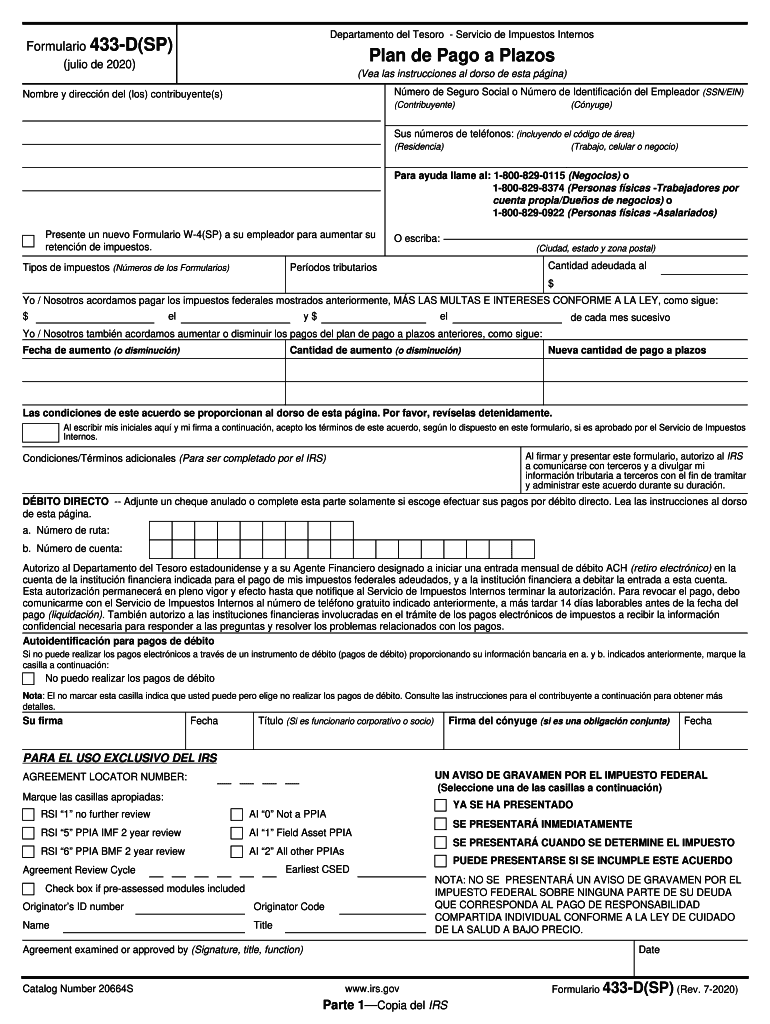

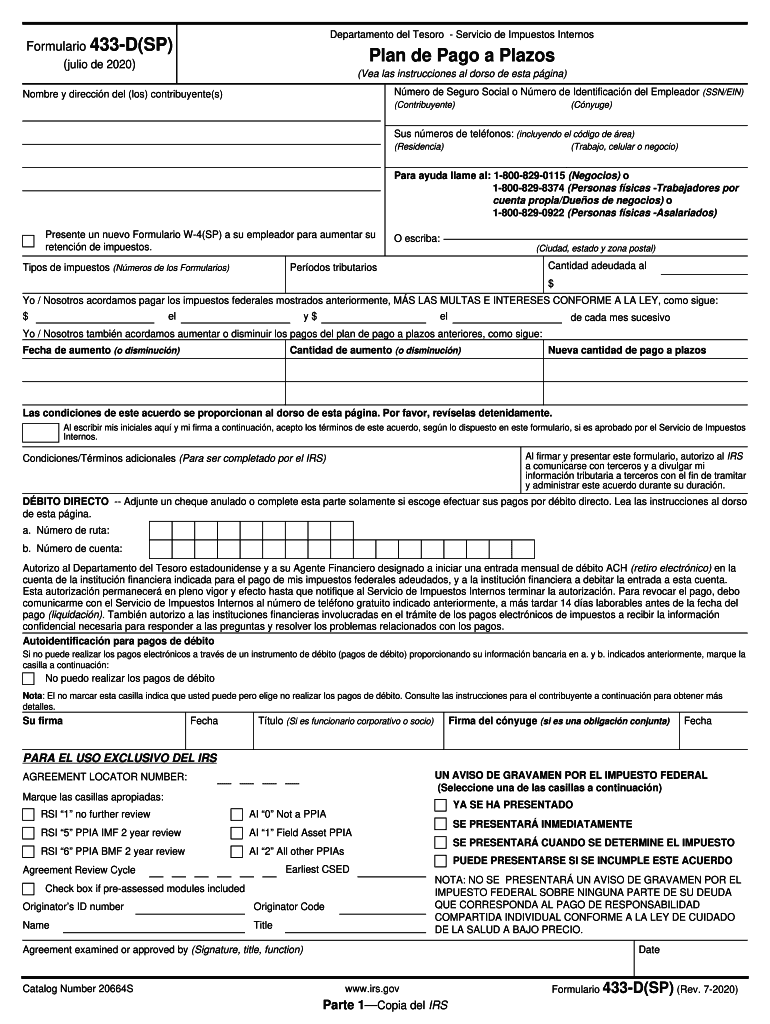

IRS 433-D (SP) 2020 free printable template

Get, Create, Make and Sign IRS 433-D SP

Editing IRS 433-D SP online

Uncompromising security for your PDF editing and eSignature needs

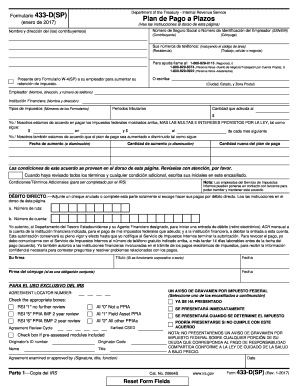

IRS 433-D (SP) Form Versions

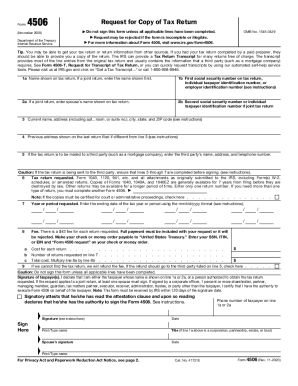

How to fill out IRS 433-D SP

How to fill out IRS 433-D (SP)

Who needs IRS 433-D (SP)?

Instructions and Help about IRS 433-D SP

Hi Amanda Kendall with true result acts professionals today I want to walk you through how to fill out a form for 3 3 d this form is used when you have an installment agreement with the IRS and you want to set that agreement up as a direct debit there are several benefits to setting up a direct debit installment agreement some include a lower setup fee with the IRS second big advantage of a direct debit agreement is that depending on how much you owe and how much you're paying you may qualify to have your lien withdrawn with a direct debit agreement as well, so we're going to walk through how to fill this out, so you can see here right here that I have filled in name and address I'm just using my information on this here over here you're going to fill in your social security number and then here you're going to fill in your phone number if you have a spouse that name would go here right next to your social security number would go there as well this box submitted new w-4 to your employer is only if you need to adjust...

People Also Ask about

Can I fax an installment agreement to the IRS?

Can I fill out form 433-D online?

How to fill out form 433-D installment agreement?

How to submit Form 433 F?

Where is my amended Ohio return?

What documents do I need to mail with my tax return?

Can I mail 1040X to IRS?

Where do I mail my 1040x in Ohio?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find IRS 433-D SP?

How do I execute IRS 433-D SP online?

How do I fill out the IRS 433-D SP form on my smartphone?

What is IRS 433-D (SP)?

Who is required to file IRS 433-D (SP)?

How to fill out IRS 433-D (SP)?

What is the purpose of IRS 433-D (SP)?

What information must be reported on IRS 433-D (SP)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.