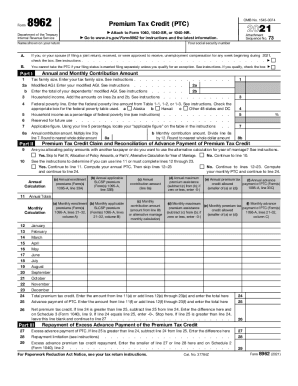

IRS 8962 2020 free printable template

Instructions and Help about IRS 8962

How to edit IRS 8962

How to fill out IRS 8962

About IRS 8 previous version

What is IRS 8962?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8962

How can I correct an error after filing the IRS 8962?

If you find an error after submitting your IRS 8962, you need to file an amended return using Form 1040-X. Be sure to include the corrected information on the appropriate forms and submit it to the IRS. This process allows you to rectify mistakes and ensure that your health coverage data is accurate.

What steps should I take to track the status of my IRS 8962 filing?

To verify the status of your filed IRS 8962, you can use the IRS 'Where's My Refund?' tool, which gives updates on your return processing. If filed electronically, check for common e-file rejection codes that indicate issues with your submission and ensure your details match IRS records to avoid delays.

What should I do if I receive an IRS notice related to my 8962?

Upon receiving an IRS notice pertaining to your IRS 8962, carefully read the document to understand the issues raised. Prepare any supporting documentation and respond promptly, either by providing the requested information or by clarifying any discrepancies in your filings.

Are there any common mistakes to watch out for when submitting the IRS 8962?

Be cautious of common errors like incorrect income reporting or mismatched coverage information when submitting your IRS 8962. Double-check your entries against your health insurance statements to minimize the chance of rejection or additional queries from the IRS.

Could the software I use to e-file the IRS 8962 have compatibility issues?

Ensure that the software you choose for e-filing the IRS 8962 is updated to the latest version, as compatibility issues can arise with older software or certain browsers. Review technical requirements for e-filing, including internet connectivity and system compatibility, to avoid submission problems.

See what our users say