, Social Security Number, the type of tax owed, the amount owed, bank account information for direct debit, and the proposed payment terms, including the monthly payment amount and payment frequency.

Fill out your IRS 433-D SP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 433-D SP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.