IRS 1120S - Schedule K-1 2020 free printable template

Show details

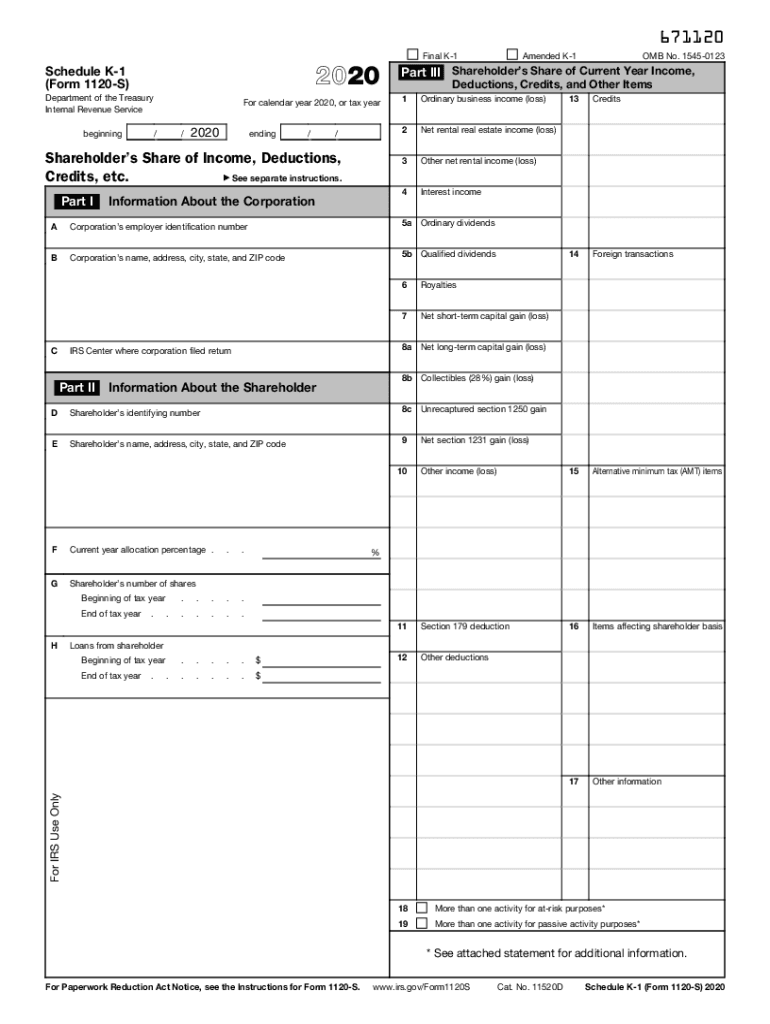

6711202020Schedule K1

(Form 1120S)

Department of the Treasury

Internal Revenue Service

/beginning/Part III Shareholders Share of Current Year Income,

Deductions, Credits, and Other Items1Ordinary

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

How to fill out IRS 1120S - Schedule K-1

Instructions and Help about IRS 1120S - Schedule K-1

How to edit IRS 1120S - Schedule K-1

To edit IRS 1120S - Schedule K-1, utilize a PDF editing tool like pdfFiller. Follow these steps:

01

Open the form in pdfFiller.

02

Select the text or fields you need to modify.

03

Make the necessary changes and save your updated form.

How to fill out IRS 1120S - Schedule K-1

Filling out IRS 1120S - Schedule K-1 involves several key steps:

01

Gather necessary information about the corporation, such as its name, address, and taxpayer identification number (TIN).

02

Collect the partner's personal information, including their name, address, and percentage of ownership.

03

Fill in the financial details pertaining to the partner’s share of income, deductions, and credits.

About IRS 1120S - Schedule K-1 2020 previous version

What is IRS 1120S - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1120S - Schedule K-1 2020 previous version

What is IRS 1120S - Schedule K-1?

IRS 1120S - Schedule K-1 is a tax document used to report income, deductions, and credits from an S corporation to its shareholders. It serves to inform shareholders of their specific share of the income or losses, allowing them to report these amounts on their individual tax returns.

What is the purpose of this form?

The primary purpose of IRS 1120S - Schedule K-1 is to ensure accurate income reporting for shareholders of S corporations. It differentiates between the corporation's income and individual shareholder amounts, thereby aiding in tax compliance and reporting accuracy.

Who needs the form?

IRS 1120S - Schedule K-1 is needed by shareholders of S corporations. If you own shares in an S corporation during the tax year, you will receive a Schedule K-1, which represents your share of the corporation's income, deductions, and credits.

When am I exempt from filling out this form?

You may be exempt from needing IRS 1120S - Schedule K-1 if you do not receive income or benefits from an S corporation, or if you are not a partner or shareholder within that corporation. For instance, if you had no involvement with the S corporation during the tax year, you wouldn't receive this form.

Components of the form

The IRS 1120S - Schedule K-1 contains several important components, including:

01

Shareholder's identification information (name, address, and TIN).

02

Corporation's identification information.

03

Details of the shareholder's share of income, losses, deductions, and credits.

What are the penalties for not issuing the form?

Failure to issue IRS 1120S - Schedule K-1 can result in penalties for the S corporation. The IRS may impose a penalty of $270 per form for late submissions, with penalties potentially accumulating if forms are not filed promptly or accurately.

What information do you need when you file the form?

To file IRS 1120S - Schedule K-1, you need the following information:

01

Details about the S corporation, including its name, address, and TIN.

02

Shareholder’s personal information, including name, address, and ownership percentage.

03

Financial figures reflecting individual income, losses, deductions, and credits allocated to the shareholder.

Is the form accompanied by other forms?

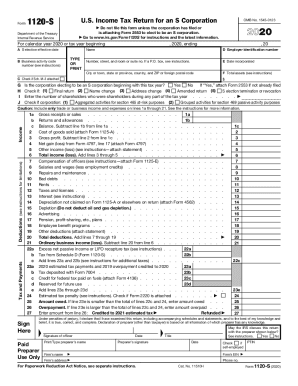

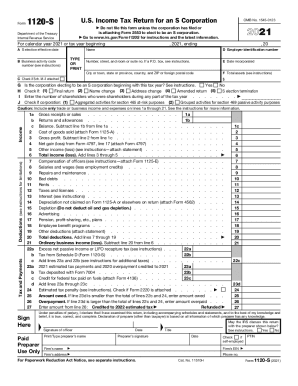

When submitting IRS 1120S - Schedule K-1, it is often filed alongside IRS Form 1120S, which is the S corporation's income tax return. This ensures accurate reporting and alignment between corporate and individual tax documents.

Where do I send the form?

IRS 1120S - Schedule K-1 should be sent to the IRS along with the S corporation's Form 1120S. Individual shareholders also need to include a copy of the K-1 when filing their personal tax returns.

See what our users say