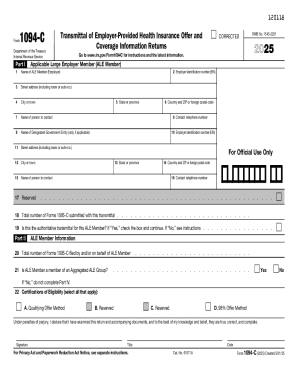

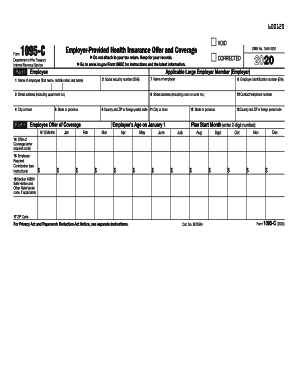

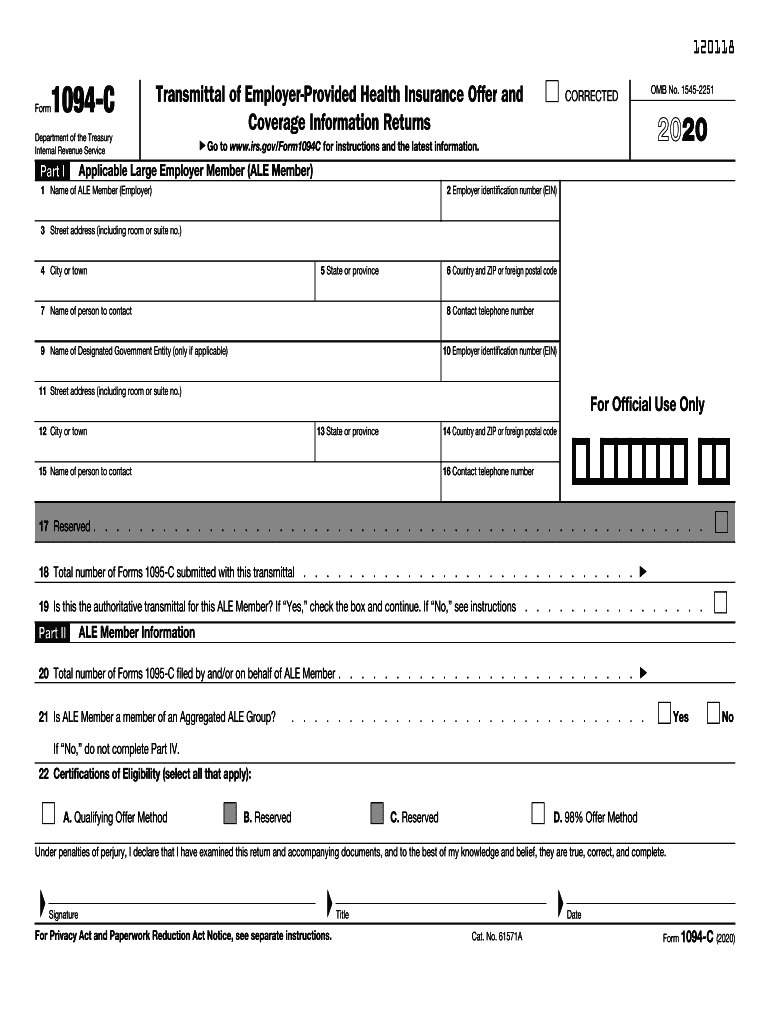

IRS 1094-C 2020 free printable template

Instructions and Help about IRS 1094-C

How to edit IRS 1094-C

How to fill out IRS 1094-C

About IRS 1094-C 2020 previous version

What is IRS 1094-C?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1094-C

What should I do if I discover an error after filing my IRS 1094-C?

If you find an error on your IRS 1094-C after filing, it’s essential to correct it by submitting an amended form. Make sure to check the IRS guidelines to ensure compliance and use the correct corrected form. For tracking the correction, maintain records and be aware of possible delays in processing.

How can I verify if my IRS 1094-C has been received and processed?

To verify the receipt and processing of your IRS 1094-C, you can check the status through the IRS's e-file system. If you filed via e-file, you may also receive confirmation of receipt. Keep an eye on any rejection codes that may indicate issues with your submission.

What privacy or data security measures should I consider when filing my IRS 1094-C?

When filing your IRS 1094-C, ensure the protection of sensitive data by using secured software or platforms compliant with IRS regulations. It's crucial to protect personal information to prevent unauthorized access and maintain privacy. Follow best practices for data security even after filing.

What common mistakes should I avoid when submitting my IRS 1094-C?

Common mistakes include misreporting employee counts and incorrect employer details. Review each section carefully, as inaccuracies can lead to penalties or delays. Double-checking your entries against IRS guidelines can help ensure a smoother filing process and minimize errors.