IRS 433-D (SP) 2022 free printable template

Show details

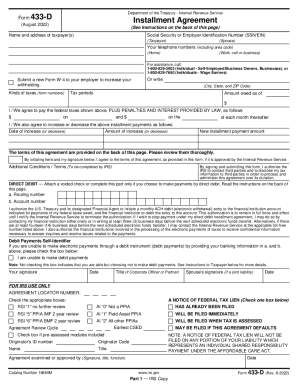

Department of the Treasury Internal Revenue Service433DFormulario (Acosta de 2022)Plan de Pago a Plazas (Ve alas instructions all torso de ESTA Gina) Nero de Seguro Social o Nero de Identificacin

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 433-D SP

Edit your IRS 433-D SP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 433-D SP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 433-D SP online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 433-D SP. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 433-D (SP) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 433-D SP

How to fill out IRS 433-D (SP)

01

Obtain a copy of IRS Form 433-D (SP) from the IRS website.

02

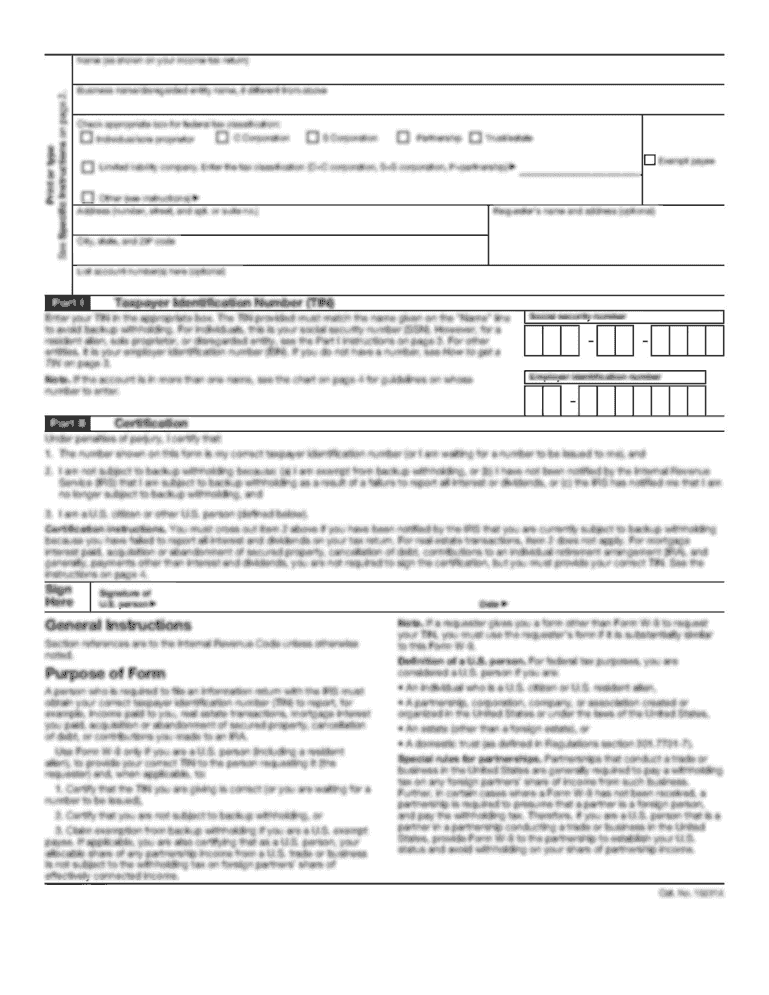

Provide your personal information, including your name, address, and Social Security number.

03

Indicate the type of installment agreement you are requesting.

04

Fill out the financial information section, including income, expenses, and assets.

05

Review the terms of the agreement carefully before signing.

06

Sign and date the form to confirm your acceptance of the payment terms.

07

Submit the completed form to the appropriate IRS address.

Who needs IRS 433-D (SP)?

01

Individuals who owe back taxes to the IRS and want to set up a payment plan.

02

Taxpayers who cannot pay their tax liabilities in full and wish to avoid collections.

03

Those seeking an installment agreement for their federal tax debts.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out form 433-D for the IRS?

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Then click done to save the changes you've made choose what you would like to do with your document.MoreThen click done to save the changes you've made choose what you would like to do with your document. Next print out the resulting document. Share it with anybody via email fax sms usps or shareable.

How to fill out a 433 D form?

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Next print out the resulting document. Share it with anybody via email fax sms usps or shareable.MoreNext print out the resulting document. Share it with anybody via email fax sms usps or shareable. Link send it out for signature.

What is a 433-D form for the IRS?

Form 433-D is a direct debit installment agreement, so it applies to many taxpayers who owe federal income tax and would like to set up a direct debit installment agreement (monthly payments come from a bank account). These taxpayers include: Individual taxpayers and wage earners. Business owners.

Can I fax form 433-D to the IRS?

Where do I fax form 433-D to IRS? Fax: 855-215-1627 (within the U.S.)

Can you submit a 433-D online?

If you'd prefer to fill out the form online, you can do so directly on the IRS website. First, enter identifying information like your name, address, Social Security number, phone number, employer information, and the kinds of taxes you filed for.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 433-D SP to be eSigned by others?

Once your IRS 433-D SP is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in IRS 433-D SP?

With pdfFiller, it's easy to make changes. Open your IRS 433-D SP in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit IRS 433-D SP straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing IRS 433-D SP right away.

What is IRS 433-D (SP)?

IRS 433-D (SP) is a form used by the Internal Revenue Service (IRS) that allows taxpayers to request a direct debit installment agreement (DDIA) for the payment of their tax liabilities.

Who is required to file IRS 433-D (SP)?

Taxpayers who owe tax debts and wish to enter into a direct debit installment agreement with the IRS are required to file IRS 433-D (SP). This includes individuals and businesses who cannot pay their tax debts in full.

How to fill out IRS 433-D (SP)?

To fill out IRS 433-D (SP), taxpayers must provide personal and financial information including their name, address, Social Security number, income details, and the amount they can afford to pay monthly. Detailed instructions are provided on the form itself.

What is the purpose of IRS 433-D (SP)?

The purpose of IRS 433-D (SP) is to formalize an agreement between the taxpayer and the IRS for the installment payment of tax debts via direct debit, helping taxpayers manage their liabilities over time.

What information must be reported on IRS 433-D (SP)?

IRS 433-D (SP) requires taxpayers to report their personal information, income, expenses, assets, and liabilities to establish their financial situation and ability to make monthly payments.

Fill out your IRS 433-D SP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 433-D SP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.