IRS 433-D (SP) 2017 free printable template

Show details

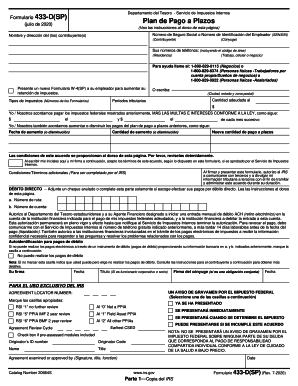

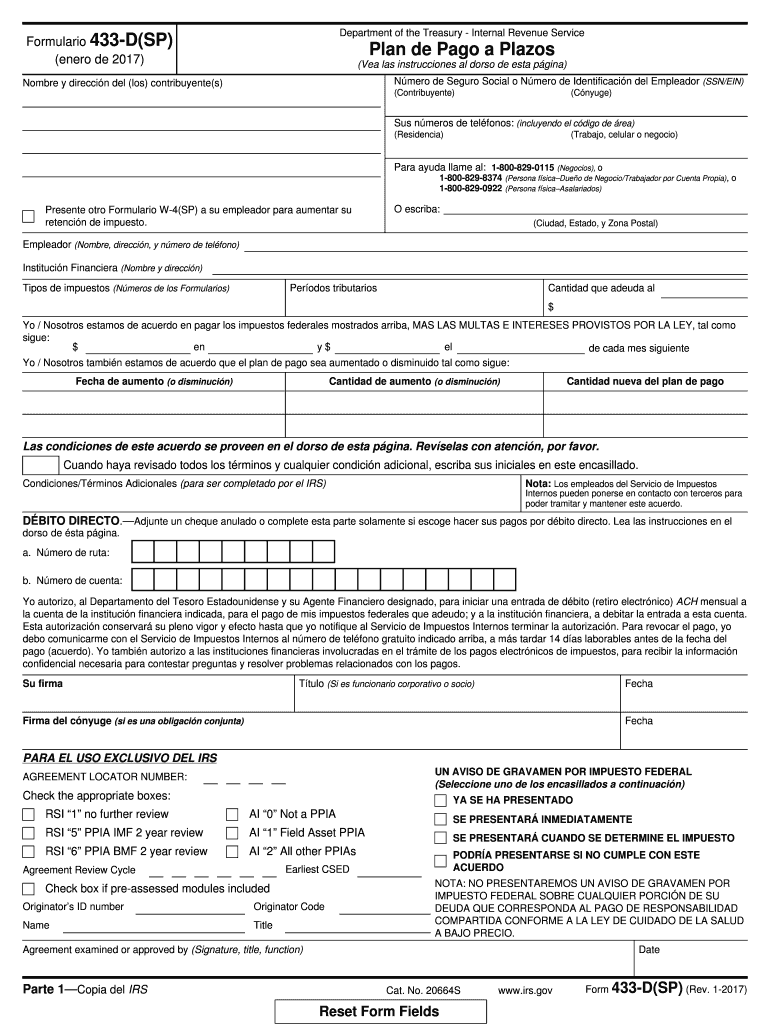

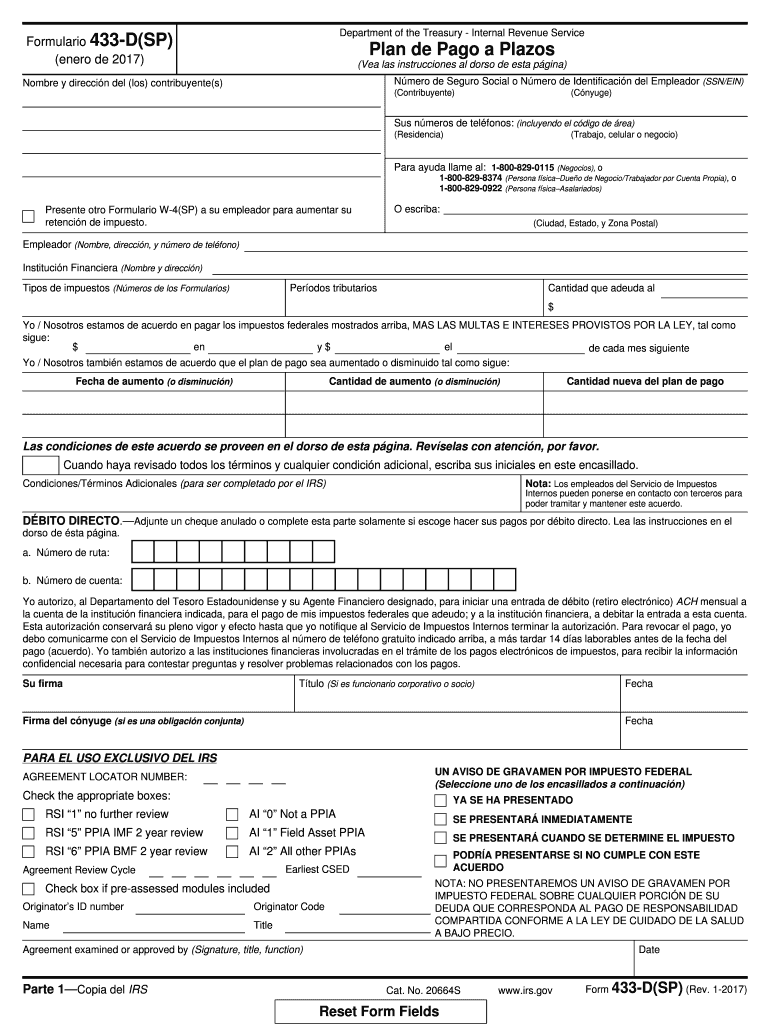

Department of the Treasury - Internal Revenue Service Formulario 433-D SP enero de 2017 Plan de Pago a Plazos Vea las instrucciones al dorso de esta p gina N mero de Seguro Social o N mero de Identificaci n del Empleador SSN/EIN Nombre y direcci n del los contribuyente s Contribuyente C nyuge Sus n meros de tel fonos incluyendo el c digo de rea Residencia Trabajo celular o negocio Para ayuda llame al 1-800-829-0115 Negocios o 1-800-829-8374 Persona f sica Due o de Negocio/Trabajador por...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 433-D SP

Edit your IRS 433-D SP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 433-D SP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 433-D SP online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS 433-D SP. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 433-D (SP) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 433-D SP

How to fill out IRS 433-D (SP)

01

Obtain IRS Form 433-D (SP) from the IRS website or your local IRS office.

02

Enter your personal information, including your name, Social Security number, and address at the top of the form.

03

Provide information regarding your income, including all sources of income such as wages, self-employment income, and any additional income.

04

List your monthly expenses, including housing, utilities, transportation, food, and any other necessary costs.

05

Detail your assets, including bank accounts, real estate, vehicles, and other valuable property.

06

Review the form for accuracy and completeness to ensure all information is correct.

07

Sign and date the form at the bottom to certify that the information you have provided is true and accurate.

Who needs IRS 433-D (SP)?

01

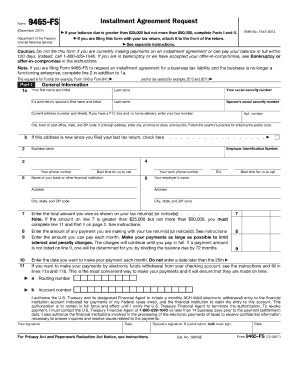

Individuals who are facing tax liabilities and wish to enter into an installment agreement with the IRS require IRS Form 433-D (SP).

02

Taxpayers who have been granted a compromise offer and need to formalize their payment agreement also need this form.

03

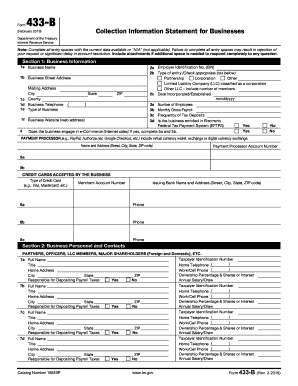

Self-employed individuals or businesses seeking to manage their tax debts may also need to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

How do I submit Form 433-D?

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Share it with anybody via email fax sms usps or shareable. Link send it out for signature.MoreShare it with anybody via email fax sms usps or shareable. Link send it out for signature.

Can I fax form 433-D to the IRS?

Where do I fax form 433-D to IRS? Fax: 855-215-1627 (within the U.S.)

Can form 433-D be faxed?

You can use Form 433-D to set up direct debit payments. When setting up the payment by phone, you can fax the signed and completed Form 433-D to the IRS representative to set up the agreement.

Can you fax documents to the IRS?

Fax: 855-215-1627 (within the U.S.) Fax: 304-707-9471 (outside the U.S.)

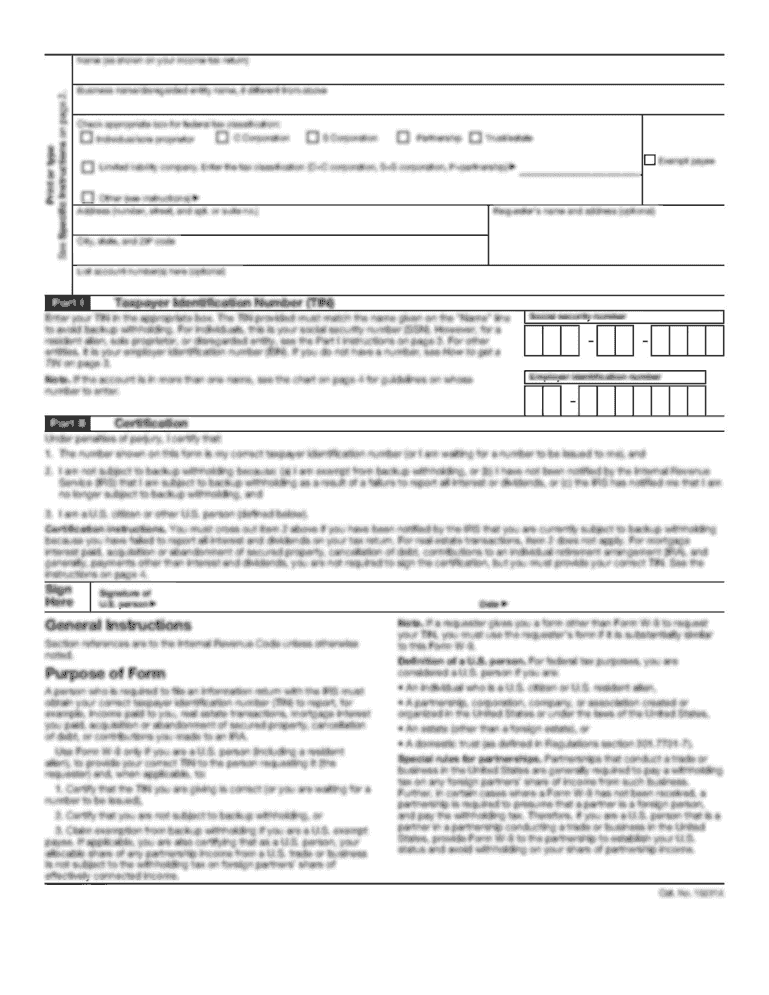

What is the difference between Form 433-D and 9465?

The Form 9465 is used mainly by taxpayers to request and authorize a streamlined installment agreement. The Form 433-D is used to finalize an approved installment agreement and authorize payments by direct debit. The Form 9465 can be filed with a tax return. The Form 433-D cannot.

How to fill out a 433-D?

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Including social security numbers for the taxpayer. And spouse indicate the initial payment amountMoreIncluding social security numbers for the taxpayer. And spouse indicate the initial payment amount you're enclosing with your form 433d followed by the amount you intend to pay per subsequent.

How do I submit form 433-D?

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Share it with anybody via email fax sms usps or shareable. Link send it out for signature.MoreShare it with anybody via email fax sms usps or shareable. Link send it out for signature.

What is direct debit installment agreement?

A payment plan with the IRS where you agree to have your monthly payments automatically withdrawn from your checking account is a direct debit installment agreement (DDIA). A DDIA has several advantages: lower user fees and less chance the agreement will default.

What is a form 433-D used for?

The Form 433-D is used to finalize an approved installment agreement and authorize payments by direct debit. The Form 9465 can be filed with a tax return.

How do I fill out a 433-D installment agreement?

0:00 1:22 How to Fill Out an IRS Form 433 D - YouTube YouTube Start of suggested clip End of suggested clip Including social security numbers for the taxpayer. And spouse indicate the initial payment amountMoreIncluding social security numbers for the taxpayer. And spouse indicate the initial payment amount you're enclosing with your form 433d followed by the amount you intend to pay per subsequent.

What is Form 433 used for?

Who should use Form 433-A? Form 433-A is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability. If you are an individual who is self-employed or has self- employment income.

How do I submit a form to the IRS?

Submit Forms via Fax or Mail If you can't submit your forms online, you can fax or mail your forms directly to the IRS. For information, see Instructions for Form 2848 or Instructions Form 8821.

What is form 433 used for?

Who should use Form 433-A? Form 433-A is used to obtain current financial information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability. If you are an individual who is self-employed or has self- employment income.

What is the fax number to IRS form 433-D?

Where do I fax form 433-D to IRS? Fax: 855-215-1627 (within the U.S.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IRS 433-D SP without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IRS 433-D SP into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I edit IRS 433-D SP on an Android device?

With the pdfFiller Android app, you can edit, sign, and share IRS 433-D SP on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out IRS 433-D SP on an Android device?

Complete IRS 433-D SP and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is IRS 433-D (SP)?

IRS 433-D (SP) is a form used by taxpayers to apply for a direct debit installment agreement with the Internal Revenue Service (IRS). It allows taxpayers to set up a plan for paying off their tax liabilities through automatic payments.

Who is required to file IRS 433-D (SP)?

Taxpayers who have received a tax bill from the IRS and are seeking to establish a direct debit installment agreement to pay off their tax debt are required to file IRS 433-D (SP).

How to fill out IRS 433-D (SP)?

To fill out IRS 433-D (SP), taxpayers must provide personal information such as their name, address, Social Security number, and details about their income and expenses. Additionally, they should specify the amount they wish to pay and the frequency of payments.

What is the purpose of IRS 433-D (SP)?

The purpose of IRS 433-D (SP) is to facilitate the establishment of an installment agreement for taxpayers who cannot pay their tax debt in full. It ensures that payments are made automatically, which helps taxpayers manage their financial obligations more effectively.

What information must be reported on IRS 433-D (SP)?

IRS 433-D (SP) requires taxpayers to report their personal details, income sources, monthly expenses, tax liabilities, proposed payment amounts, and banking information to set up the direct debit arrangement.

Fill out your IRS 433-D SP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 433-D SP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.