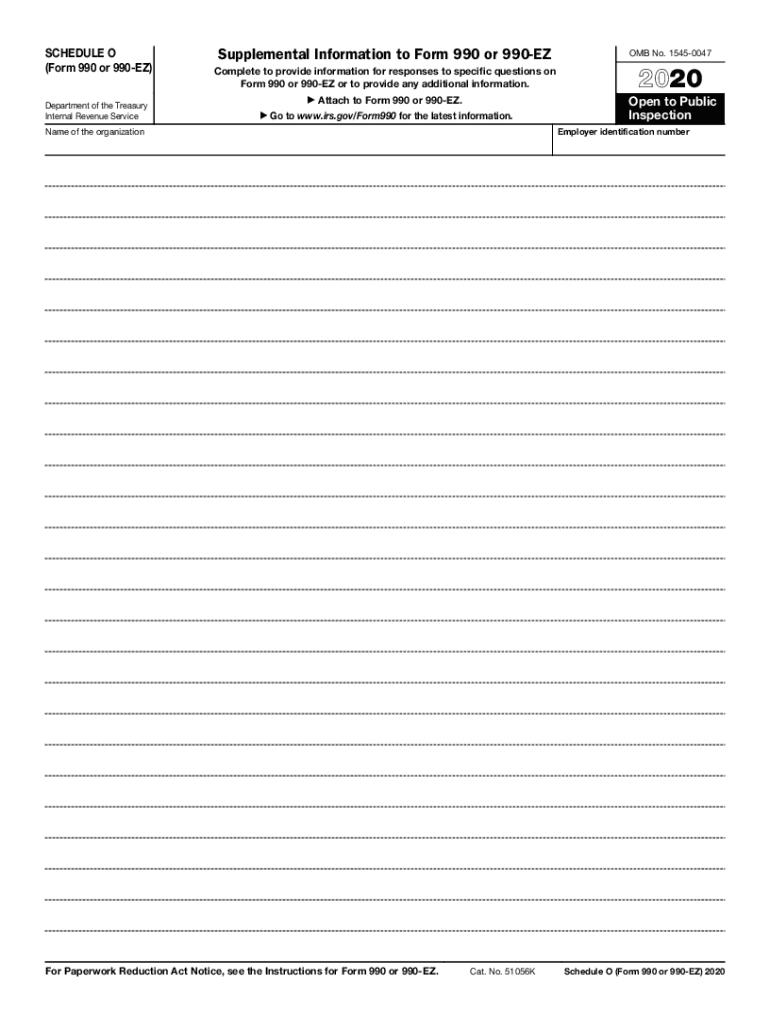

Who needs the Schedule O (Form 990 or 990-EZ)?

Schedule O (Form 990 or 990-EZ) is an addendum officially called the Supplemental Information to Form 990 or 990-EZ. It should be completed by tax-exempt nonprofit organizations that file their tax returns using the IRS Forms 990 or 990-EZ.

What is the purpose of the Schedule O form?

A nonprofit organization is supposed to be using this IRS Supplemental Information Form, rather than separate attachments, to provide the IRS with sufficient information for responses to specific questions on Form 990 or 990-EZ, and explanation of the organization’s operations or responses to various questions.

In this way, all the information that refers to the tax return of the tax-exempt organization, but cannot be revealed on their IRS forms 990 or 990-EZ, is covered on their Schedule O.

Which documents do Schedule O support?

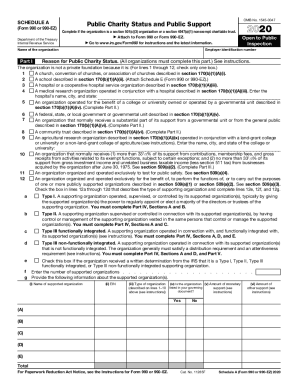

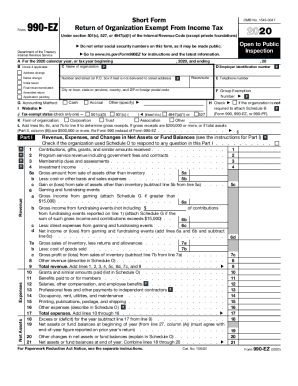

As has been stated above, Schedule O (Supplemental Information to Form 990 or 990-EZ) form serves as an accompaniment to the tax return of a non-profit business using IRS Forms 990 or 990-EZ.

When is Schedule O Form due?

The US Internal Revenue Service expects both Forms 990 or 990-EZ to be filed together with their comprehensive explanation, which is Schedule O. The due date for submission is always the standard 15th day of the fifth month of the fiscal year. Typically, it falls on May 15, if it is not a federal holiday or a weekend.

What information should be provided on the Schedule O Form?

The very first items that should be indicated legibly are the name of the tax-exempt organization and its employer identification number (EIN).

The rest of the form is actually a blank form that should be filled out as the filer’s situation requires. However, it is of vital importance to indicate clearly the number of the item from 990 or 990-EZ form being answered.

What do I do with the Schedule after its completion?

The completed form is attached to the 990 or 990EZ and filed with the IRS.